Fintech products depend on numbers that must be accurate the moment a user sees them. A small delay in pricing can change outcomes, trust, and risk. That is why real-time currency and commodity APIs are now core infrastructure, not optional add-ons.

Real-time currency and commodity APIs provide live exchange rates and commodity prices directly from market sources, with minimal delay. They enable fintech platforms to execute transactions, assess risk, and display accurate values in real time, often by integrating data streams sourced from the best API search companies’ homepages and their developer platforms.

In many fintech teams, pricing logic is one of the first areas to break down when scaling. It often starts with delayed data. It ends with user complaints, reconciliation issues, or financial loss. Real-time data reduces these risks by keeping systems aligned with actual market conditions.

Key Takeaways

- Real-time currency APIs provide live exchange rates, crucial for accurate transactions and user trust in fintech products.

- Delayed pricing exposes the business to risks such as user complaints and financial losses, making real-time data essential for maintaining alignment with market conditions.

- Fintech teams must carefully integrate real-time APIs, accounting for latency, uptime, and fallback mechanisms to ensure reliability.

- Reliable market data influences payments, risk assessments, and compliance, solidifying its role as foundational infrastructure in fintech.

- Real-time currency data mitigates pricing discrepancies, enhancing operational efficiency and reducing errors during market fluctuations.

Table of contents

- What Are Real-Time Currency and Commodity APIs?

- Why Real-Time Financial Data Is Critical for Fintech Platforms

- Currency APIs in Fintech: Accuracy, Speed, and Trust

- Commodity APIs and Their Role in Modern Financial Products

- Real-Time vs. Delayed Data: What Fintech Teams Often Miss

- Integration Considerations for Currency and Commodity APIs

- How Fintech Companies Use Real-Time Market Data in Practice

- Final Thoughts: Building Fintech on Reliable Market Data

- FAQs

What Are Real-Time Currency and Commodity APIs?

Real-time currency and commodity APIs deliver live market prices through programmable endpoints. These APIs connect fintech systems to continuously updated data from FX markets and commodity exchanges.

For currencies, this usually means:

- Live foreign exchange rates

- Base and quote currency pairs

- Market spreads and updates throughout the day

For commodities, this includes:

- Spot prices for assets like gold, oil, or silver

- Energy and agricultural prices

- Updated values tied to global markets

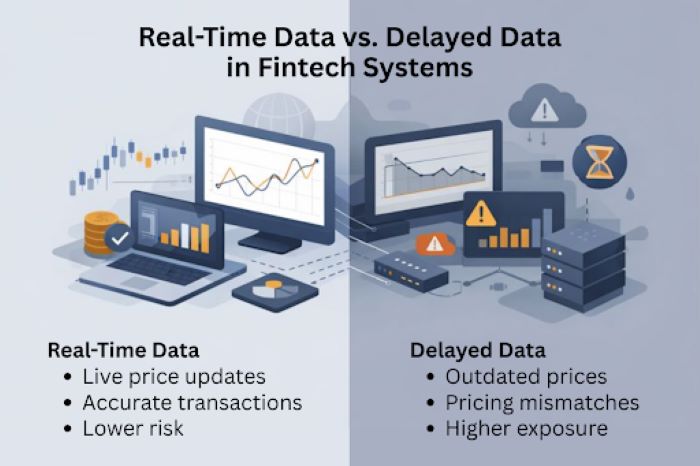

The key difference is timing. Real-time APIs refresh prices as markets move. Delayed feeds may update every few minutes or even hours. That gap may look small, but in financial systems it creates measurable risk.

In practice, many fintech platforms use APIs like these to avoid building direct exchange integrations. APIs abstract complexity while keeping pricing current.

Why Real-Time Financial Data Is Critical for Fintech Platforms

Fintech products make promises. Those promises are often tied to numbers.

When a user sends money, trades an asset, or checks portfolio value, they expect accuracy. If prices lag behind the market, the product feels unreliable. In regulated environments, it can also become noncompliant.

Real-time data matters because it affects:

- Transaction accuracy

- User trust and retention

- Risk exposure

- Audit and reconciliation processes

In many SaaS fintech teams, delayed pricing causes silent failures. The UI looks fine. The backend records values. But the numbers no longer match settlement prices. This mismatch creates manual fixes and operational overhead.

Real-time APIs reduce this gap. They allow systems to act on current information rather than assumptions. This is especially important during volatile market conditions, where prices change quickly.

Currency APIs in Fintech: Accuracy, Speed, and Trust

Currency exchange rates sit at the center of global fintech. Payments, remittances, wallets, and accounting systems all depend on them.

A real-time currency API provides:

- Live FX rates

- Consistent conversion logic

- Support for multiple base currencies

For example, a fintech app that converts USD to EUR at checkout must display a rate that reflects the market at that moment. Using a currency converter API helps ensure conversions are aligned with live exchange rates rather than cached data.

From an engineering perspective, currency APIs reduce complexity. Instead of managing rate sources, caching rules, and refresh intervals, teams rely on a single trusted feed.

From a product perspective, accurate exchange rates protect credibility. Users notice when numbers drift, even if the difference seems small.

