The recent fall of FTX highlights the fact that centralized systems are susceptible to the same counterparty risks as traditional financial institutions, and yet have less established regulation. Events such as this have negatively affected many individuals and have highlighted the need for a more open and transparent financial system where users have control over their own funds. Decentralized finance (DeFi) in Cosmos is the solution to this problem, building financial infrastructure on top of blockchain networks in a secure and trustless way.

Why else might DeFi be needed?

Some current global challenges include:

- Citizens at times, are unable to access their own funds. Examples include a Chinese bank freezing funds last July (incitement of riots), and more recently, the collapse of FTX.

- Remittances average 6.3% in fees and are subject to lengthy delays.

- There are 1.7 billion unbanked people worldwide.

- High inflation and currency control. For example, Argentinians are limited to the purchase of $200 USD per month, despite their inflation now exceeding 70%.

- Real-world assets are often highly illiquid and immobile.

DeFi offers solutions to these and to other issues commonly faced in the world of traditional finance.

The Impact of FTX

In the world of blockchain, centralized firms provide various platforms and services that simplify the user experience. FTX was an example of a centralized exchange where users could easily buy or sell crypto, trade assets, engage in staking, and so on. However, using a centralized exchange comes at the expense of trusting them with one’s funds, and these firms are still subject to counterparty risks, similar to banks in the world of traditional finance. But unlike banks, a lack of regulation provides more leeway, and in the case of FTX, they were operating out of the Bahamas, which had less regulatory oversight and consumer protection.

Parties, especially institutions, will always have a need for centralized firms. Yet, every time that an event such as the fall of FTX occurs, people seek alternatives that increase the demand for solutions like DeFi. This has been evident recently as funds continue to flow out of centralized exchanges, as we saw with $1.9 billion being withdrawn from Binance in just 24 hours.

This has also been clear via the success of the decentralized synthetics protocol GMX, which has continued to rise steadily in Total-Value-Locked. They are a decentralized application providing access to perpetuals, which are basically on-chain derivatives. As DeFi becomes more user-friendly and blockchain adoption grows, those providing decentralized solutions to real-world financial services will flourish.

DeFi on Cosmos

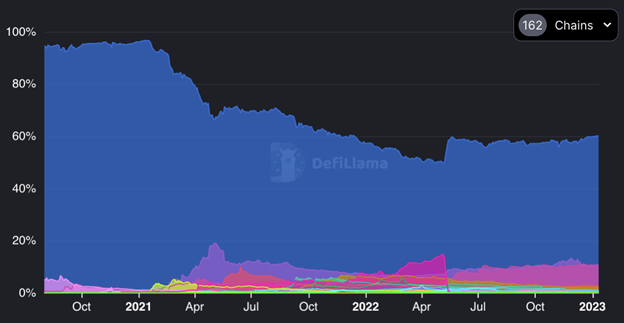

Ethereum introduced the initial concept of smart contracts and, as such, has had a big head start against rival blockchains, being the most developed DeFi ecosystem. However, other blockchains have been taking back market share, each coming forth with its own unique value propositions and use cases in an attempt to build community and, in turn, attract developers and users.

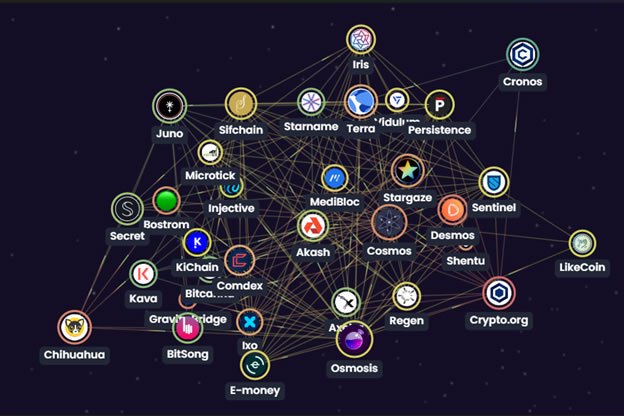

One such blockchain is Cosmos, where Comdex exists. For those new to Cosmos, it can be thought of as an ecosystem of interconnected blockchains, like a hub-and-spoke, with Cosmos Hub at the center. Applications on Ethereum benefit from its Proof-of-Stake security but suffer from certain trade-offs, such as less potential for project-specific customization and less interoperability with other blockchains. With Cosmos, each application can be its own unique Proof-of-Stake blockchain, opening up the potential for an internet of custom-purpose blockchains in the future.

Despite having a very strong developer ecosystem, Cosmos DeFi itself has to-date lagged behind other blockchains, in part due to a lack of available stablecoins. This is changing with the announcement of native USDC coming to Cosmos and the rise in crypto-collateralized stablecoins such as our very own CMST which we detailed in our blog post here.

There are several reasons that make Cosmos well-suited for a strong DeFi ecosystem:

- Throughput: as each Cosmos application is its own blockchain, they are unaffected by the network congestion as is common with Ethereum.

- Customizability: blockchain functionality and validator sets can be custom-purposed depending on individual needs. For example, dYdX will have its custom validator set to manage transactions off-chain in order to reduce network congestion.

- Control: projects may build vertically, horizontally, or however they see fit. They might wish to make core technological changes or introduce a new feature.

- Interoperability: as more projects build upon Cosmos, network effects grow. Each blockchain will be able to communicate seamlessly and securely with one another using the Inter-Blockchain Communication (IBC) protocol.

- Gas Fees: gas fees are now paid in the native token of the protocol, meaning that value accrues to their token rather than to another blockchain network such as Ethereum.

dYdX’s recent move over to Cosmos has also gained widespread attention and, if successful, may lead to others following suit. All in all, as stable coins become more widely available within Cosmos and more projects begin to see the benefits of building there, the future may be well-poised for future growth.

Comdex and the Path Forward for Cosmos DeFi

This is where Comdex comes in.

Our goal is to democratize finance by building an infrastructure layer optimized for aggregating cross-chain liquidity with a suite of cutting-edge DeFi products. The primary means of doing this is by providing modules built on the core primitives of finance, allowing builders to utilize them to launch DeFi applications.

So builders can now benefit from Comdex’s customizable modules, whether that be primitives for functionalities such as liquidations, lending, oracles, vaults, assets, or much more. This will be extremely relevant as more and more projects come to Cosmos in the future, requiring reliable and customizable infrastructure that’s interoperable with the rest of the Cosmos ecosystem.

On the consumer side, Comdex is building out a suite of services such as:

- CMST: our crypto collateralized stablecoin, mintable through Harbor Protocol.

- C-Swap: our decentralized exchange.

- Commodo: our borrowing and lending market.

Ethereum projects Curve, Aave, and Frax have been racing to provide all three of the above solutions. For example, Curve is introducing its own stablecoin, while Frax, has introduced its own AMM and borrowing/lending market.

Comdex already has all of the above, which can be used by other projects wishing to deploy. With the Comdex chain, builders have access to a stack of modules that allow smoother go-to-market for any dApp launching in Cosmos. The Comdex chain, therefore, acts as the de facto infrastructure layer of interchain DeFi.

In our next piece, we’ll dive deeper into DeFi in Cosmos. In the meantime, please share your thoughts below — we hope you’re as excited as us!

We also frequently post exciting updates and news. You can follow along via any of the following: