Introduction

Over the past decade, the cryptocurrency market has experienced significant growth, attracting both seasoned and novice investors. One such technique that has garnered attention is copy trading, which enables users to replicate the positions of other traders in the market automatically. This approach mixes elements of passive investing and active decision-making, providing a choice for those who want access to professional strategies without being responsible for every trade. In fact, the global social trading platform market was valued at about USD 3.2 billion in 2024 and is projected to grow at a CAGR of around 9% between 2025 and 2034, reflecting the increasing popularity of this investment style. In this guide, we’re going to look at what copy trading is, how it works, the pros and cons, and what happens in 2025 when investing here.

Table of contents

Copy Trading Meaning and How It Works

Copy trading is social trading, where what happens in the account of a chosen trader is automatically replicated in the accounts of investors. Instead of typing in each trade by hand, you allocate funds and trade side by side with another person. For instance, lets say when trader open trades in the crypto market (spot or futures), that same trades are also opened automatically in the followers’ accounts. Investors do have some flexibility hiking or reducing allocations or adding protective, tools such as stop-loss or take-profit orders, and deciding when to pause or exit. As well as replicating individual traders’ activity, a few platforms offer access to algorithmic strategies or trading signals, acting as a link between automated and manual investment.

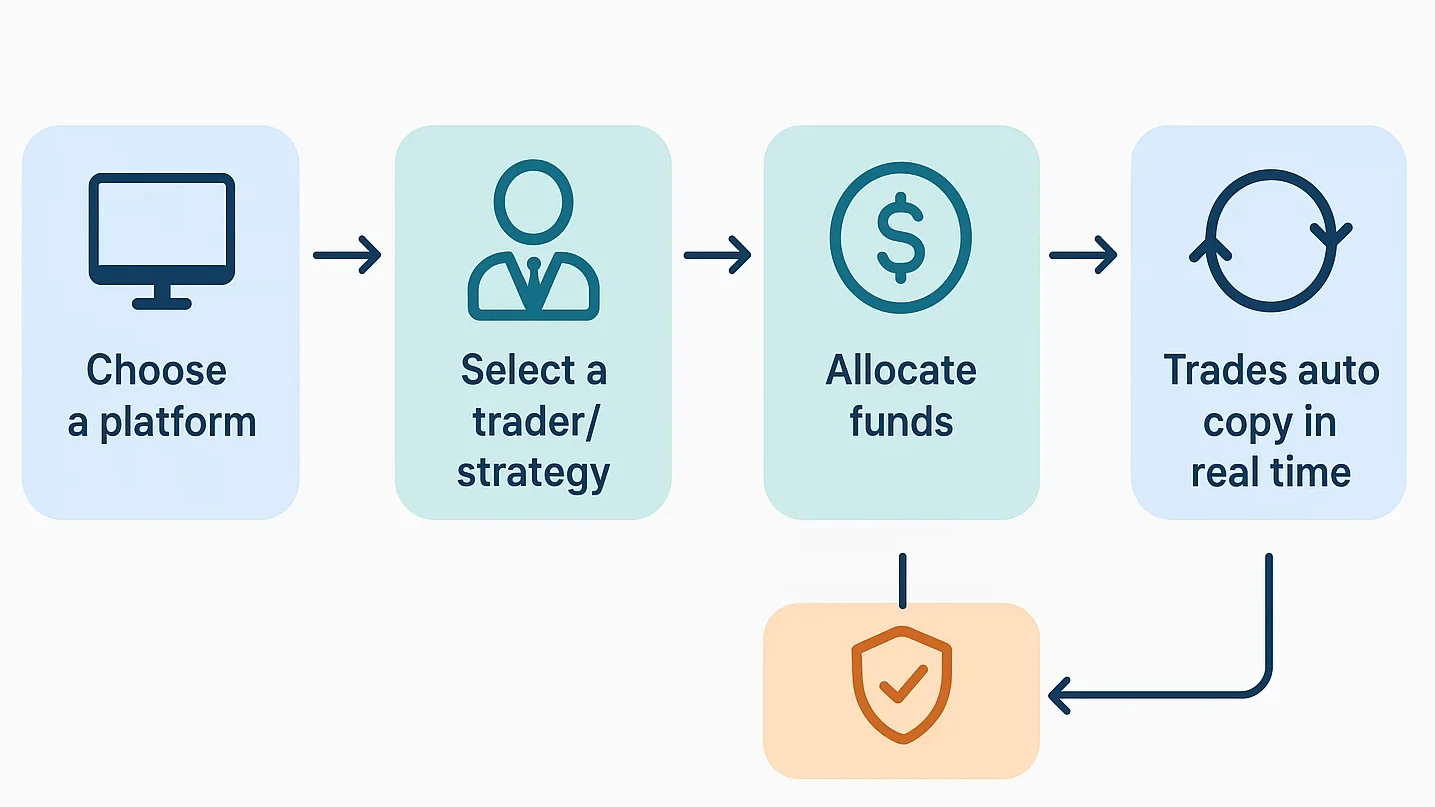

Copy Trading for Beginners: Step-by-Step

First of all, the way it works is usually through finding the right stats of the individual trader itself to copy, such as the trading history, drawdown levels, risks. After users sign up and verify their account, they attach their wallet or funding source and look at the traders or strategies on offer. Filtering is possible based on trading style, asset classes or historical past performance in most systems. Before risking your capital, it’s best to look at how a trader approaches risk and see what their track record has been like, consistently over time.

When funds are allocated, protective settings such as stop-loss and take-profit can be applied to reduce potential downside. After that, trades are mirrored in real time, with many platforms offering alerts or dashboards to track performance. Beginners are typically encouraged to start with small amounts and diversify their funds by spreading them across multiple traders or trading strategies, rather than relying on a single source. Regular monitoring helps ensure that results remain aligned with expectations.

