Gold plays a major role in the global digital finance system, acting as a stabilizing force when currency markets fluctuate or geopolitical tensions rise. Its long history as a reserve asset continues to shape how central banks, institutional investors, and individual buyers manage risk.

Reports from EBC Financial Group indicate that the total above-ground stock supports a market cap estimated at nearly USD 27.8 trillion in 2025. In addition, global investment demand climbed to 1,179.5 tonnes in 2024, a 25% jump from the previous year, according to the World Gold Council.

With numbers this large, interest in gold tokenization continues to grow as investors look for modern ways to access a trusted asset. The blend of blockchain efficiency and physical backing offers a fresh pathway for trading, storage, and utility. This article breaks down how it works, the impact it may deliver, and the challenges that still need attention.

Key Takeaways

- Gold serves as a stabilizing force in digital finance, attracting significant investment and tokenization interest.

- Tokenization of gold creates digital tokens representing physical gold, streamlining access and management for investors.

- The process involves secure acquisition, minting tokens on a blockchain, and routine auditing to ensure trustworthiness.

- Tokenized gold enhances liquidity, lowers costs, and improves accessibility, appealing to both retail and institutional investors.

- Despite benefits, challenges include regulatory hurdles, market volatility, and the need for stringent custody measures.

Table of contents

What Is the Tokenization of Gold?

Tokenization of gold refers to the creation of digital tokens that represent ownership of physical gold stored in secure vaults. Each token corresponds to a specific and measurable quantity of gold. This approach blends traditional asset backing with blockchain-based recordkeeping.

Tokenization of real world assets provides a structured model in which investors hold verifiable, asset-backed digital finance units without relying on complex intermediaries. The result is a simplified way to access and manage gold exposure.

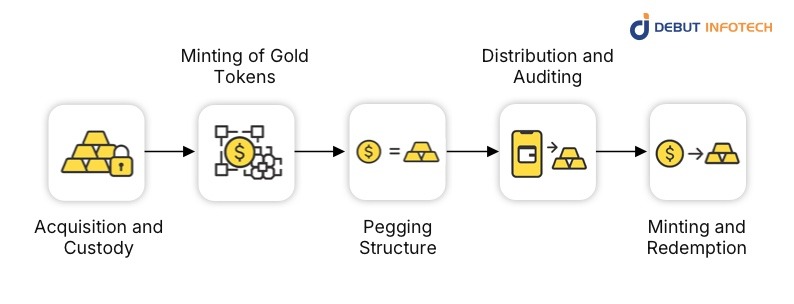

How Does Gold Tokenization Work?

1. Acquisition and Custody

The process begins with accredited providers sourcing certified gold and entrusting it to trusted custodians. These custodians follow strict procedures to ensure the metal remains secure, traceable, and audit-ready. This foundation is crucial because investors rely on verifiable reserves when engaging with tokenized gold platforms.

Providers must maintain clear custody reports to build user confidence and support long-term adoption.

2. Minting of Gold Tokens

Once gold is secured, digital finance tokens are minted on a blockchain network. Each unit represents a precise portion of the stored metal. This minting step transforms a typically immovable asset into a flexible digital instrument.

It opens the door to broader participation, making gold more accessible to global users who want to interact with it in smaller units.

3. Pegging Structure

Tokens maintain a direct link to physical holdings through a pegging model governed by predetermined ratios. This structure aligns token value with real-world reserves and limits pricing inconsistencies.

Detailed documentation, automated checks, and periodic verification procedures support the integrity of this peg. These guardrails contribute to a predictable and reliable trading environment.

At this stage, the technical foundation becomes critical. Building and maintaining a secure pegging structure, smart contracts, and audit-ready systems requires specialized expertise.

Many businesses choose to hire blockchain developers with experience in asset-backed tokens to ensure accurate reserve mapping, tamper-resistant contracts, and seamless integration with custody providers. The right development team helps minimize technical risk while supporting scalability and regulatory compliance.

4. Distribution and Auditing

After minting, tokens are moved to exchange platforms and wallet systems, where users can buy, hold, or transfer them with ease.

