Revenue planning has always been a high-wire act, but 2025 raises the stakes. Markets are volatile, investors expect faster pivots, and finance teams are under pressure to spot risks before they snowball. Add in an explosion of AI-powered forecasting tools, and the landscape looks completely different from just two years ago.

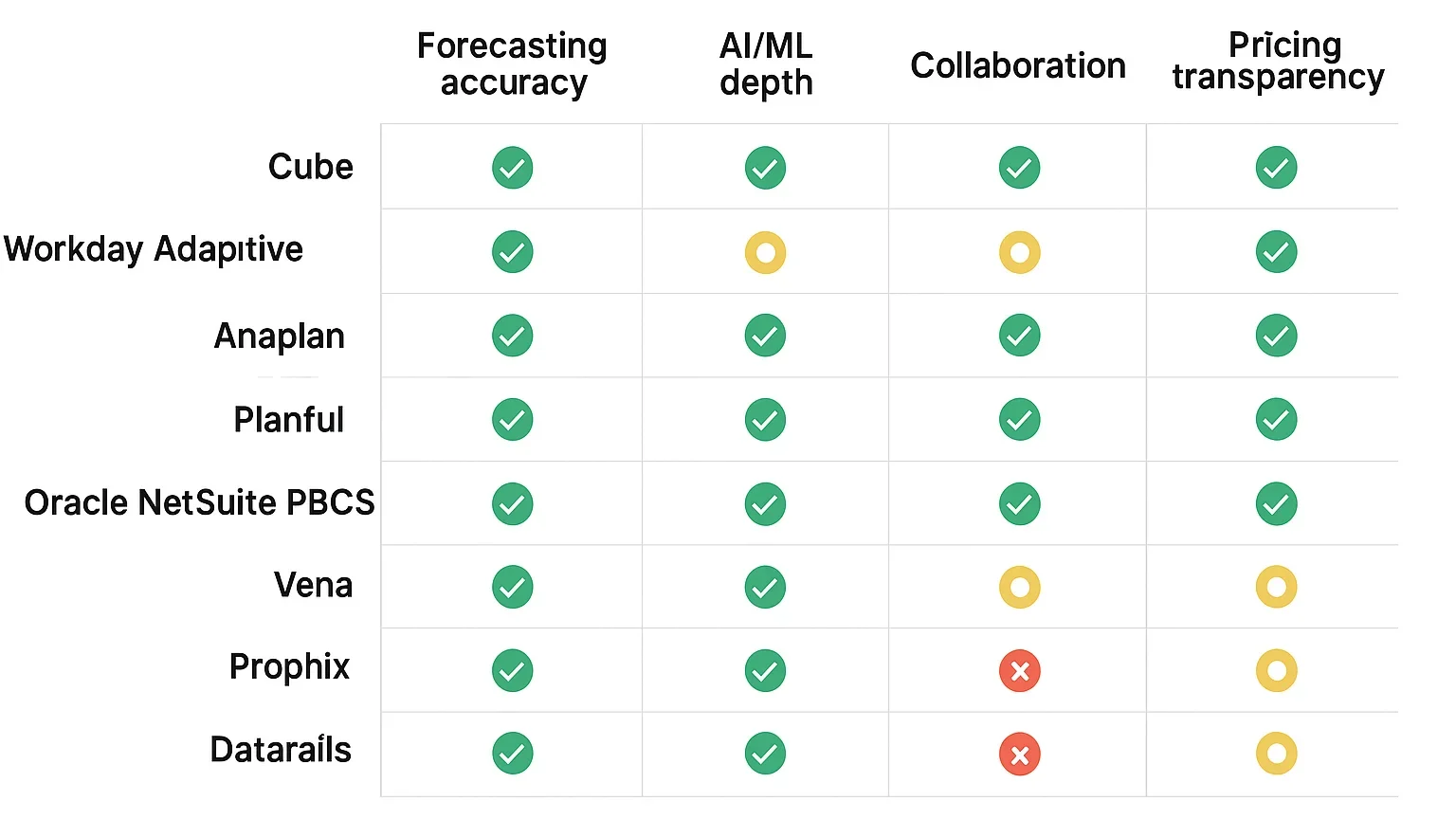

This guide highlights the nine revenue-planning platforms that finance leaders say provide the most significant lift today. Each contender was scored on forecasting accuracy, speed-to-value, collaboration features, depth of AI/ML, and pricing clarity so you can jump straight to the short list that matches your needs.

