Let’s face it, keeping track of your investments can feel like herding cats. One minute you’re on the ASX checking your shares, and the very next minute you’ve got to recall how much rental income is generated by the property in Bondi, and let me tell you, not even a puny effort can chart through the disarray of the gold coins you’ve moved into for a rainy day. Makes your head twirl faster than a boomerang on a gusty day!

But the good news is you do not need to juggle everything yourself anymore. Some ripper digital tools are there to help you track all your investments in one place, taking some weight off your shoulders. Whether on the verge of full-fledged investing or just taking a few dips into the markets, these tools give you an in-depth snapshot of your portfolio in real time to make smarter decisions instead of being weighed down by stress.

Here we are going to discuss why digital tools are a valuable tool for managing personal finances, present some options that are best for Aussies, give you tips for picking the right one for you, and show you how to take off so you can stop worrying and start investing with confidence. Onwards we go!

Table of contents

Why Use Digital Tools for Investment Tracking?

One might be asking, “Why can’t I just use a spreadsheet or keep everything in my head?” You could, but honestly, spreadsheets are as exciting as watching paint dry, and using your brain for anything with all the tossing and turning will not be dependable (especially if you’re anything like me, who can’t even recall what I had for breakfast).

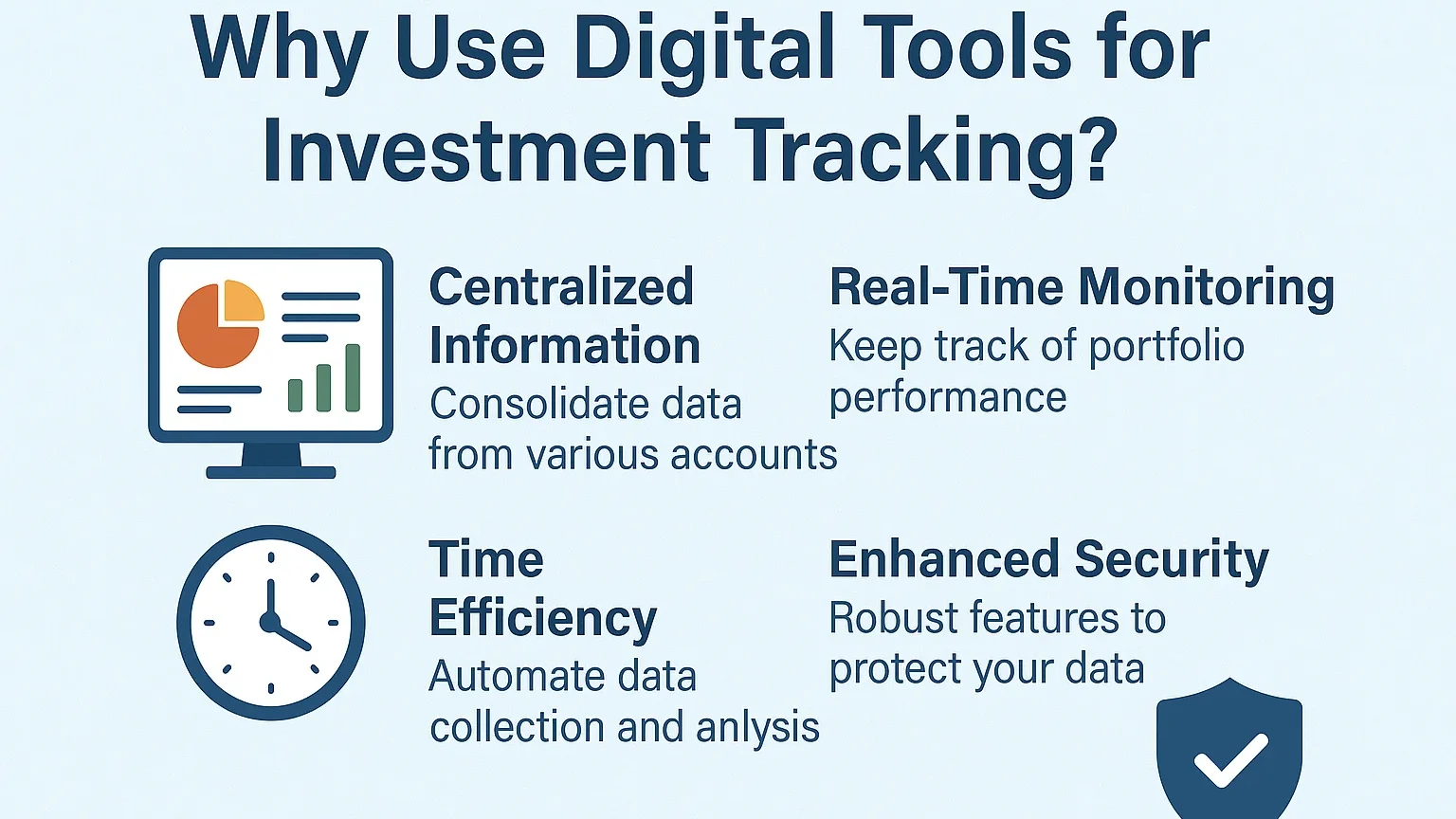

The advantages of digital tools are becoming increasingly apparent.

