Running a business means I’m always on the move, and every mile I drive adds up. Tracking those miles by hand can quickly turn into a headache and eat up my valuable time. That’s where a mileage tracker app comes in handy for finances on the go, making it easy to log trips while I focus on growing my business.

With just a few taps on my Android phone, I can organize my travel expenses and keep my records accurate. Whether I’m heading to client meetings or picking up supplies, a mileage tracker helps me stay on top of my finances without the stress.

Key Takeaways

- Managing finances on the go is challenging for Android entrepreneurs due to manual tracking and paperwork.

- A mileage tracker app automates logging and reporting, significantly saving time and reducing errors.

- Key features include automatic trip detection, real-time expense categorization, and digital receipt integration.

- Integrations with accounting tools streamline bookkeeping and tax prep, making records audit-ready.

- Choosing a well-rated app with strong support ensures efficient financial management on the go.

Table of Contents

- The Challenges of Financial Management for Android Entrepreneurs

- The Role of Mileage Tracker Apps in Business Efficiency

- Key Features That Benefit Entrepreneurs

- Integrations with Other Financial Tools

- How a Mileage Tracker App Saves Time with Finances on the Go

- Automated Expense Reporting

- Streamlined Tax Deductions and Compliance

- Selecting the Best Mileage Tracker App for Android Devices

- App Comparison Table

- Practical Tips for Maximizing App Benefits for Finances on the Go

- Conclusion

The Challenges of Financial Management for Android Entrepreneurs

Managing finances as an Android entrepreneur involves tracking multiple revenue streams, frequent travel expenses, and rapid expenditures. Maintaining accurate records becomes difficult because sales, marketing, and client meetings often happen outside the office. Handling paper receipts, manually logging mileage, and entering data into spreadsheets create errors and consume hours each week. Categorizing business expenses, for example, fuel, lodging, and meals, further complicates expense management and finances on the go without automated tools.

Reconciling bank transactions and invoices on limited time, especially during tax season, increases stress and raises the risk of missing deductible expenses. Coordinating payments and reimbursements with contractors or remote teams introduces more paperwork and delays. Relying on manual processes limits the ability to react quickly to cash flow changes, leading to missed opportunities and growth constraints.

The Role of Mileage Tracker Apps in Business Efficiency

Mileage tracker apps streamline routine finance tasks for Android entrepreneurs. Automated logging and reporting reduce time spent on manual recordkeeping, freeing me to focus on growth.

Key Features That Benefit Entrepreneurs

- Automatic trip detection captures every business journey using GPS, removing guesswork from mileage logs.

- Real-time expense classification organizes travel costs by project or client, enabling instant cost allocation.

- Digital receipt storage attaches photos to trips, eliminating the need for paper records.

- Customizable reports generate IRS-compliant summaries, ensuring tax-ready records with minimal effort.

Integrations with Other Financial Tools

Direct syncing with cloud accounting platforms like QuickBooks or FreshBooks imports mileage data instantly. Seamless API connections send mileage details to expense trackers such as Expensify or Zoho Expense for consolidated reports. Two-way calendar integration prompts mileage tracking from client meeting events, optimizing missed log prevention. Bank feed imports help reconcile fuel purchases with trip logs for accurate cost management.

How a Mileage Tracker App Saves Time with Finances on the Go

A mileage tracker app accelerates routine finance tasks for me, letting technology handle documentation while I focus on running my business. This automation eliminates manual steps and slashes time spent on expense documentation and tax prep.

Automated Expense Reporting

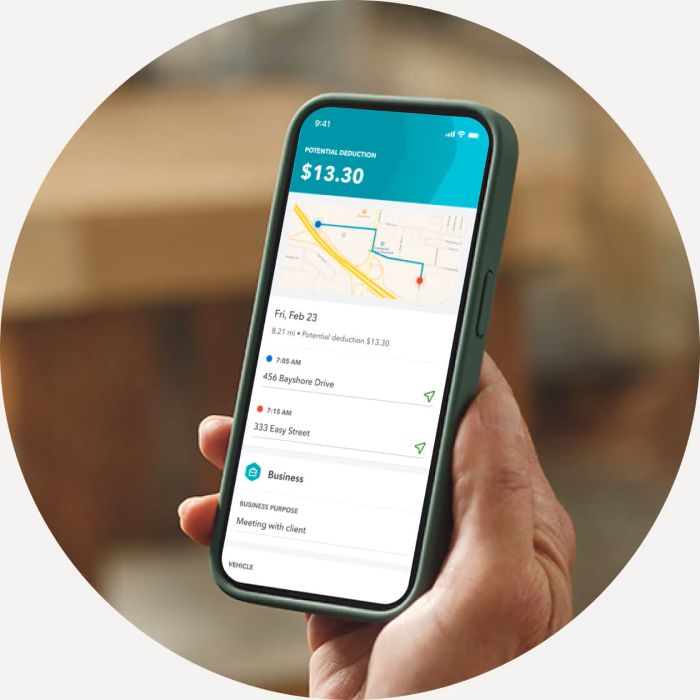

Automated expense reporting in mileage tracker apps organizes my trip data instantly. Each drive logs automatically using GPS, so I don’t input addresses or mileage amounts by hand. Digital receipt uploads attach directly to each trip entry, eliminating lost paperwork.