Table of contents

How We Ranked the Platforms

Finance technology budgets are expanding fast, and priorities are clear:

- Fifty % of CFOs plan significant increases in generative AI spending for 2025, and 24% will boost budgets for financial planning software (Gartner, 2025).

We interviewed 12 CFOs and VPs of FP&A, ran live demos with each vendor, and weighted scores as follows:

- Forecasting accuracy (30%)

- Time-to-value (20%)

- Collaboration and workflow (15%)

- AI/ML depth (15%)

- Pricing transparency (10%)

- Customer sentiment (10%)

Platforms needed at least 25 customer reviews and an active product roadmap to be considered.

The Snapshot View

- Cube: No-code, AI-powered FP&A hub for mid-market and scaling enterprises.

- Workday Adaptive Planning: Enterprise stalwart with native HR linkage.

- Anaplan: Connected-planning heavyweight built for multidimensional models.

- Planful: Mid-market favorite for rolling forecasts and Office integration.

- Oracle NetSuite PBCS: Best match for NetSuite ERP users.

- Vena: Excel interface plus Power BI visuals; rising AI roadmap.

- Prophix: Manufacturing/CAPEX specialist with built-in workflow.

- Datarails: SMB-friendly Excel consolidator.

- Pigment: Modern UX and lightning-fast scenario sandboxes.

1. Cube: Best for No-Code, AI-Powered FP&A

Cube tops the list because it eliminates the typical trade-off between the familiarity of Excel and Google Sheets, while also offering enterprise-grade control. Finance pros keep their spreadsheets, but Cube’s Data Engine centralizes every metric, cleans the numbers, and pushes updates back to sheets in seconds. The new “Agentic AI” layer generates forecasts, suggests key drivers to watch, and provides real-time answers to questions.

Why finance leaders ranked it #1

- Speed: Most mid-market teams deploy in under 30 days.

- Flexibility: Real-time sync with both Google Sheets and Excel.

- AI boost: Automated variance narratives and scenario suggestions save hours.

A SaaS company cut its forecast cycle from five days to two, saving 60% of analyst hours in its first quarter on Cube.

2. Workday Adaptive Planning

Workday’s planning module shines in organizations already running Workday HCM or ERP. Built-in people data means revenue plans update automatically with changes in headcount. Dashboards are polished, and its Elastic Hypercube engine handles huge models without punishing load times.

3. Anaplan

If you need true connected planning, with finance linked to supply chain and sales operations, Anaplan remains the heavyweight. Model Builders can create virtually any scenario, and the new Polaris engine speeds calculations dramatically. The trade-off: steeper learning curve and higher price.

4. Planful

Planful (formerly Host Analytics) is a mid-market workhorse. Spotlight for Office embeds live numbers in PowerPoint and Excel, making board-deck refreshes painless. Recent releases add AI anomaly detection, but its sweet spot is still quick rolling-forecast cycles.

5. Oracle NetSuite Planning & Budgeting

NetSuite PBCS is the natural upgrade for NetSuite ERP customers. Pre-built connectors eliminate manual imports, and Smart View enables finance teams to slice data within Excel without compromising governance. Licensing can be rigid, but integration pays off for NetSuite shops.

6. Vena

Vena bets that finance pros never really want to leave Excel. Its grid resides within the familiar spreadsheet, while a centralized database (plus native Power BI) provides governance and visual impact. AI features are emerging, but customers rave about the flexibility of templates.

FP&A teams still spend only 35% of their time on high-value analysis; the rest is eaten by data gathering and validation (FP&A Trends Survey, 2024). Vena attacks that imbalance by automating consolidation and submissions.

7. Prophix

Manufacturers and CAPEX-heavy firms love Prophix for its waterfall visuals and capital-project workflows. The built-in process manager prompts users to submit forecasts on time, and the new AI “Task Assistant” flags anomalies.

8. Datarails

If you’re an SMB living in Excel models, Datarails might be the fastest lift. The platform ingests your existing workbooks, maps the logic, and then auto-consolidates each refresh. Role-based dashboards keep leadership out of fragile formulas.

9. Pigment

The newest entrant delivers a slick, consumer-grade UI and sub-second scenario modeling. Drag a driver slider, and every connected metric updates instantly. Finance teams that want modern design and have the capacity to learn a new interface give Pigment five-star reviews.

