Tampa Bay’s winter mornings shine, but markets can dim the view. Nearly 690,000 locals over 65 watched a classic 60/40 blend tumble about 20 percent in 2022—the worst since the 1930s. That jolt raised a practical question: Is your nest egg built for the next hit? A portfolio stress test models recessions, rate shocks, and hurricane-driven tourism slumps so you spot cracks early. We vetted Tampa advisors, big-bank tools, and DIY tech to map who offers deep analytics, fair fees, and plain-English fixes. Ready? Let’s see how we picked the winners.

Key Takeaways

- Tampa Bay faced significant investment losses in 2022, prompting a need for proper portfolio risk assessment.

- A rigorous six-point rubric identified the best local advisors based on transparency, tech use, and retirement expertise.

- The article compares ten standout firms offering diverse portfolio risk assessment tools, including personalized stress tests and DIY options.

- Services range from detailed reports by fiduciaries to free tools for self-directed retirees, catering to different preferences.

- Regular portfolio stress tests help identify weaknesses early, allowing adjustments before financial challenges arise.

Table of contents

- How We Chose Tampa’s Top Portfolio Stress Test Experts

- A Quick Side-By-Side Look at Portfolio Stress Tests

- 1. Signature Financial Solutions: Clarity Without Surrendering Control

- 2. Dolphin Financial Group: Retirement Risk In Living Color

- 3. Carriagegate Wealth: Scenario Planning For The “What-If” Decade

- 4. Tampa Bay Financial Advisors: Smooth Sailing Through Market Chop

- 5. Carter Ridge Strategic Advisors: One Roof For Market and Life Risks

- 6. Suncoast Equity Management: Veteran Discipline for Capital Preservation

- 7. AssuredPartners Investment Advisors: Big-Firm Firepower, Neighborhood Access

- 8. Wells Fargo Advisors’ RAPTR: A Free Reality Check In Under An Hour

- 9. Empower Personal Dashboard: DIY Monte Carlo at Your Kitchen Table

- 10. NewRetirement Planner: The Power-User “what-if” Laboratory

- Frequently Asked Questions

- Conclusion

How We Chose Tampa’s Top Portfolio Stress Test Experts

We didn’t Google “best advisors” and walk away. Instead, we built a six-point rubric and sifted through every Form ADV, website footer, and third-party database we could access.

First, we pulled the SEC-registered firm list for Tampa from SmartAsset’s advisor census, which provided clean, disclosure-free candidates plus hard numbers on assets, fees, and minimums.

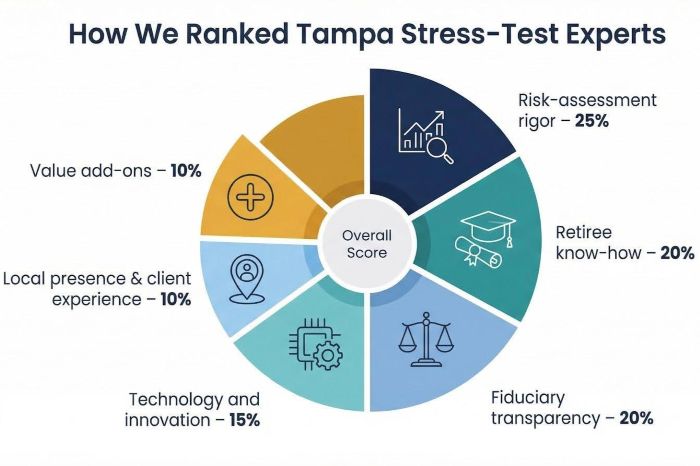

Then we scored each service across six weighted factors:

- Risk-assessment rigor (25 percent): Do they run Monte Carlo simulations, scenario models, or simply eyeball your mix?

- Retiree know-how (20 percent): Credentials such as CFP® or RICP and a clear focus on retirement income.

- Fiduciary transparency (20 percent): Fee-only firms score highest, while hybrids earn credit when conflicts are plainly disclosed.

- Technology and innovation (15 percent): Use of tools like Riskalyze/Nitrogen, HiddenLevers, or proprietary analytics that surface hidden concentrations.

- Local presence and client experience (10 percent): Tampa offices, face-to-face access, and strong review trends.

- Value add-ons (10 percent): Stand-alone second opinions, flexible minimums, or extras such as insurance stress tests.

We tallied the results, held tie-breaker calls when data looked unclear, and narrowed the list to ten standouts. Each finalist excels in at least one pillar and scores solidly on the rest. Together they cover every style of stress test, from complimentary big-bank snapshots to deep, fee-only fiduciary reviews.

