Not too long ago, loan management meant paper files stacked to the ceiling, endless data entry, and phone calls chasing missing documents.

It worked, but it was slow, messy, and prone to errors.

Now, most financial institutions are swapping filing cabinets for software that can handle the entire lending process in one place.

Loan management software automates the boring bits, keeps you compliant, and gives you real-time visibility into every loan you manage.

It serves as your lending control center, from application to final payment. It checks credit scores, calculates interest, schedules payments, sends reminders, and integrates with tools like CRMs, accounting software, and payment gateways. Some now even use AI for sharper risk assessment and faster approvals.

Key Takeaways

- Loan management software streamlines the lending process by automating tasks, ensuring compliance, and providing real-time insights.

- Key platforms in loan management include LendFusion for scalability, HES FinTech for rapid deployment, CloudBanking for flexibility, LoanDisk for budget-friendly options, and Nortridge for enterprise needs.

- Each platform offers unique benefits, such as AI-driven decision making, customizable workflows, and all-in-one solutions, catering to various lender sizes and requirements.

- Choosing the right loan management software optimizes approval speeds, reduces errors, and enhances customer focus.

- Demos and integration discussions are essential to find the best fit for your loan management needs and future growth.

Table of Contents

In this post, let’s look at the top loan management software on the market.

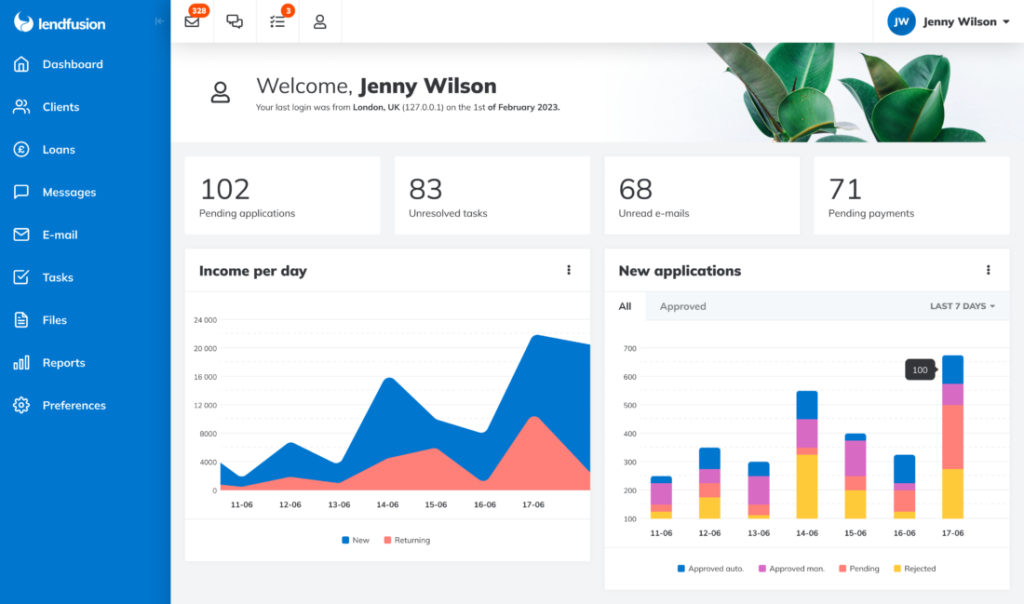

1. LendFusion

LendFusion stands out in this crowded market thanks to its end-to-end lending coverage, and it keeps things clean and no-nonsense. It’s a solid all-in-one tool that handles everything from onboarding to reporting.

What it does well:

- A Decision Engine that auto-approves or flags loans based on your risk rules. This makes underwriting faster.

- Audit Trail that records every action in real time. Think transparency, easy compliance checks, and fraud protection.

- Customer Portal gives borrowers their own dashboard for documents, balances, and payment schedules, no support tickets needed.

Why financial institutions like it:

- Wide-ranging features for mortgage lenders, credit unions, and loan brokers.

- Pricing starts at €1,659/month for portfolios up to €2 million, scaling up to €9,999 for large ones. No surprises tucked in.

- Users rave about its ease of use, helpful support, and flexibility.