Copy Trading Cryptocurrency: Pros, Risks, and Best Practices

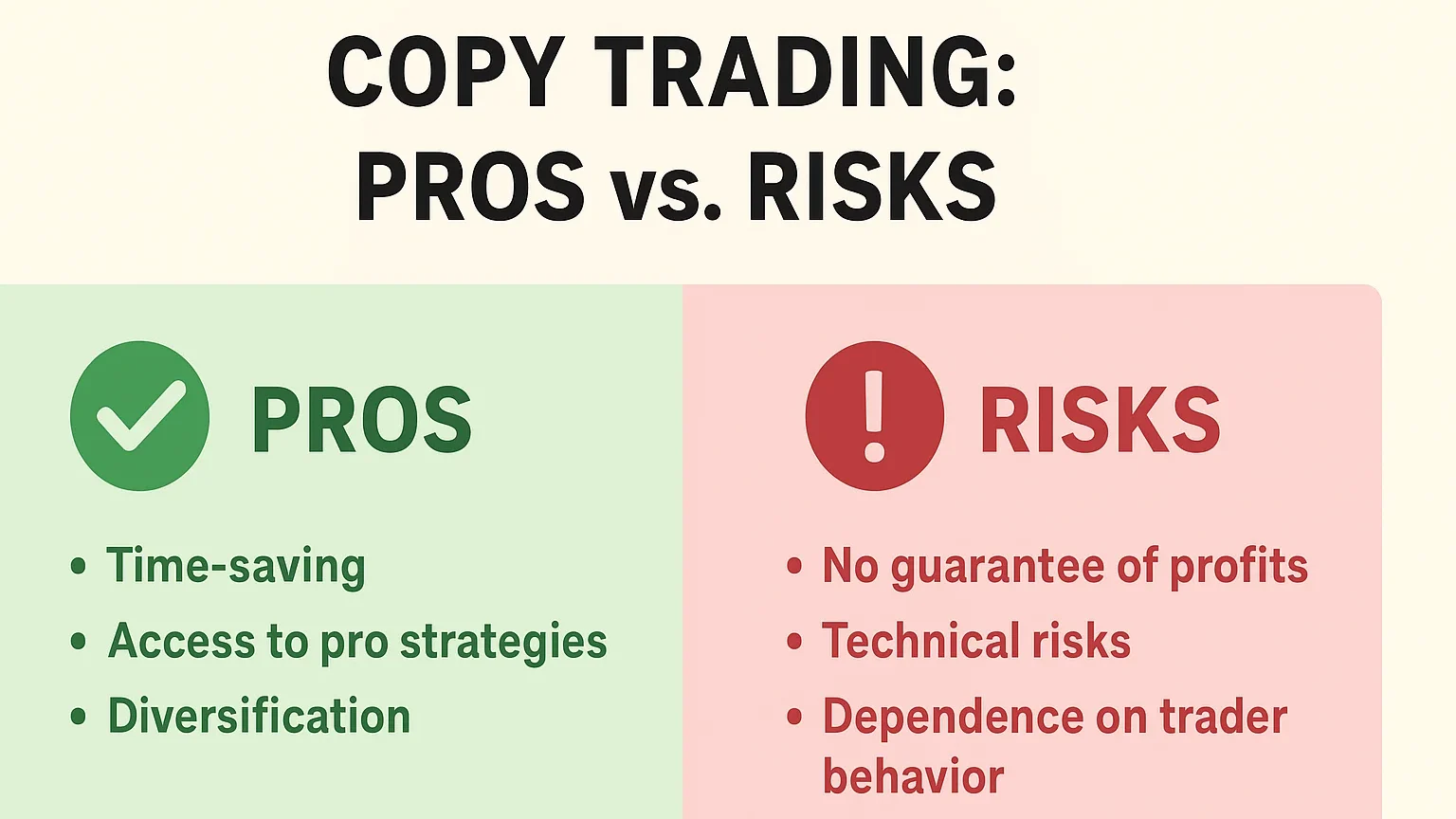

Copy trading presents both opportunities and risks. On the positive side, it reduces the need for constant manual trading, which can be useful for individuals who lack time or technical expertise. When done through a regulated platform, it also provides an opportunity to observe how more experienced traders operate, which can serve as a valuable learning tool. Furthermore, because capital can be allocated to several different traders or strategies, it creates opportunities for diversification. Many platforms also publish useful statistics, such as win rates and drawdowns, which help participants make informed choices.

At the same time, the risks are high. Results in the past do not guarantee results in the future, and strategies that work well often become less effective as more people pursue them. Technical issues, such as downtime and latency, can impact trade replication, and traders may alter their strategies causing further uncertainty. For these reasons, it would not be accurate to consider copy trading as a risk-free substitute.

Surely, good practice could be to employ risk protection tools such as stop-loss orders, and to analyze performance constantly. Risk management for newbies. Allocating just a part of your capital to copy trading and not staking your whole bankroll is a way of managing risk. Reviews and adjustments are occasionally needed due to shifts in market conditions and trader performance.