Next, you’ll see a quick table to compare them at a glance before we dive into the full rundown.

A Quick Side-By-Side Look at Portfolio Stress Tests

Before we dive into the ten full write-ups, here’s a quick snapshot. Scan the rows, note the perks that matter to you, and keep reading for deeper context.

| Provider | Minimum assets | Core stress-test tool | Fiduciary? | Fee style | Stand-out benefit |

| Signature Financial Solutions | None | Custom open-architecture analysis | Yes | Flat advice fee | One-time “second opinion” while you keep control |

| Dolphin Financial Group | None | Nitrogen risk score + Color-of-Money chart | Yes | Fee-based | Visual green-yellow-red dashboards retirees love |

| CarriageGate Wealth | None noted | WealthVision scenario modeling | Yes | Fee-based | Holistic plan that folds in estate and longevity risk |

| Tampa Bay Financial Advisors | None | In-house risk profiling | Yes | Fee-based | Ongoing tweaks as life or markets shift |

| Carter Ridge Strategic | None | Modern risk software + insurance overlay | Yes | Fee-only | Combines market, insurance, and cash-flow stress tests |

| Suncoast Equity Management | $250k | Disciplined value + MPT analytics | Yes | Fee-only | Twenty-five-year track record of downside control |

| AssuredPartners | None | Multi-factor research + institutional tools | Yes | Fee-based | Big-firm depth with no stated minimum |

| Wells Fargo RAPTR | None | RAPTR scenario engine | Reg BI | Commission/AUM, free test | Complimentary big-bank stress report |

| Empower Dashboard | None | 1,000-scenario Monte Carlo | N/A | Free | DIY probability score updates daily |

| NewRetirement Planner | None | Deep custom Monte Carlo | N/A | $0–$120 per year | Power-user “what-if” playground |

Think of this table as a quick taste of the range: boutique fiduciaries, giant brokerages, and DIY software. Next, we’ll explore why each option earned a spot on our list.

1. Signature Financial Solutions: Clarity Without Surrendering Control

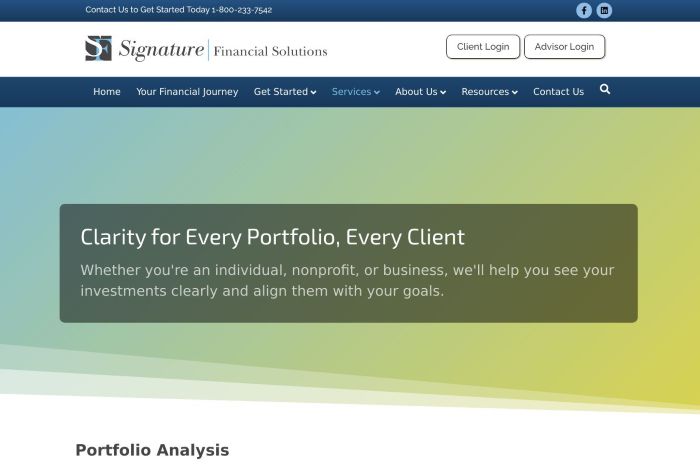

Step into Signature’s South Tampa office and you’ll see a whiteboard filled with accounts, not a sales brochure. Advisors map every IRA, 401(k), and dormant brokerage account, then feed each holding into an open-architecture portfolio stress test engine whose nondiscretionary portfolio analysis delivers clear diagnostics and tailored next steps while you remain in control.

Signature Financial Solutions portfolio analysis service page screenshot

You stay in the driver’s seat. Signature’s flagship service is a nondiscretionary “second opinion.” Line by line, the team shows how a 2008-style crash, a five-year inflation run, or an unexpected medical bill could hit your balance. They deliver a playbook to shore up weak spots; you choose whether to act.

Why retirees like it: no asset minimums, no custodian change, and a flat planning fee that doesn’t rise with market swings. It is pure advice, not a precursor to a product pitch.

Pros? A fiduciary oath, CFP® leadership, and sophisticated fintech analytics often found only at larger firms. Cons? You must execute the plan yourself or hire them later for full management. Best for detail-oriented retirees who want clear risk answers today yet prefer to pull their own trade trigger tomorrow.

2. Dolphin Financial Group: Retirement Risk In Living Color

Dolphin’s Clearwater office feels closer to a tech showroom than a brokerage. Clients answer eleven plain-language questions, then watch a personal “risk number” light up: green for safe, yellow for balanced, red for aggressive. The moment the pie chart shows two-thirds of your savings in bright red, the message lands.