Possible drawbacks:

- Feels feature-rich. That’s great, but a bit overwhelming for smaller teams. Onboarding may take more work.

- While flexibility is there, customization has its limits. It might not fit ultra-unique workflows.

Bottom line:

If you want a reliable, scalable platform that grows with you, LendFusion is a top pick. It packs powerful tools without overcomplicating things and keeps borrowers happy with self-serve access.

2. HES FinTech

Remember the days when launching a new loan product took forever? HES FinTech flips that idea on its head. It’s a modular, white‑label lending platform that handles everything, from digital onboarding to servicing and collections, with AI-powered speed and flexibility.

What it owns:

- All‑in‑one loan journey—origination, underwriting, servicers, collections, dashboards.

- An AI decision engine that scans data, predicts repayment risk, cuts NPLs, and approves loans in seconds.

- Ultra‑fast deployment. A live system in as little as three months, not years.

- Flexible workflows & strong integrations. Works with KYC, credit bureaus, payment systems, CRMs, and more.

Why financial institutions like it:

- Users have seen big drops in errors, faster product launches, and cleaner operations.

- A quick go‑to‑market loan platform that’s intuitive and offers out-of-the-box core functions.

Possible drawbacks:

- Price tag starts around $75 K/year—it’s more of a serious‑player tool, not for tight budgets.

- The interface is smooth, but full customization of backend workflows might still lean on development support.

Bottom line:

If you want a scalable, AI-driven platform that rolls out fast and handles the full lending lifecycle, HES is a strong contender. Just be ready to invest upfront.

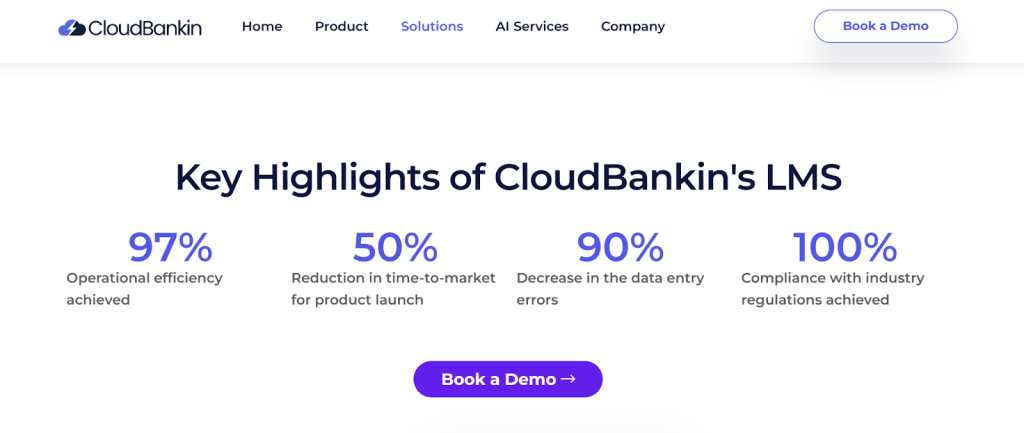

3. CloudBankin

CloudBankin offers a Loan Management System (LMS) that jumps in as a low-code, cloud-based LMS that takes you from product setup to repayment tracking, all in one smooth ride.

What it does well:

- One-stop dashboard. Everything, from multiple loan products to client data, lives in one place.

- Flexible reporting with more than 50 exportable & customizable options.

- Repayment gymnastics—supports structured, bullet, declining, amortizing, partial, pre-EMI, rescheduling—you name it.

- Built-in controls for global workflow config, audit trails, alerts, NPA tools, auto write-offs, GST & TDS, accounting integration, and co-lending modules.

- Sets you up in roughly 2 weeks, all on a secure, modern cloud infrastructure.

Why financial institutions like it:

- Launch new loan products fast and painlessly.

- No more spreadsheets. It runs your entire lending workflow with fewer errors, better compliance, and scale built in.

Possible drawbacks:

- It’s feature-rich, so it might feel a bit much if you’re a small team just starting out.

Bottom line:

CloudBankin is a powerful, cloud-native LMS for the modern lender. If you want flexibility, scalability, and deep control without wrestling legacy infrastructure, it’s a solid bet.

