In the modern digital landscape, e-commerce has made the act of selling internationally frictionless. A few clicks can connect a small merchant in London with a customer base in Singapore or New York. Yet, for many growing digital businesses, the excitement of global sales is often dampened by the reality of outdated financial plumbing. AI-powered payments promise to eliminate many of these barriers by automating verification, reducing fraud, and accelerating settlement across borders. Cross-border payments, characterized by hidden fees, unacceptable delays, and operational complexity, remain the primary bottleneck restricting true exponential growth.

The core paradox facing the global economy is this: while information and goods move at digital speeds, money often lags weeks behind. E-commerce platforms, marketplaces, and global service providers are increasingly reliant on instant liquidity and seamless transactions, but the legacy correspondent banking system was simply not built for the volume and velocity of digital commerce.

Key Takeaways

- AI-powered payments can revolutionize e-commerce by removing barriers like high fees and slow settlement times.

- Traditional banking systems hinder global sales, creating inefficiencies that affect cash flow and vendor relationships.

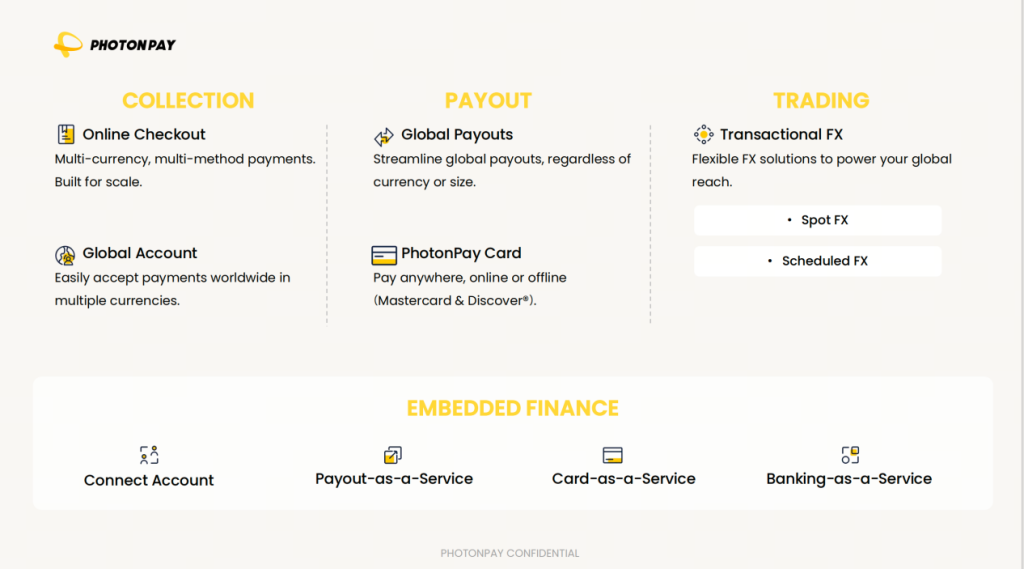

- PhotonPay introduces a unified digital finance platform designed to simplify cross-border transactions and enhance financial processes.

- The platform offers solutions like multi-currency payments, global accounts, and real-time FX management, addressing the needs of modern businesses.

- Adopting AI-powered payments transforms finance from a cost center into a strategic advantage, enabling quicker scalability and market penetration.

Table of contents

The Legacy Problem: Why Traditional Payments Fail E-commerce

For years, businesses have been forced to navigate archaic systems that actively penalize international trade. The obstacles presented by traditional finance are no longer minor inconveniences; they are measurable impediments to scaling:

- Exorbitant and Hidden FX Costs: Traditional banks operate with high wire fees and, more significantly, apply wide foreign exchange (FX) spreads. These spreads act as a non-transparent tax on every international payment, severely eroding the already tight profit margins of digital merchants and service platforms.

- Unacceptable Settlement Times: Routing funds through multiple intermediaries (a hallmark of legacy systems) dictates slow settlement times, often spanning 2 to 5 business days. This delay creates unpredictable cash flow, complicates vendor relationships, and strains liquidity, which is critical for restocking and investment.

- Operational Complexity: Managing foreign currency receivables often requires maintaining multiple, fragmented bank accounts in various jurisdictions. This heavy administrative burden necessitates extensive paperwork, increases compliance risk, and makes real-time financial reconciliation nearly impossible.

The New Blueprint: Digital Financial Infrastructure

To thrive in the age of global digital commerce, businesses need financial tools that are as fast, intelligent, and scalable as their e-commerce platforms. The necessary transition is not simply finding a cheaper processor, but adopting a unified, technology-first infrastructure built for the 21st century.

Leading this evolution is a new wave of fintech solutions, most notably PhotonPay, a global digital finance AI-powered platform that is fundamentally redefining the landscape of cross-border commerce. This infrastructure unifies diverse financial functionalities into a single API-first environment, empowering businesses to transact globally with the simplicity of local operations.

A Unified AI-Powered Payment Platform for Global Commerce

PhotonPay provides a platform specifically designed to eliminate the frictions described above, transforming complex international finance into a strategic operational advantage.

The platform’s core services include:

- Online Payments: Multi-currency solutions and various payment methods built for scale, ensuring merchants can accept locally preferred payment types globally to boost conversion rates.

- Global Accounts: Enables businesses to easily accept payments worldwide and in multiple currencies by seamlessly setting up virtual global accounts (e.g., local receiving accounts and IBANs).

- Card Issuing: Allows the platform to issue cards that can be used for corporate expenditures anywhere Mastercard and Discover®️ Network are accepted, both on and offline, centralizing global expense management.

- Payouts: Streamlines mass payments to vendors, affiliates, and suppliers around the world regardless of the transaction size and currencies, ensuring timely distribution.

- FX Management: Expands international reach with ever-evolving foreign exchange solutions, offering competitive, real-time rates that allow businesses to proactively manage currency risk.

- Embedded Finance: With this API-first architecture, institutions of all sizes can build, launch, and scale their own embedded finance products, accelerating time-to-market for new financial offerings.

Strategic Advantages for the E-commerce Enterprise

The integration of such digital infrastructure offers profound strategic benefits for any enterprise focused on e-commerce and global services:

- Optimized Liquidity and Cash Flow: By moving payments from multi-day settlement cycles to near-instant or same-day processing, businesses immediately gain access to their capital. This reliable, rapid cash flow enables faster reinvestment in inventory, marketing, and expansion.

- Radical Cost Reduction: The shift from opaque, bank-driven FX spreads to competitive, wholesale-like rates drastically cuts transaction costs. This transparency allows finance teams to forecast margins accurately without the constant threat of unexpected FX volatility.

- Simplified Compliance and Risk Management: Centralized platforms automate essential compliance checks (KYC/AML) and leverage AI for advanced fraud detection. Furthermore, a single interface for multi-currency management replaces the administrative nightmare of juggling disparate bank accounts.

- Enabling True Localization: The ability to provide local bank details to customers in key markets fosters trust, reduces payment failures, and is essential for market penetration in new regions. Businesses can receive funds as if they had a physical presence in every major market they serve.

Conclusion

The future of e-commerce is undeniably borderless, but this future can only be realized if the underlying financial technology is up to the task. The legacy systems are too slow and costly to support the speed, scale, and complexity of modern digital commerce.

For e-commerce leaders, adopting AI-driven financial infrastructure is not an incremental improvement; it is a fundamental shift that transforms finance from a cost center and operational roadblock into a powerful engine for global scalability. By prioritizing technological agility, transparency, and speed, these AI-powered payment platforms ensure that businesses can focus their energy where it matters most: on serving customers and capturing market share worldwide.