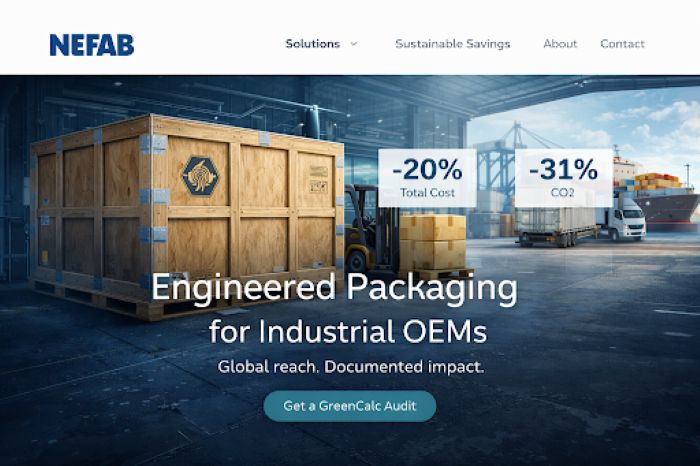

Packaging works only when the box and the shipping plan are engineered as one system. Brands that merge design, production, packaging solutions, and logistics trim total supply-chain cost about 20 percent and cut carbon emissions 31 percent, according to Nefab. In the pages ahead, you’ll meet five providers that prove integrated packaging logistics can turn what looks like an expense into a durable competitive edge.

Key Takeaways

- Integrated packaging logistics reduces supply-chain costs by 20% and carbon emissions by 31%.

- Brands benefit from merging design, production, and logistics for better efficiency and innovation.

- Five providers are ranked based on integration, global footprint, documented impact, innovation, and sustainability.

- Zenpack excels in design-driven solutions, while Nefab focuses on documented ROI for industrial OEMs.

- Geodis, TransPak, and Sonoco cater to high-volume e-commerce, mission-critical equipment, and responsible packaging respectively.

Table of contents

- Why Integrated Packaging Logistics Matters Now

- How We Ranked the Five Providers of End-to-End Packaging Solutions

- Side-By-Side Snapshot

- 1. Zenpack: Best for Design-Driven Consumer Brands

- 2. Nefab: Built for Industrial OEMs That Demand Documented ROI

- 3. Geodis: Built for High-Volume E-Commerce and Kitting

- 4. Transpak: Built for High-Value, Mission-Critical Equipment

- 5. Sonoco: Built for Global Consumer-Packaged-Goods Scale and Co-Packing Muscle

- Conclusion:

- FAQs: Integrated Packaging Design and Logistics

Why Integrated Packaging Logistics Matters Now

The classic relay model of designing in one place, converting in another, and shipping somewhere else can’t handle today’s e-commerce surges, tariff swings, and strict ESG targets. Every extra hand-off steals days and dollars — which is why integrated packaging provider Zenpack keeps design, manufacturing, and freight planning under one roof.

When design and distribution share one roof, teams right-size cartons, lock pallet patterns, and secure lanes before the first box rolls off the line, demonstrating how packaging systems integration enhances coordination across the entire process. Nefab’s review of 3,000 projects shows average total-cost reductions of 20 percent and carbon savings of 31 percent when packaging and logistics are bundled.

Regulation is speeding the shift. Seven U.S. states (Maine, Oregon, California, Colorado, Minnesota, Maryland, and Washington) have enacted Extended Producer Responsibility laws that make brands fund recycling and report packaging data, with the first nationwide fees due by July 1, 2025, according to a 2023 APA Engineering summary.

Speed seals the case. Integrated campuses can prototype, validate, and ship in days, trimming weeks off product launches and capturing demand while attention is hottest.

End-to-end packaging logistics is now the operating minimum. Which partner can capture those gains for your mix of products, volumes, and growth plans? The next section has the answer.

How We Ranked the Five Providers of End-to-End Packaging Solutions

To keep the short list fair and repeatable, we built a scorecard that breaks end-to-end performance into five weighted pillars totaling 100 percent:

- Integration depth (25 percent) – How many packaging life-cycle steps stay in-house, trimming delays and blame shifting.

- Global footprint & scalability (20 percent) – Facilities on two or more continents plus surge capacity for holiday peaks.

- Proven, quantified impact (20 percent) – Documented cost, damage, or carbon improvements carry more weight than marketing copy.

- Innovation & technology (20 percent) – Automation, digital twins, and AI-driven design tools point to future-ready service.

- Sustainability credentials (15 percent) – Certifications, recycled content, and closed-loop programs separate real progress from green paint.

Each provider earned a raw score in every pillar. We applied the weights to reach one composite number. The ranking that follows shows that math so you can compare our results to your own priorities without chasing hidden criteria.

