Since the beginning of DeFi, there has not been a lack of innovation. Decentralized finance has enabled the development of whole new asset classes for trading and arbitrage, as well as the conduct of transactions without requiring authorization. Cryptocurrency owners globally topped 300 million this year, with 1 billion unique users expected by 2023. We expect this growth to continue and exponentially increase as more products are developed and new use cases are identified. But, before getting into how the next absolute highest performance environment for DeFi will look, we must first address some of the issues that the current blockchain sector is experiencing.

Current problems in DeFi

A nascent field like decentralized finance holds the potential to innovate the legacy financial system and supercharge it with on-chain capabilities. Still, the road to mass adoption is longer than we’ve thought. Many L1s experimented with DeFi, NFTs, GameFI, and other apps running on the same blockchain, competing for the same block space. Congestion and high fees emerged from combining transactions from several dApps into one pot, and at times, transaction spam was so extreme that chains had to be halted.

As crypto adoption grows, the industry will have to solve the scaling problem. It’s not unimaginable to expect hundreds of thousands of transactions per block, especially on general-purpose blockchains. Mixing different use cases could become a persistent and heavy problem for developers and users of everyday apps, resulting in heavy migrations to application-specific blockchains with the possibility to interoperate using standardized bridges. Chains built solely for DeFi or NFTs ought to become the new standard.

When it comes to developing exchanges, developers are forced to choose between decentralization and efficiency. Decentralized Exchanges (DEXs) are inherently decentralized but suffer from throughput limitations and network congestion. Centralized Exchanges (CEXs) offer much faster throughput but are highly centralized and subject to increased regulatory pressure. As a result, decentralized exchanges have become very popular over the past few years.

Most centralized exchanges make use of an orderbook for trading since it’s easier for market makers to provide active liquidity and leads to deeper liquidity. Most decentralized exchanges haven’t been able to use orderbooks, because updating orders requires a lot of transactions, which is expensive on chains such as Ethereum. As a result, the AMM (Automated Market Maker) model is popular with decentralized exchanges, which lets users deposit liquidity once and then not update their orders. The AMM model results in impermanent loss and fewer incentives for Market Makers and is a worse approach overall. Thus, there is a massive need for on-chain orderbooks in crypto, which is exactly what Sei helps with.

Onboarding institutions and their needs

Institutions have significantly higher demands and standards than retail crypto investors. Before institutions feel comfortable diving into DeFi, there are a few key issues to overcome. On everyone’s wish list, security is always at the top. In many circumstances, numerous code audits are insufficient because bugs can and usually do slip under the auditor’s radar. If bridges are involved in the process the complexity increases and with it the risk of exploits.

Before being seriously regarded by sophisticated players, the technology must gain experience and be battle-tested. Regulations, digital asset custody, AML (anti-money laundering), and documentation are just some of the additional roadblocks to mainstream adoption in the institutional market. DEXs will hardly ever be able to achieve these norms, hence a completely decentralized solution for institutions would never work. However, a happy medium for both sides may exist.

Going deeper into the technical requirements for institutional usage, AMMs are unsuitable since they lack the orderbook infrastructure and liquidity required to handle high-volume trades without experiencing slippage. Furthermore, onboarding institutions require a certain degree of regulation that will allow these parties to take exposure to this disruptive technology in a more structured way. Closing the knowledge gap and making the investment process understandable for the TradFi world and regulators alike is both an opportunity and a challenge we must tackle as an industry.

Building the future of DeFi in Cosmos

Now that we have a better understanding of the ongoing issues with integrating institutions and developers into the decentralized ecosystem, we must consider how to overcome them.

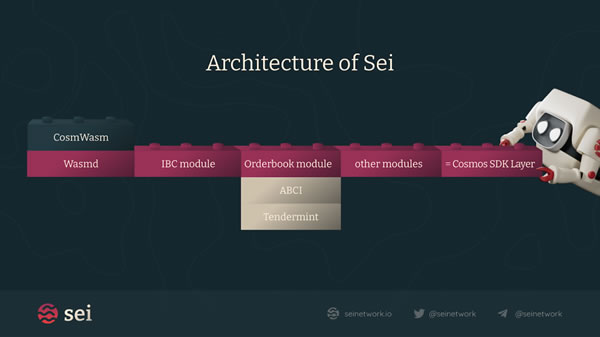

One of the most promising options is Sei Network, the first orderbook-specific L1 blockchain. Purpose-built, Sei is meant to provide the foundation for liquidity and trading in the Cosmos ecosystem, combining the security and decentralization of an on-chain orderbook with the speed and efficiency of off-chain implementations. Developed using the Cosmos SDK and Tendermint core, Sei features a built-in central limit orderbook (CLOB) module that can be leveraged as a shared liquidity hub for decentralized applications to create markets for any asset. To make it painfully easy for developers to build on top, the wasmd module has been implemented to enable CosmWasm smart contracts as well as a new dex module that allows for smart contracts to utilize the underlying CLOB. The Rust-based CosmWasm, a core component of various blockchains, is stable, bug-free, and a simple to use coding library. With an emphasis on high security, CosmWasm was designed to be a safe haven for developers.

Bringing institutional traders into DeFi requires an orderbook and security. Offering cheap transactions and working with Market Makers (MMs) to onboard large amounts of liquidity, Sei provides an orderbook-based trading experience in a decentralized, permissionless manner while also providing the flexibility to implement Automated Market Makers (AMMs) usage for popular long-tailed assets.

The team behind Sei observed, studied, and iterated upon major DeFi projects that came before us. With extensive experience in both blockchain technology and traditional finance, we know what it takes to make a high-performance, user-friendly DeFi environment. We believe in the Internet of blockchains where application-specific blockchains become the norm. The architecture of a purpose-built chain means parameters can optimize for an orderbook design and can prevent MEV which is critical for creating a fair trading experience in DeFi.

Who is building similar solutions?

Numerous crypto trends have emerged over the years, and DeFi had a clear path – from primitive AMMs to liquidity mining platforms to Uniswap V3. However, in the coming months or years, it’s natural to expect that orderbook-based projects will start dominating the DEX universe as institutions join and the retail user base expands. Although the orderbook scene is still vastly underexplored, we welcome world-class teams like dYdX, Serum, Injective, and Crescent who are constantly innovating in Defi. In the end, we all have the same goal of building a suitable environment to accommodate a stronger and more transparent financial system on the blockchain.