Providers conduct routine audits to confirm the presence and purity of vault holdings. These checks reinforce accountability and assure users that every circulating token mirrors actual gold. Clear reporting also strengthens regulatory alignment and cryptocurrency stability in markets.

5. Minting and Redemption

Investors can redeem tokens for physical gold or equivalent market value. This redemption mechanism ensures tokens behave as genuine claims rather than speculative representations. The flexibility to switch between digital and physical formats supports long-term interest. It encourages new participants who prefer adaptable asset structures in digital finance.

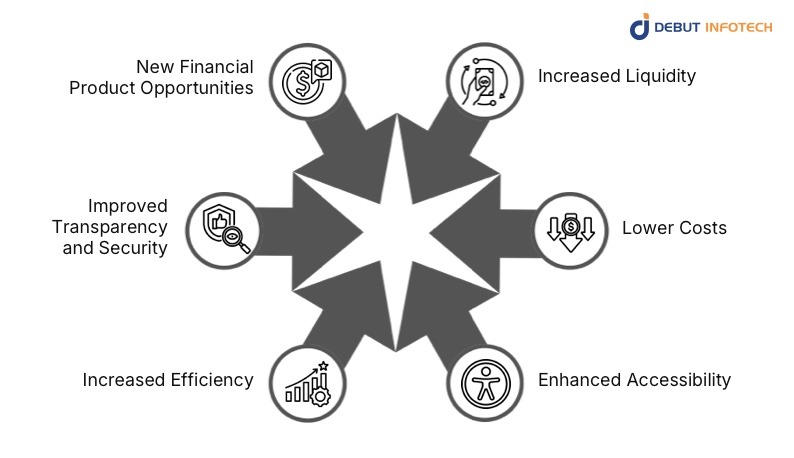

Impacts of Tokenized Gold

1. Increased Liquidity

Tokenized gold introduces greater liquidity by enabling continuous trading across multiple digital markets. This reduces friction associated with traditional bullion transactions and allows investors to enter or exit positions more efficiently.

The shift encourages more consistent market activity and stabilizes overall asset availability.

2. Lower Costs for Digital Finance

Blockchain-based settlement reduces reliance on multiple intermediaries and manual reporting layers. This streamlining lowers transactional and administrative costs.

Investors benefit from more affordable access to gold exposure. At the same time, providers or RWA Tokenization companies operate with leaner processes that support broader scaling.

3. Enhanced Accessibility

Tokenized models make gold ownership easier for users who might not have the means to purchase or store bars. Fractional tokens introduce practical entry points and remove barriers tied to logistics and storage. This expanded accessibility strengthens participation from global retail markets and institutional groups.

4. Increased Efficiency

Digital finance transfer mechanisms shorten settlement times and simplify verification procedures. Automated smart-contract logic manages movement, recordkeeping, and compliance tasks. These efficiencies reduce operational complexity and create a more optimized commodities trading ecosystem.

5. Improved Transparency and Security

Blockchain’s auditability supports clear transaction histories and reduces information gaps. Combined with custodial reporting, tokenized gold markets deliver a measurable level of security and reliability. This strengthens trust and fosters long-term engagement from both traders and institutional entities.

6. New Financial Product Opportunities

Tokenized commodities reserves serve as building blocks for new financial instruments. Lenders, fintech platforms, and investment firms can develop yield products, collateral models, and settlement systems backed by verifiable gold units. This expansion supports innovation and provides users with broader diversification options.

Use Cases of Gold Tokenization

1. P2P Transactions

Tokenized gold enables direct transfers between users without involving traditional clearing systems. These transactions settle quickly and leave an immutable audit trail, which reduces disputes and delays.

The ability to send gold-backed value across borders through a simple wallet interaction makes it a practical alternative to conventional remittance channels, especially for users who want reliable value exchange without relying on banks.