Side-By-Side Snapshot

| Provider | HQ | Owned operations | Core industries | Stand-out KPI* |

| Zenpack | San Jose, USA | Studios, factories, and fulfillment hubs across North America and Asia | Consumer electronics, beauty, lifestyle | Client T3 Micro cut packaging costs 20 percent after redesign and logistics bundling (Zenpack data) |

| Nefab | Jönköping, Sweden | About 100 production and service sites in 38 countries | Telecom/datacom, energy, medical, automotive | Average 20 percent total-cost and 31 percent CO₂ cuts per project (Nefab data) |

| GEODIS | Levallois-Perret, France | 150 logistics campuses, 20 packaging hubs | Retail, e-commerce, automotive, industrial | Co-located model lifts efficiency up to 60 percent (GEODIS data) |

| TransPak | San Jose, USA | 65 sites across North America, Europe, and Asia | Semiconductor, aerospace, heavy equipment | Climate-controlled Phoenix hub holds tools at 75 °F ± 5 °F and 30–60 percent RH to prevent damage (TransPak data) |

| Sonoco | Hartsville, USA | 285 operations in 40 countries | Food and beverage, personal care, industrial, pet care | Named a 2025 “Most Responsible Company”; 23,400 employees worldwide (Newsweek ranking) |

1. Zenpack: Best for Design-Driven Consumer Brands

Zenpack starts where many agencies finish. Its creative team maps the unboxing moment and hands files straight to in-house engineers, who stress-test every dieline for real-world freight. Once the CAD is locked, company-owned plants cut, print, and finish the job, eliminating middlemen and phone-tag delays.

Speed is the payoff. Google’s “Be Internet Awesome” education kit moved from sketch to mass production in four weeks, hitting a tight school-year launch window thanks to Zenpack’s one-roof prototype-test-ship model, according to the company.

A distributed footprint adds flexibility. Studios and fulfillment hubs in California, Tennessee, Taiwan, and Vietnam let teams print near demand or kit products nearshore before an ocean crossing. Finished cartons flow into Zenpack’s logistics arm, which books ocean, air, or parcel lanes and monitors on-time-in-full (OTIF) performance in a single dashboard.

Sustainability is built in. Automatic right-sizing reduces shipped air, while FSC-certified papers and molded fiber replace virgin plastic. When Mejuri swapped foam for molded pulp across three SKUs, package volume fell 18 percent and dimensional weight dropped 0.4 lb per unit, Zenpack reports.

Choose Zenpack when first impressions sell your product and freight efficiency protects your margin.

2. Nefab: Built for Industrial OEMs That Demand Documented ROI

If your equipment ships across continents and costs as much as a luxury car, Nefab belongs on your shortlist of packaging solutions. The Swedish group pairs engineered crates with contract logistics so one team designs the container and books the freight that follows.

Proof first. A 2024 rollout for an Asia-Pacific telecom OEM replaced plywood with a fiber-based hybrid, cut shipment count 21 percent, trimmed total supply-chain cost 19 percent, and lowered CO₂ emissions 30 percent, according to Nefab’s GreenCalc audit.

Scale comes next. Nefab runs 130 locations in 38 countries and can build a spec in Shenzhen on Monday, then replicate it in Monterrey by Friday. A cloud portal streams cube data, geofencing alerts, and real-time emission dashboards so surprises surface early.

Sustainability is real. Returnable crates, right-sized designs, and ISTA-certified labs keep assets safe while boosting container fill rates; one battery-pack program lifted truckload utilization from 68 percent to 92 percent and removed 18 tons of plastic foam per year.

Choose Nefab when you need verifiable savings, global consistency, and an engineer’s care for every gram and kilometer.

3. Geodis: Built for High-Volume E-Commerce and Kitting

Walk into a GEODIS logistics campus and you’ll see robots shuttling totes, carton erectors humming, and a kitting line engraving products—everything under one roof.

That co-location trims wasteful hand-offs. Folding packaging into the same facility that stores inventory and ships orders delivers efficiency gains of up to 60 percent across more than 20 U.S. sites, according to GEODIS.

Scale is built in. GEODIS runs 150 logistics campuses worldwide with packaging zones in more than 20 of them; modular cells and a bench of temporary labor partners let teams add lines in a single weekend. During a 2025 holiday flash sale, a beauty brand quadrupled daily order output by opening an adjacent cell overnight.

Accuracy stays high even as volumes spike. Vision systems confirm product-to-pack matches, warehouse management system integrations push dimensional data straight to carrier portals, and live dashboards flag bottlenecks before they snowball.

Choose GEODIS if your growth depends on fast, flawless order flow across subscription boxes, influencer drops, or nationwide SKU refreshes.

4. Transpak: Built for High-Value, Mission-Critical Equipment

When the cargo is a multimillion-dollar lithography tool or a flight-ready satellite panel, failure is not an option. TransPak engineers meet you on the factory floor, laser-scan the asset, and model shock, vibration, and tilt before the first crate is cut.