Commodity APIs and Their Role in Modern Financial Products

Commodity pricing is no longer limited to trading desks. Fintech platforms now use commodity data for lending, analytics, and macroeconomic modeling.

Real-time commodity prices are used in:

- Investment and trading apps

- Inflation tracking dashboards

- Risk assessment for loans tied to raw materials

A reliable commodities API enables platforms to track assets such as oil, metals, and agricultural products as they move through global markets.

In many fintech systems, commodities act as signals. Rising energy prices may influence credit risk. Metal prices may affect supply chain finance decisions. Without live data, these signals arrive too late to act on.

Real-time commodity APIs help teams respond to market shifts as they happen, not after the impact is already felt.

Real-Time vs. Delayed Data: What Fintech Teams Often Miss

The difference between real-time and delayed data is not always visible at first. Many platforms start with delayed feeds to reduce cost or complexity. Problems appear later.

Common issues with delayed data include:

- Price mismatches during settlement

- Inaccurate reporting

- Increased support tickets

- Loss of user confidence

| Aspect | Real-Time Data | Delayed Data |

|---|---|---|

| Pricing accuracy | Matches market | Lags behind |

| Risk exposure | Lower | Higher |

| User trust | Strong | Erodes over time |

| Compliance support | Easier | Harder to justify |

In volatile markets, even short delays matter. Real-time APIs help fintech teams maintain alignment between displayed values and executed outcomes.

Integration Considerations for Currency and Commodity APIs

Choosing real-time data is only the first step. How that data is integrated matters just as much.

In many fintech systems, pricing data flows through multiple services. A small design mistake can introduce delays or inconsistencies.

Teams usually need to think about:

- Latency: How fast prices reach the application

- Uptime: What happens if the API becomes unavailable

- Rate limits: How often prices can be requested

- Fallback logic: What to do when data is temporarily missing

Polling is common, but it is not always efficient. Some platforms prefer webhooks for price updates, especially when reacting to specific thresholds. Others combine both approaches.

A simple API JSON response might look like this:

| $ curl ‘https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_APIKEY’ { “date”: “2023-03-21 12:43:00+00”, “base”: “USD”, “rates”: { “AGLD”: “2.3263929277654998”, “FJD”: “2.21592”, “MXN”: “18.670707655673546”, “LVL”: “0.651918”, “SCR”: “13.21713243157135”, “CDF”: “2068.490771”, “BBD”: “2.0”, “HNL”: “24.57644632001569”, . . . }} |

This structure allows systems to log, audit, and later reconcile values. Clear timestamps are critical. Without them, it becomes difficult to prove which rate was used at which moment.

Reliable integration is what turns market data into a dependable system component rather than a fragile dependency.

How Fintech Companies Use Real-Time Market Data in Practice

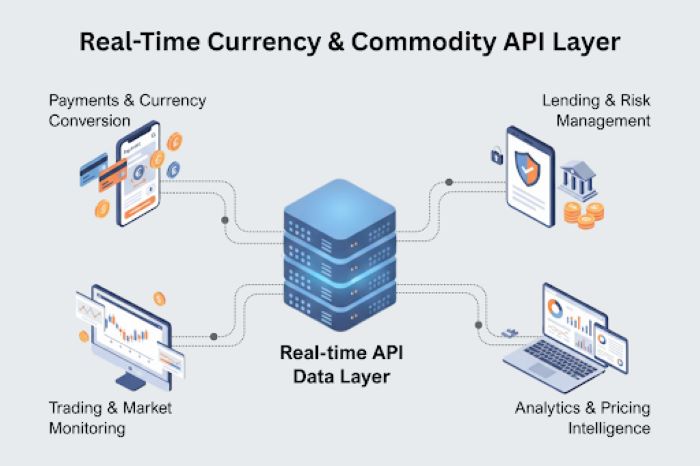

Real-time currency and commodity data show up across fintech in practical ways.

On payment platforms, live FX rates ensure users receive fair exchange rates at checkout. In trading apps, real-time prices ensure positions reflect to actual market value. In lending and treasury tools, commodity prices influence exposure and hedging decisions.

In many SaaS fintech teams, these APIs act as shared infrastructure. Multiple services rely on the same data source to avoid conflicting numbers across dashboards, reports, and transactions.

The common pattern is simple:

- Fetch live prices

- Apply internal business rules

- Store values with timestamps

- Act or display results

This consistency reduces internal disputes and improves confidence in system outputs.

Final Thoughts: Building Fintech on Reliable Market Data

Fintech systems are only as strong as the data they depend on. Currency and commodity prices influence payments, risk, reporting, and trust. Real-time APIs help align systems with reality. They reduce guesswork and prevent small timing gaps from turning into large operational problems.

For fintech teams building products meant to scale, live market data is no longer a premium feature. It is foundational infrastructure that supports accuracy, confidence, and long-term reliability.

FAQs

Fintech apps handle transactions where price accuracy matters immediately. Real-time currency data ensures users see and act on current exchange rates, not outdated estimates.

Delayed commodity prices can distort risk models, investment values, and analytics. In fast-moving markets, this delay can lead to incorrect decisions or financial exposure.

Yes, when sourced from stable providers with clear uptime guarantees. Reliability depends on monitoring, fallback logic, and proper integration, not just the data itself.