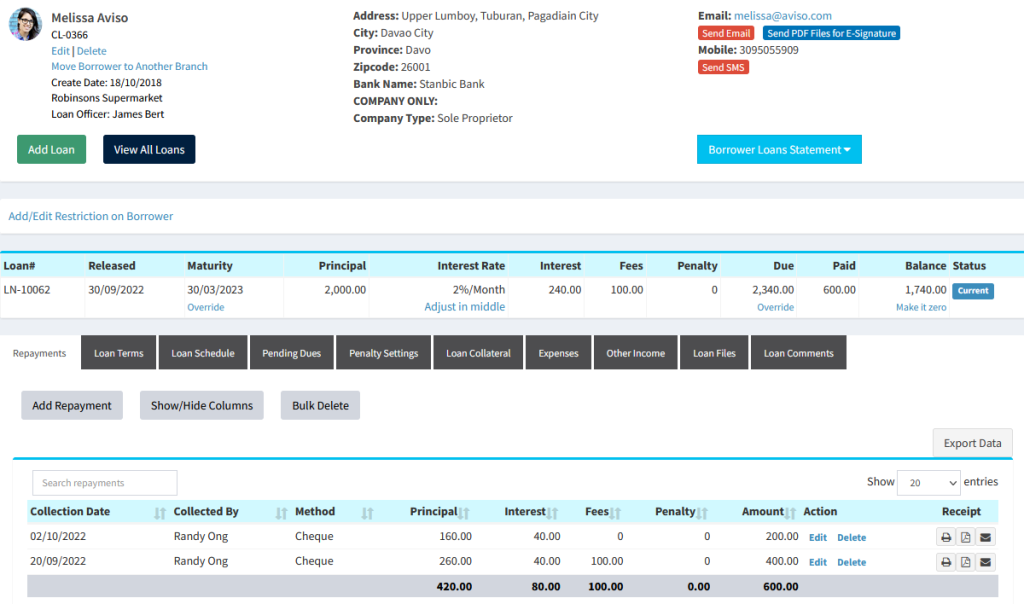

4. Loandisk

Loandisk brings your microfinance hustle into a neat, cloud-first dashboard. It’s like turning your filing room into a smooth, searchable hub—where loans, savings, and investor data all live together.

What it does well:

- All your lending tools in one place. Manage loans, savings accounts, repayments, and even investors from a single window.

- Send SMS or emails for reminders, birthday messages, repayments, you name it. Customize your templates to keep it personal.

- Solid reporting + charts, visualize trends like collections, cash flow, P&L, and arrears. Helps you spot business shifts quickly.

- Savings & investor support. Set up accounts with interest rules, print statements, and manage them all alongside loans.

Why financial institutions like it:

- Users love how friendly it is in terms of interface and cloud-based simplicity.

- Great for lean teams—pricing starts at $59/month and scales nicely.

Possible drawbacks:

- Mostly aimed at microfinance and small-to-mid lenders. Might not stretch to meet the needs of big enterprise workflows.

Bottom line:

LoanDisk is a budget-friendly choice if you’re running a lean lending operation and want something intuitive but powerful to manage loans, savings, and investor dashboards in one platform.