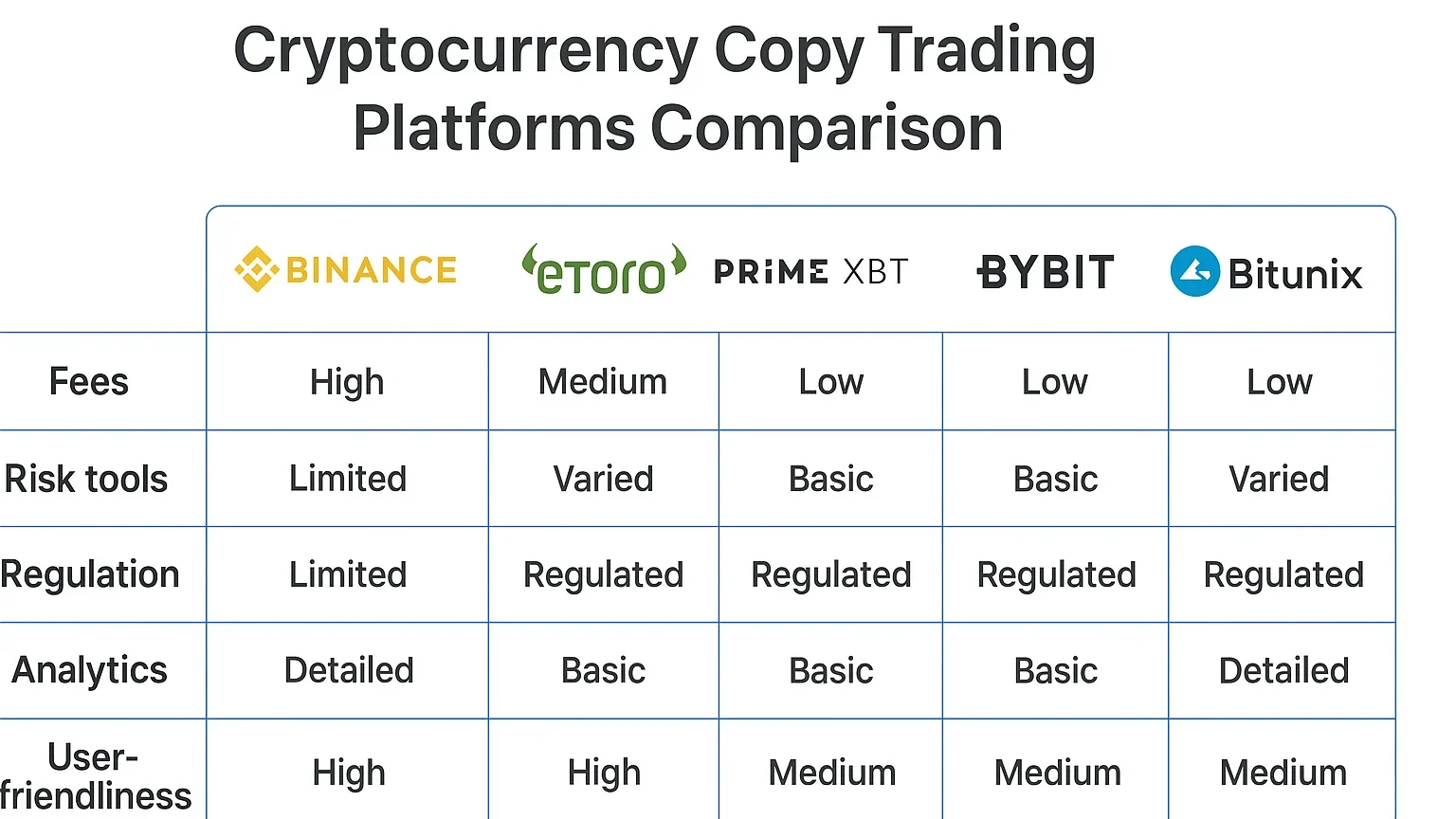

Top Cryptocurrency Copy Trading Platforms: Comparison (2025)

In 2025, multiple platforms offer copy trading, each with its pros and cons. Binance offers a broad global market with good liquidity; however, the futures fees are quite high, and the risk disclosure is insufficient. eToro, best known for stocks and forex, can also offer crypto and has a strong reputation for its regulatory framework and social trading platform. PrimeXBT is all about leverage and futures options, although there are portfolio statistics availÂable and real-time details on your balance, open orders, available margin and open position. Bybit has a strong presence in Asia, yet the platform’s analysis features are somewhat limited. Bitunix leverages analytics and education, providing a combination of traders and automated strategies with risk analytics and filtering capabilities.

All of these platforms are not equal in terms of cost, available risk tools, and the types of traders they support. Some emphasize automation and algorithms, while others center on community and social interaction. In selecting among them, investors should closely compare features, costs and the degree of regulatory oversight to determine which best fits their own goals and risk tolerance.

Best Practices for Copy Trading