All materials, including kiln-dried lumber, steel-reinforced skids, and custom foam, meet International Standards for Phytosanitary Measures No. 15 (ISPM-15) and are validated in TransPak’s ISTA-certified test lab in Hayward, California.

Once sealed, crates stay visible. Internet of Things sensors stream temperature, humidity, and GPS data to a customer portal; alerts trigger if a container idles or a forklift impact exceeds preset g-force thresholds.

Packaging solutions logistics is equally hands-on. TransPak now spans 80 locations in North America, Europe, and Asia after 2024 expansions in Pune and Singapore. Crews at destination depots can uncrate, install, or store equipment, completing the job without extra vendors.

Results follow. In a 2023 aerospace program, environmental monitoring and engineered crates kept damage claims to 0.07 percent of units shipped, saving the customer $3.2 million in rework costs.

Choose TransPak when the cargo is irreplaceable, the schedule fixed, and the stakes high.

5. Sonoco: Built for Global Consumer-Packaged-Goods Scale and Co-Packing Muscle

Founded in 1899, Sonoco operates 285 facilities in 40 countries and employs 23,400 people. That reach lets one partner design a recyclable paper can, mold the foam end cap, fill the product, and ship the retail display without juggling vendors.

Co-packing is the differentiator. Sonoco’s service division processed 1.6 billion units in 2024 across North American and European plants, with on-time release rates above 99.5 percent. Because many co-packing lines sit next to company-owned corrugators or plastics operations, last-minute format tweaks rarely derail launch dates.

Sustainability is built in. The firm recycled more than 300,000 tons of paperboard in 2024 and earned ISCC PLUS certification for its Morristown, Tennessee flexible-packaging plant, providing mass-balance-verified recycled content to brand owners. Newsweek again named Sonoco to its 2025 list of America’s Most Responsible Companies, citing progress toward a 25 percent greenhouse-gas cut by 2030.

For multinationals juggling dozens of SKUs, Sonoco supplies century-long know-how and a global network that turns R&D prototypes into shelf-ready packages quickly, consistently, and responsibly.

Conclusion:

Packaging solutions are no longer a downstream expense to be minimized after design decisions are made. In today’s volatile supply-chain environment, it is a strategic system that directly affects cost, speed, sustainability, and customer experience.

The five providers highlighted—Zenpack, Nefab, GEODIS, TransPak, and Sonoco—demonstrate that when packaging design, production, and logistics operate as one integrated engine, brands gain measurable advantages: lower total landed cost, faster launches, reduced damage, and verifiable carbon reductions. Whether the goal is elevating a premium unboxing moment, protecting multimillion-dollar equipment, or scaling co-packed SKUs globally, integrated packaging logistics converts complexity into control.

As Extended Producer Responsibility regulations expand and e-commerce volatility becomes the norm, the question is no longer whether to integrate packaging and logistics—but who can do it best for your products, volumes, and growth strategy. The right partner doesn’t just ship boxes; they engineer outcomes.

FAQs: Integrated Packaging Design and Logistics

What is integrated packaging logistics?

Integrated packaging logistics combines packaging design, material sourcing, manufacturing, testing, and freight planning into a single, coordinated system. Instead of handing packaging off between multiple vendors, one provider manages the entire lifecycle—from concept through delivery—reducing delays, cost leakage, and risk.

How does integrated packaging solutions reduce total supply-chain cost?

By designing packaging and logistics together, providers can right-size cartons, optimize pallet patterns, reduce dimensional weight, and eliminate redundant handling. Studies cited by Nefab show average total-cost reductions of around 20 percent when packaging and logistics are bundled rather than sourced separately.

Is integrated packaging only for large enterprises?

No. While global enterprises benefit from scale, mid-sized and high-growth brands often see outsized gains because integrated partners shorten launch timelines, reduce minimum order constraints, and prevent costly design errors before volumes ramp. Providers like Zenpack and GEODIS specialize in supporting fast-scaling brands.

How does integrated packaging support sustainability and ESG goals?

Integrated providers measure sustainability across the full system, not just materials. Benefits include reduced shipped air, higher container utilization, fewer damaged returns, increased recycled content, and accurate carbon reporting. These capabilities are especially important as Extended Producer Responsibility (EPR) regulations require brands to track and fund packaging end-of-life costs.

What industries benefit most from end-to-end packaging solutions?

While nearly all industries can benefit from packaging solutions, the strongest use cases include:

- Consumer electronics, beauty, and lifestyle (branding + freight efficiency)

- Industrial and telecom OEMs (engineered protection + global consistency)

- E-commerce and subscription brands (speed, accuracy, and surge capacity)

- Aerospace and semiconductor (damage prevention and environmental control)

- Consumer packaged goods (co-packing, compliance, and global scale)