2. Store of Value

Holding tokenized gold gives users a straightforward way to preserve wealth while avoiding the complexities of physical storage. Tokens remain tied to real vault reserves, so buyers retain exposure to a stable asset without having to manage transportation or insurance. This structure appeals to long-term savers who want clarity, portability, and easy liquidation when market conditions shift, without compromising the trust associated with physical gold.

3. DeFi Applications

Tokenized gold can be integrated into lending pools, collateral systems, automated strategies, and yield-based protocols on decentralized finance platforms. Its backing provides a reliable asset that helps balance risk across digital portfolios.

Users gain more utility from their gold holdings, as tokens can support borrowing power or produce structured returns. This hybrid use strengthens both the DeFi ecosystem and traditional asset-backed investment models.

Challenges to Consider for Digital Finance

1. Regulatory Hurdles

Tokenized gold projects must navigate diverse legal classifications across global markets. Licensing, reporting, and asset-backing requirements differ by region, creating operational pressure.

Clear compliance frameworks, transparent disclosures, and consistent auditing help providers align with regulators and reassure users who want predictable, legally sound investment environments.

2. Market Volatility

Even though gold is relatively stable, tokens can face added volatility from exchange activity, liquidity gaps, or speculative trading. Gold tokenization platforms need controls that monitor unusual price movements and ensure orderly market behavior.

Stable liquidity planning and clear communication reduce uncertainty for users engaging with tokenized gold products.

3. Custody Issues

Physical gold reserves must remain secure, verified, and fully allocated to back circulating tokens. Any weakness in storage, auditing practices, or insurance coverage can affect credibility.

Providers must maintain strict custody standards and offer verifiable proof of holdings to build confidence in a market that depends heavily on trust and accountability.

4. Technological Vulnerabilities

Blockchain networks and smart contracts require continuous security assessments to prevent breaches, coding errors, or system downtime.

Providers must invest in routine audits, real-time monitoring, and patch management. These measures help safeguard tokens and maintain uninterrupted access for users who rely on smooth, resilient infrastructure for their digital finance.

5. Market Adoption and Trust

Adoption may slow if users remain unfamiliar with digital assets or unsure about the reliability of tokenized gold systems.

Clear education, strong transparency frameworks, and consistent communication build confidence. This trust is essential for encouraging broader participation and supporting long-term usage across retail and institutional markets.

Examples of Tokenized Gold

1. Tether Gold (XAUT)

Tether Gold provides digital tokens backed by allocated gold bars stored in Swiss vaults. Each token corresponds to a specific amount of gold, giving holders a clear ownership claim.

The project focuses on transparency through regular attestations. It offers simple redemption options, making it one of the most recognized asset-backed gold tokens.

2. Kinesis Gold (KAU)

KAU tokens represent fully allocated, investment-grade gold held in audited vaults worldwide. The system supports instant settlement, low-cost transfers, and practical everyday use through its payment features.

Kinesis emphasizes liquidity and accessibility, allowing users to hold, spend, or redeem gold while benefiting from a structured, well-regulated ecosystem.

3. Comtech Gold (CGO)

Comtech Gold issues tokens backed by gold stored in UAE-regulated vaults, in accordance with Shariah-compliant standards. Each token reflects verifiable ownership, supported by clear documentation and frequent audits.

The platform integrates on-chain tracking and reliable custody, offering investors a secure, standardized way to interact with gold in tokenized form.

Conclusion

Gold tokenization is reshaping how investors and institutions interact with one of the world’s most trusted assets. It brings stronger liquidity, lower costs, simpler access, and a structure that supports both traditional and emerging financial models.

As adoption grows, gold’s role in digital markets will expand, creating smoother pathways for trading and long-term holding. The shift is gradual, but the direction is clear as gold tokenization continues to redefine what ownership looks like.

Debut Infotech delivers end-to-end support to businesses looking to launch secure, scalable gold tokenization platforms. As a top-tier asset tokenization development company, our team handles asset-backed token design, vault integration, smart contract development, and regulatory alignment with a clear focus on reliability and transparency.

We help clients turn physical gold reserves into usable digital finance assets that fit modern trading, payments, and DeFi ecosystems, making the transition smooth and future-ready.