The week of March 8 seems like a lifetime ago. That week was, more or less, the last one in the U.S. where things still felt “normal.” It was certainly a completely different business environment, with veterinary and other retail healthcare practices – including dental, optometry and chiropractic (no different from restaurants, retail outlets and other small businesses having a steep revenue drop-off starting in mid-March.

Throughout the crisis, the one area where people are spending more money is on their pets. Early on, there were widespread reports about the increase in pet adoption, driven in part by people wanting the company of a dog or cat to keep them company during the shelter-in-place.

Trends show

Despite the devastating economic impact across industries in the US, pet parents are investing in the health of their pets at a record pace. Surprisingly, that spending pattern varies depending on where you are in the US. One of the key trends that Sikka Insights has identified over the last 3 months is the disparity in spend across the nation on animal oral health.

Pet parents in the Western states, particularly San Diego, Phoenix, and San Antonio lead the country in bathing and grooming and pet oral health care, investing at a significantly higher rate compared to pet parents in New York, Chicago, and Indianapolis. It raises the question – do pet parents in the West care more about their pets than their counterparts do across the MidWest and Eastern seaboard?

The extra attention given to pets during the COVID-19 crisis is not just a US phenomenon. Just this week, the German Minister of Food and Agriculture proposed a new rule for animal welfare – an order to exercise one’s dog twice a day, for at least an hour. While there is certainly merit – for pets and pet owners – in encouraging exercise, it’s hard to see how this rule will be enforced. And it definitely feels like regulatory overreach. It’s hard to imagine a rule like that being welcomed in the US.

Tools that inform

Sikka Insights empowers informed decisions through data insights on scheduling, production, treatment plans, procedures and other key performance indicators (KPIs) for veterinary practices. By analyzing the activity of over a thousand opted-in veterinary practices across the US during the COVID-19 crisis, Sikka has been able to draw some remarkable conclusions.

These insights not only help veterinary practices to manage their business more effectively, they also allow the major suppliers in the industry to anticipate and meet the needs of their customers, the veterinary practices. Sikka Marketplace, working with Midmark Animal Health, has also introduced Dentistry Tracking Reports for veterinary dental care.

‘Having access to timely data at a micro and macro level is essential for us to help practices to enhance patient care and maximize return on investment,” according to Andrew Schultz, Jr., Director of Business Development and Clinical Services at Midmark Animal Health. “Partnering with Sikka is enabling the animal health practices we support to gain a better understanding of their key performance indicators, particularly in this unprecedented economic environment.

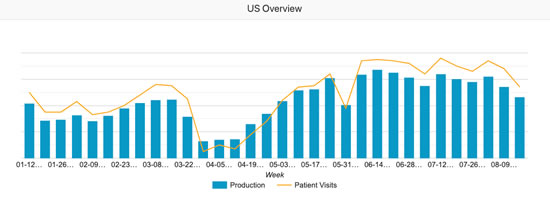

An insightful example of the value and timeliness of this data is available on the SIKKA Covid-19 Rebound website. Various retail healthcare segments, including animal health, are displayed in a variety of heat maps, quantifying the impact that the COVID-19 pandemic has had on U.S. practice production and pet visits, and how practices across the 50 states are managing through the crisis.

Data from our COVID-19 “Rebound Map” details the catastrophic drop in production and visits (~80%) compared to pre-crisis levels across retail healthcare, and how the veterinary industry’s production has bounced back to normal levels. In fact, among all retail healthcare sectors, vets seem to have fared the best during this crisis, experiencing a smaller drop and faster rebound than other types of practices.

Here’s what Sikka Software’s data is showing for week ending August 16, 2020:

Note: The dip for the week ending May 31 was as a result of the Memorial Day weekend.

What does the Future Hold?

One of the biggest positive developments that I believe will come out of this tumultuous period is the veterinary industry undergoing a digital transformation to match that of many other industries.

Some of the changes happening now on the technology front not only put veterinary practices more in line with what other healthcare providers are doing, but also with the way we conduct the rest of our lives – online, immediate and built for self-service.

From a pet parent perspective, think about filling out pet patient forms. What was once a tedious, manual task, required every year or so, will be a casualty of the “touchless” world we now inhabit. The technology for pet parents to provide this information digitally has been available for years, and now it will be standard practice in veterinary and other retail health practices.

The same goes for payments. We can purchase just about anything we want online and immediately, and now more veterinary practices are getting on board with this trend through payment portals that eliminate in-person and manual processes. Eliminating ‘the check is in the mail’ should help the U.S. Postal Service focus on other priorities.

There are proven and reliable tech solutions purpose-built for veterinary and other retail healthcare practices available that replace all the manual and time-consuming financial processes and are low- or no-touch. There is simply no reason for any practice to have to use paper or process transactions in-person in 2020.

Another critical – and time-consuming and inefficient – process is scheduling. Phone calls and making appointments in the office are a dying breed. As with payments, the technology has been around for a while to make scheduling all-digital and text-based, but many practices saw no urgent need to upgrade. Again, that’s changed.

Even patient communication, once the domain of the telephone call and voicemail message, are moving quickly to the way most of us already communicate in our daily lives – texting.

There’s a lot more to running a veterinary practice, as any vet will tell you. I’m just presenting a few of the most time-consuming and costly business processes to demonstrate the trend of digital transformation brought on by the COVID-19 crisis.

Things are looking up, but we’re not out of the woods yet

While the slowdown in new COVID-19 cases we are seeing nationwide is great news on one hand, there is still a lot of uncertainty in the market and the economy. The lack of a 2nd stimulus package from the Federal Government has the possibility reducing pet parents’ disposable income and reducing the amount of money available for animal health.

We have still a long way to go before we get back to where we were at the beginning of March. There are physical, financial and psychological hurdles to be dealt with and overcome. The previously “normal” veterinary experience is gone forever, and we all have to come to terms with that.

But none of this explains why pet parents in the west are spending more on their pets’ care than their counterparts in the east. As Chris Matyszczyk so eloquently put it in his recent article on this topic “That’s the thing with data. It offers you lovely numbers far more often than it offers you reasons.”

Comments are closed.