Under those colors, Nitrogen’s analytics engine tests thousands of market paths. Advisors layer in Social Security timing, required withdrawals, and healthcare costs to see whether your lifestyle stays afloat. If the chart leans too red, they suggest concrete fixes such as shifting a slice to short-term bonds, adding guaranteed income, or trimming concentrated stock.

Retirees praise the easy visuals and the firm’s fiduciary pledge. One caution: Dolphin is fee-based and insurance-licensed, so ask how any policy fits your wider plan. This option suits visual learners who prefer to grasp risk at a glance while letting a professional handle the math.

3. Carriagegate Wealth: Scenario Planning For The “What-If” Decade

CarriageGate’s meetings feel like a flight simulator. WealthVision loads your holdings, health assumptions, estate wishes, and potential business sales, then runs fifty market scenarios. You watch projected balances rise or dip while an advisor explains how a three-year inflation spike or a tech-sector slump could affect cash flow.

The follow-up report pairs each risk with a hedge: diversify an overweight growth fund, ladder Treasuries to cover three years of withdrawals, and review long-term-care coverage. Estate and tax considerations appear on the same dashboard, so no detail slips through a silo.

CarriageGate operates as a fiduciary and delivers family-office polish, with fees that reflect the depth of service. It suits affluent retirees who want every “what-if” addressed before leaving full-time work.

4. Tampa Bay Financial Advisors: Smooth Sailing Through Market Chop

TBFA keeps a steady hand on the tiller. Advisors first chart your starting point—risk tolerance, spending needs, and insurance gaps—then feed the data into an in-house model that blends diversification rules with real-world shocks such as rate hikes, recessions, and Florida insurance spikes.

You receive a plain-language memo instead of a data dump. The report flags overweight sectors, shows how a twenty-percent slide would affect monthly cash flow, and lists course corrections. Advisors meet at least once a year, and whenever life or markets shift, to rebalance and update the plan.

Fees fall in the midrange for fee-based firms, and the local office offers face-to-face support without big-firm formality. Couples seeking continuous guidance often find the fit appealing.

5. Carter Ridge Strategic Advisors: One Roof For Market and Life Risks

Carter Ridge is young in Tampa yet operates with seasoned discipline. Advisors begin with a full inventory of investments, insurance contracts, emergency cash, and hurricane-deductible exposure. A cloud platform then stress-tests each line item, toggling scenarios such as early bear markets or long-term-care events.

The insurance overlay sets this process apart. If the model shows a shortfall under a nursing-home scenario, the team compares asset reallocation with hybrid long-term-care coverage to plug the gap. Recommendations sit under a fiduciary standard, and any commission potential is disclosed upfront.

A shorter history means no decades-long track record, but it also brings fresh technology, flexible pricing, and extra advisor access. Retirees who want one quarterback for investments and protection often find the structure appealing.

6. Suncoast Equity Management: Veteran Discipline for Capital Preservation

Suncoast has guided client money through every major storm since 1998, and that history shapes its portfolio stress test mindset. Rather than rely on flashy dashboards, the team leans on fundamental research, modern portfolio theory, and a disciplined value bias that trims excess before it becomes pain.

The process begins with a downside audit. Analysts back-test your current mix against the dot-com bust, the 2008 crash, and the 2022 bond rout. If projected drawdowns exceed your comfort or income needs, they pivot to quality stocks, short-duration bonds, and a small slice of alternatives to reduce volatility.

As a fully fee-only firm with a $250,000 minimum, Suncoast delivers institutional-grade reports and quarterly letters that read like concise market textbooks. Returns may lag in frothy bull runs, but many retirees accept that trade-off for steadier sleep.

7. AssuredPartners Investment Advisors: Big-Firm Firepower, Neighborhood Access

AssuredPartners blends Wall Street research with a walk-in office on Kennedy Boulevard. A centralized research desk reviews fundamentals, technicals, and modern portfolio theory, then hands local advisors plain-spoken action notes.

The stress test feels like an annual checkup. Your portfolio is measured against more than thirty historical market slumps and several rate-shock scenarios. A printed report flags sector overweights, bond-duration mismatches, and excess fund costs. Advisors suggest fixes immediately, drawing from a broad menu that ranges from low-cost index funds to alternative income strategies.

The firm sets no asset minimum, making its tools available to new and seasoned investors alike. Fees are primarily percentage-of-assets, and some recommendations may carry commissions, so request a written breakdown before signing. In return you receive institutional-grade analytics close to home.

8. Wells Fargo Advisors’ RAPTR: A Free Reality Check In Under An Hour

Picture RAPTR as a diagnostic scan. You hand over recent statements, and a Wells Fargo advisor feeds each holding into a Broadridge engine. Minutes later a report shows how your mix stands up to more than one hundred market shocks, from stagflation to a replay of 2008.