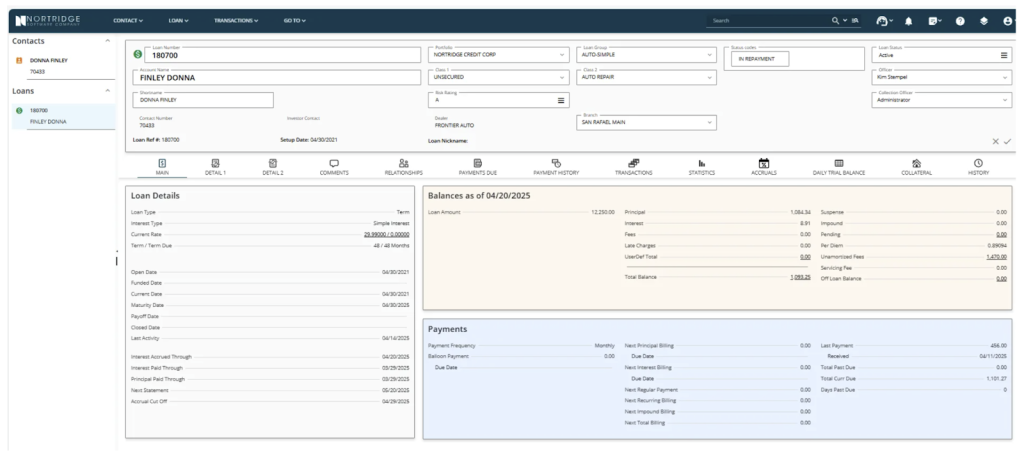

5. Nortridge

If you’re running lending operations that are serious about flexibility and scale, this might be your fit. Nortridge has been around for over 40 years, and it keeps evolving to meet modern enterprise needs.

What it does well:

- Supports every loan type under the sun, including term, revolving, auto, commercial, and real estate, you name it.

- Fully configurable, end-to-end platform. From origination, servicing, and collections, to reporting and automation, you can tailor it without needing to code.

- Powerful payment engine and collections tools. Payment waterfalls, ACH, fee handling, charge-offs, bankruptcy rules, all rolled in.

- Strong security and compliance. SOC II, 256-bit encryption, detailed audit trails, and robust role-based access.

- Deep reporting analytics with dashboards, custom reports, and real-time data to keep you in the know.

- API-ready and highly integratable. Hook into CRMs, accounting tools, credit bureaus, payment systems—you choose.

- Borrower portal + multichannel communication (SMS, email, mail), all recorded and branded.

Why financial institutions like it:

- Users love the customization and support. One says Nortridge helped them cut costs while scaling fast.

- Value for money gets solid marks too.

Possible drawbacks:

- It’s packed with features. That’s awesome until you need training.

- New updates can come too quickly, and some users report the occasional bug or latency.

Bottom line:

Nortridge is your enterprise-grade powerhouse if you want loan software that molds to your business and grows as fast as you do.

Quick Comparison of the Top 5 LMS for Financial Institutions

Here’s a quick glance, TL;DR matrix if you’re in a hurry.

| Software | Best For | Key Features | Pricing (Starting) | Deployment | Notable Pros | Potential Drawbacks |

|---|---|---|---|---|---|---|

| LendFusion | Mid-to-large lenders, mortgage brokers, and credit unions | Decision engine, audit trail, customer portal, integrations | €1,659/month (up to €2M portfolio) | Cloud | Scalable, transparent reporting, borrower self-service | Can feel overwhelming for small teams; limited ultra-custom workflows |

| HES FinTech (LoanBox) | Banks, fintech lenders, and leasing companies | AI decision engine, end-to-end lifecycle, fast deployment, integrations | ~$75K/year | Cloud, White-label | Rapid go-to-market, AI-driven risk analysis, modular | High upfront cost; backend customization may need dev support |

| CloudBankin | Modern lenders need flexibility & compliance | Low-code setup, 50+ reports, varied repayment types, co-lending, audit trail | Not publicly listed | Cloud | Quick deployment (~2 weeks), strong compliance features, scalable | Feature-heavy for very small teams |

| LoanDisk | Microfinance, small-to-mid lending institutions | Loans, savings, investors, SMS/email automation, charts & reports | $59/month | Cloud | Budget-friendly, intuitive UI, all-in-one microfinance tool | May not meet complex enterprise workflows |

| Nortridge | Large, enterprise lenders across loan types | Highly configurable, multi-loan support, collections, API, borrower portal | Custom | Cloud & On-prem | Extremely flexible, deep integrations, strong analytics | Steep learning curve, occasional bugs, update pace |

Wrapping Up

The right loan management software does way more than keep your records tidy. It completely optimizes how you lend. It speeds up approvals, reduces errors, keeps you compliant, and frees your team to focus on customers instead of paperwork.

From budget-friendly tools like LoanDisk to enterprise powerhouses like Nortridge, there’s something here for every type of lender. The key is matching the platform to your current needs while leaving room for where you want to be in a few years.

Don’t just skim the features: take demos, ask about integrations, and see how each system handles the unique quirks of your lending process. A little homework now can save you a lot of pain (and money) later.

Choose well, and your software won’t just manage loans, it’ll help you grow them.