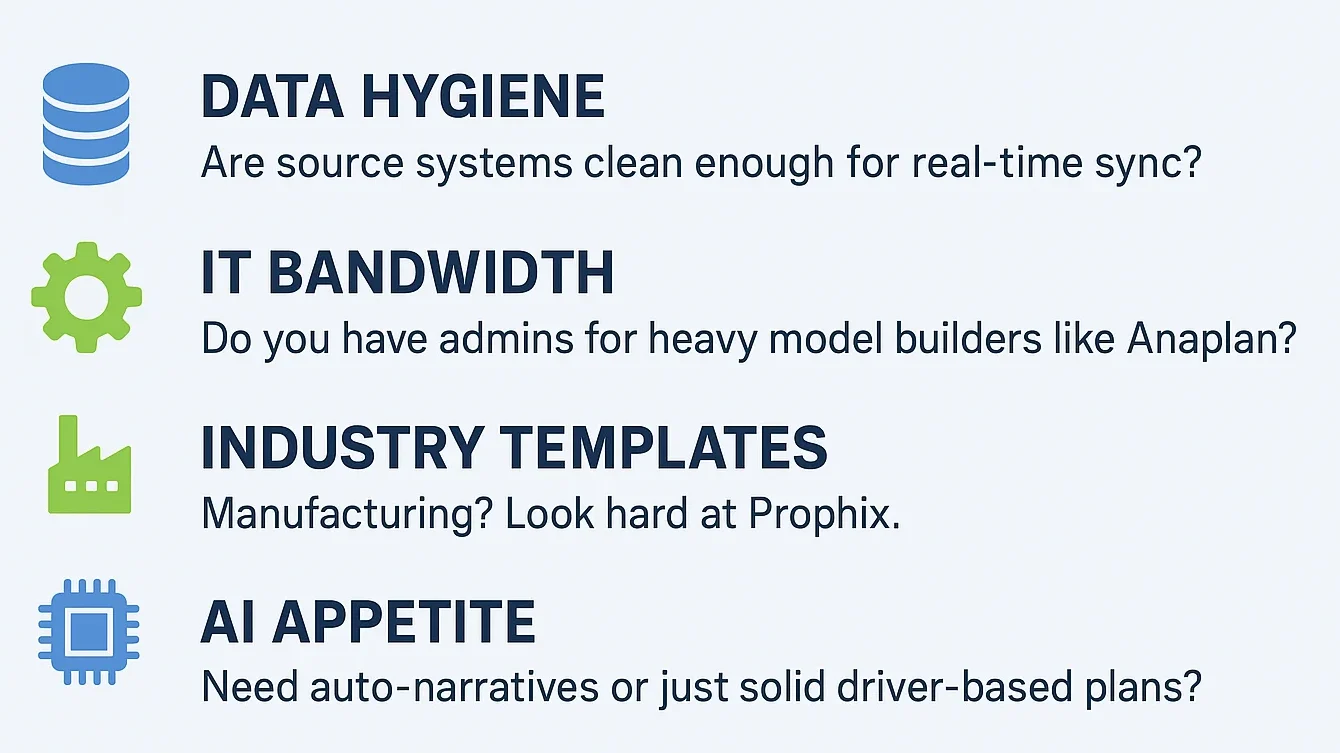

Choosing the Right Fit: A Quick Checklist

- Data hygiene: Are source systems clean enough for real-time sync?

- IT bandwidth: Do you have admins for heavy model builders like Anaplan?

- Industry templates: Manufacturing? Look hard at Prophix. SaaS? Cube or Pigment.

- AI appetite: Do you need auto-narratives or just solid driver-based plans?

- Change management: Can teams abandon manual Excel workbooks?

- Budget flexibility: Subscription tiers vary 3-4× across this list.

In 2024, 58% of finance functions are already utilizing AI, representing a 21-point increase from the previous year. Buying a platform that can exploit that momentum matters.

Caveats & Counterpoints

Even the best platform won’t fix messy source data or cultural resistance. Implementation fatigue is real, and AI features exacerbate data-quality issues if the numbers are unreliable. Budget extra time for driver alignment and user training before chasing advanced functionality.

Conclusion

Effective revenue planning requires both solid processes and appropriate tools. The nine platforms discussed here address a wide range of needs, from small business consolidation to enterprise-level connected planning. A practical approach to vendor selection is to pilot two options for 30 days and track a measurable KPI, such as hours-to-insight, to identify which platform best fits the organization’s requirements.