The service is free, offered as an introduction to the firm’s advisory program. Even so, the report provides security-level risk statistics that reveal hidden concentrations and estimate how far your balance could fall before sleep becomes elusive.

Recommendations follow Regulation Best Interest, not a full fiduciary standard, so bring detailed questions. For self-directed retirees, the insight alone can justify the coffee meeting, and you can leave with actionable data and no obligation.

9. Empower Personal Dashboard: DIY Monte Carlo at Your Kitchen Table

Open a free Empower account, link your IRAs and taxable funds, and within minutes the Retirement Planner produces a Success Score. Behind that single number are more than one thousand market sequences. Some soar, some crash early, and the tool measures whether your money still lasts to age 95 under each path.

You can adjust variables on the fly. Want to buy a boat at 70 or boost travel spending by ten percent? Move a slider, rerun the simulation, and watch the probability change. The interface resembles a fitness tracker, inviting small tweaks until a green check mark appears.

A human coach is not included (Empower offers advice for an added fee), so you must translate findings into trades on your own. For spreadsheet-friendly retirees who value autonomy, this dashboard delivers an always-on stress test at no cost beyond a few clicks.

10. NewRetirement Planner: The Power-User “what-if” Laboratory

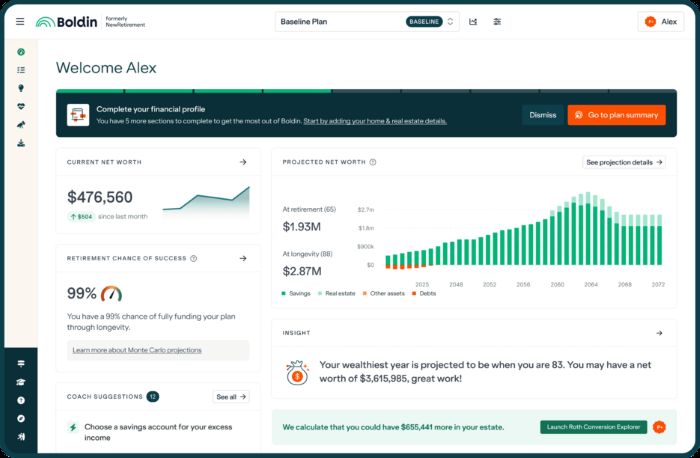

NewRetirement feels less like a quick check and more like a research lab. The free tier builds a baseline plan, while the Plus version (about one hundred dollars a year) unlocks side-by-side scenario wars: retire at 63 versus 67, sell the rental or keep it, assume three or five percent inflation.

NewRetirement Planner Monte Carlo and scenario comparison dashboard

A robust Monte Carlo engine runs each scenario hundreds of times. You can layer a custom market crash in year five, dial health expenses to “high,” and push longevity to age 100. The dashboard then shows how each tweak lifts or lowers your probability of success, updating charts instantly for every adjustment.

The trade-off is complexity. Plan to invest a few hours inputting data and learning menus. There is no automatic trade execution, but you can export action lists or book paid coaching if you prefer guidance. Analytical retirees who want ultimate control and answers to every hypothetical often find no consumer tool matches this sandbox.

Frequently Asked Questions

What is a portfolio stress test?

A portfolio stress test acts like a hurricane drill for your money. Software loads your current holdings, replays past crashes, and models new shocks so you can see, in dollars, how a thirty-percent stock drop or a decade of four-percent inflation would affect your income plan.

How often should I run one?

Run a risk assessment each year and after any major change such as a market swing, home sale, or health event. Catching risk drift early lets you make small tweaks instead of emergency repairs.

DIY tool or human advisor?

Free platforms such as Empower and NewRetirement provide strong engines but no co-pilot. If you enjoy spreadsheets and stay calm when markets slide, go DIY. If you want tax ideas, behavioral coaching, or trade execution, hire a fiduciary.

What is sequence-of-returns risk and how do I fight it?

This risk occurs when market losses hit early in retirement, shrinking the base that future gains must rebuild. Keep one to three years of spending in cash or short bonds, add guaranteed income streams where sensible, and stay flexible on withdrawals when markets drop.

What red flags tell me I’m taking too much risk?

Holding more than ninety percent in equities past age sixty-five, large single-stock positions, or feeling the urge to sell each time cable news turns red are warning signs. A stress test quantifies those dangers and shows how to dial them back.

Conclusion

A well-structured portfolio stress test reveals weaknesses before the next financial storm hits. Use these Tampa-area resources—whether human advisors or robust DIY platforms—to check your plan, patch the gaps, and retire with greater confidence.