Reports break down trips by client, date, and purpose. Examples include sales visits, project meetings, and deliveries, letting me export categorized expenses in seconds for accounting. Real-time syncing pushes this data to cloud accounting tools like QuickBooks or Xero, maintaining up-to-date records across platforms.

Streamlined Tax Deductions and Compliance

Streamlined tax deductions and compliance features support consistent, audit-ready records for my business. The app classifies trips based on IRS or HMRC mileage standards, recording eligible business, commuting, and personal trips for accurate deductions.

I review flagged entries to confirm tax-deductible travel, ensuring compliance with 2024 regulations. End-of-year, I download tax-ready mileage logs, each with start and end locations, timestamps, and purposes, supporting expense claims without scrambling for lost records or receipts. Consistent categorization helps reduce audit risks, directly impacting my long-term financial health.

Selecting the Best Mileage Tracker App for Android Devices

Automatic Trip Detection

Automatic trip detection logs every drive using GPS, capturing business mileage precisely. Apps like Everlance and MileIQ use background tracking, so I never miss trips or forget entries with finances on the go.

Expense Categorization

Real-time expense categorization enables grouping trips by purpose and client, supporting tax-ready records. QuickBooks Self-Employed, for example, assigns categories during the drive for seamless integration with business finances.

Digital Receipt Integration

Digital receipt integration reduces manual record-keeping by letting me snap photos of fuel and toll receipts, which link to trip logs for audit-proof documentation. DriversNote accepts digital uploads and attaches them directly within each entry.

Cloud Sync and Data Export

Cloud sync and export functions back up all trip data automatically, allowing fast access from multiple Android devices or desktop apps. Zoho Expense supports CSV export, making it easy to transfer logs for tax filing or sharing with accountants.

Customization and Integrations

Customization and integrations with other accounting tools boost efficiency by syncing trip data, invoices, and expense reports across platforms. Apps like TripLog connect with Xero and FreshBooks, eliminating duplicate data entry for complete cost tracking.

Battery Optimization

Battery optimization settings in certain apps, such as Fuelio, extend phone uptime while running GPS logging in the background without disruptions to daily routines.

User Ratings and Support

User ratings and support factors provide insight into reliability and issue resolution. My experience and data from Google Play averages show that top-rated mileage tracker apps such as Mileage Expense Log consistently maintain at least a 4.5 rating, signaling strong overall satisfaction.

App Comparison Table

| App Name | Automatic Logging | Receipt Uploads | Data Export | Accounting Integrations | Average Rating |

|---|---|---|---|---|---|

| Everlance | Yes | Yes | Yes | QuickBooks, Xero | 4.7 |

| MileIQ | Yes | No | Yes | Excel, QuickBooks | 4.4 |

| QuickBooks S.E. | Yes | Yes | Yes | QuickBooks, TurboTax | 4.5 |

| Driversnote | Yes | Yes | Yes | CSV, PDF | 4.6 |

| Zoho Expense | Yes | Yes | Yes | Zoho Books, Xero | 4.5 |

| TripLog | Yes | Yes | Yes | FreshBooks, Xero | 4.5 |

| Fuelio | No | Yes | Yes | Excel | 4.4 |

| Mileage Expense Log | Yes | Yes | Yes | CSV | 4.6 |

Practical Tips for Maximizing App Benefits for Finances on the Go

- Customize mileage categories to organize logs for analyses and tax reporting.

- Set up automatic trip detection with GPS tracking, if battery and privacy settings allow.

- Schedule regular data exports to cloud storage or accounting software.

- Integrate with expense platforms like QuickBooks or Expensify.

- Use digital receipt uploads for paperless audit trails.

- Review and edit trip logs routinely for accuracy.

- Monitor app updates and feature releases for performance improvements.

- Optimize battery and privacy settings to balance tracking precision with device longevity.

Conclusion

Managing finances on the go as an entrepreneur is never easy, but using a mileage tracker app on my Android device has made a noticeable difference. I can now capture every trip and expense with confidence, knowing my records are accurate and always ready for tax season. With less time spent on manual tracking, I’ve freed up energy to focus on growing my business. Embracing the right tools not only streamlines my workflow but also helps me make smarter financial decisions on the go.