Going into 2023, much has changed for the VC ecosystem and public markets. Bill Gurley, general partner at Benchmark, put it best when he tweeted that the days of free Fed cocktails are over. “An entire generation of entrepreneurs and tech investors built their perspective on valuations during the second half of an amazing bull market run. The ‘unlearning’ process could be painful, surprising, and unsettling to many.” Gurley’s candidness sets the stage for “How Access + Level Playing Makes You the Biggest Winner of All.” This establishes the immediate need for simultaneous mindset change and market overhaul.

Interestingly, if Steve Jobs were alive today, even he might agree with Gurley. Jobs was adamant that “You should never start a company with the goal of getting rich. Your goal should be making something you believe in and making a company that will last.”

Key Takeaways

- The VC ecosystem has changed; entrepreneurs must adapt to new market realities and let go of past mindsets.

- Access to capital is limited; many small investors lack opportunities in private markets.

- There’s a significant amount of new private market capital waiting to be deployed, but many don’t know how to access it.

- To succeed, stakeholders must connect effectively and remove barriers to capitalize on growth opportunities.

- The next era for startups is approaching, creating opportunities for those ready to innovate and engage.

Stop Playing By The Old Rules

If you believe the media hype, you could not help but think that the startup market is all gloom and doom. At least, until the venture capital market recovers. More specifically, until VC firms feel it is safe to go back in the water.

Prior to plummeting investment, VC firms had an incredible run. Success begot more success, leading to a stranglehold on a critical sector. In turn, this limited access, capital participation, and innovation. As Alex Rampell, General Partner at Andreessen Horowitz, stated: “Not everyone has access to private markets,” and even fewer got access to prized VC funds and deals.

So, what’s the answer? Waiting on the VCs like banks in 2008? Definitely not. It’s time for a paradigm shift. We need a new financial ecosystem not dependent upon the Fed, that’s fast, scalable, and ready-to-go. One that provides unprecedented access and a level, fair playing field. One that removes the barriers between you and where you want to go, making you the biggest winner of all.

Aligning Strengths To Make Weaknesses Irrelevant

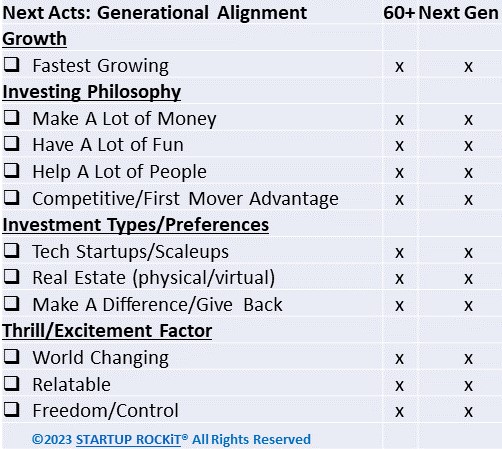

Our research at STARTUP ROCKiT, summarized in the chart below, found that there’s a festering groundswell of new private market capital on the sidelines. This capital is waiting to be invited and deployed. In fact, despite what you might hear to the contrary, there’s no generational divide on this issue.

Regardless of age, aspirers, small businesses, and investors want to take control of their financial futures. Most don’t know where or how to begin. As a result, seamless access to connections, capital, and benefits beyond product/policy (BBP) is critical going forward.

Meeting Unmet Needs

Walter Wriston put it best, saying, “Capital goes where it is welcome and stays where it is well treated.” Wriston defined capital as the value each of us brings uniquely to the table – be it money, experience, expertise, creativity, product, size, and the like. Collectively, this makes up our capital DNA.

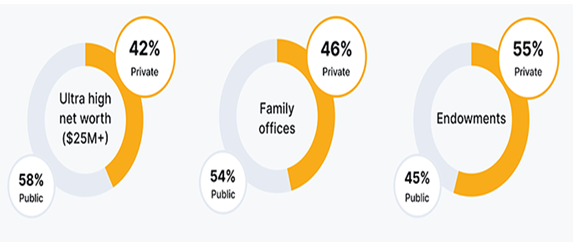

For those favoring more access and participation, it is quite clear that the “little guy” has not been invited or welcomed. While rarified investors have nearly 50% portfolio allocation to private investments, the average “little guy” (investor) has 0% exposure to private markets, as confirmed by Brownstone Research below. Hence, the vast opportunity.

Biggest Winner Of All

Yet, all is not gloom and doom. Far from it. For those investors and entrepreneurs hooked on the Fed and juiced valuations and distorted perspectives, the process of “unlearning” is real and unsettling. For the rest of us, unprecedented access, connectedness, and a new golden age for the startup ecosystem are just around the corner.

Getting in front of a major growth story is key. There is no question that women and minority businesses, the tech startup and scaleup sectors, and next act and investor revolutions are going to be massively bigger than they are today.

The challenge before us is how to ROCKiT capital connectedness, helping people, businesses, and powerful ideas that would not otherwise meet become extraordinary together fast.

Those looking for growth or a new way forward can now skate to where the puck is going (Wayne Gretzky). The ability to access capital and inject it into an innovative idea or company is key to growing the economy, small businesses, and next acts. This approach has been at the heart of every major recession. When capital dries up, major recessions occur. Thus, it is more important than ever to reinvent this broken, misaligned space.

The stakes have never been higher. The opportunities are never greater. It’s time to get off the sidelines and into the game.