For those considering copy trading, certain practices can help improve outcomes. Diversifying across several traders or strategies reduces reliance on any single source of performance. Applying stop-loss and take-profit settings helps limit exposure to large market swings. Regularly reviewing data, such as win rates, drawdowns, and overall portfolio performance, is crucial to ensure that results remain aligned with expectations. Rather than allocating all investment capital to copy trading, treating it as one component of a broader portfolio may provide a better balance.

FAQ

What does copy trading mean in crypto?

Copy trading is an automated system in which an investor’s account mirrors the trades of another trader in real time.

Is copy trading suitable for beginners?

It can make entry into trading more accessible, but risks remain, including platform outages, unreliable traders, and market volatility.

Can copy trading result in losses?

Yes. Profitability depends on trader performance, platform reliability, and broader market conditions.

How should I choose a trader to copy?

Long-term consistency, measured drawdowns, and diversified portfolios tend to be stronger indicators than short-term gains. Reviewing trader history and strategy before committing is recommended.

Conclusion

Copy trading has become one of several options available to cryptocurrency investors. It offers automation and access to professional strategies, but also involves risks such as performance uncertainty and operational limitations. When approached with caution, diversification, and effective use of protective tools, copy trading can be a valuable supplement to broader investment strategies. The best platform or approach will depend on an individual’s goals, experience, and tolerance for risk.