- One of the conveniences is that you can consult your portfolio anytime, whether you’re sitting on the couch or savoring your flat white at the local café.

- These digitally built tools pace themselves in real time, so you are never guessing on whether your investment is faring well.

- Finally, they stitch together all your assets under a single dashboard view, which saves time and significantly reduces manual tracking errors.

It’s just like a financial advisor in your pocket, minus the dollars. The peace of mind that comes with knowing all bases are covered is equally priceless. No more thinking, “Did I miss checking that?”

Types of Digital Tools for Investment Tracking

Now that you’re sold on the idea, here are some of the best digital tools available for Aussies. We divided them into categories based on the types of investments they suit best.

Apps for Stock and Share Investments

For those involved with shares, ETFs, or managed funds, there are numerous apps for the very job. Sharesight, for instance, is one of the local favourites of Australian investors. It tracks your shares across multiple brokers automatically, calculates dividends, and even prepares tax reports for you. It also integrates directly with the ASX, so you’re updated with the latest information at all times. CommSec Pocket is another excellent option from Commonwealth Bank. It suits first-timers with a simple, easy-to-understand interface that helps track shares and ETFs without causing unnecessary stress.

Usually, the apps are tailored with a few features, such as portfolio analysis, price alerts, and news updates. These help based on your information and decisions, rather than forcing you to sift through endless financial statements.

Property Investment Tools

If you have rental properties, tracking real estate investments can be challenging, but specific tools make it easy. For those with investment properties set for passive income, tools like PropertyMate or RentCheck are just a godsend. PropertyMate lets you track rental income, expenses, and property value all in one place, even calculating your net passive income so you can see exactly how much that investment is padding your wallet. RentCheck, on the other hand, is excellent if you’re managing multiple properties; it helps you keep tabs on tenants, maintenance costs, and rental payments.

Using these tools means you can spend less time on paperwork and more time enjoying the fruits of your investment property passive income.

Platforms for Diverse Asset Classes

What if your portfolio is a little more eclectic? Maybe you’ve got shares, property, and a few physical assets like gold and silver bullions. Don’t worry, there are tools for those ungainly combos, including those shiny treasures. Although it is US-based, Personal Capital remains a popular choice among Aussies. It tracks a wide variety of assets, including international shares and physical assets like gold and silver coins that you enter manually; after all, one can never keep track of such a peculiar asset specification relevant to anyone. My Prosperity is closer to home and designed to provide a holistic view of your wealth. It links to your bank accounts, superannuation, and investments. You can even add manual entries for assets such as precious metals or collectibles.

If you’d like it all in one place, from your ASX shares to your bullion stash, these big platforms and all-around solutions are the way to go.

Choosing the Right Tool for You

With so many choices out there, how does one narrow down the best? It all boils down to what suits you.

- Ease of Use: So, maybe you’re not so tech-savvy. In that case, look for a tool with a simple, intuitive layout; you don’t want to spend more than an hour figuring out how to start inputting your data.

- Compatibility: Ensure that whatever you choose is compatible with all types of investments, especially if your portfolio is quite well diversified.

- Cost: Then comes the cost factor. Some tools are free, while others have subscription fees, so it’s a good idea to weigh the features you want most against how much you’re willing to spend on them.

- Security: However, security should be high on your priority list, as all your financial information is pretty sensitive. Choose an app with heavy-duty encryption standards; two-factor authentication is a great plus. According to ACCC Scamwatch, 70% of Australian users say security is their top concern when choosing a financial app.

- Customer Support: Lastly, if you’re a newbie investor, customer support will help you hit the ground running when you get stuck.

Sharesight provides a solid foundation for share investors with its detailed tax reporting, but it might be a little overwhelming for beginners. My Prosperity stands out for the holistic view it offers of your finances, including super and bank accounts, but it might be overkill if you have just a couple of investments. Try a couple and see which one clicks with you.

Getting Started on Your Selected Tool

After you pick your tool, it’s time to put in the hard yards.

- Start by listing everything you have: shares, properties, super, even those shiny bullion coins, and set it up as a checklist to know what you’re working with.

- Input the data of everything entered. Some tools link to your accounts automatically; others require manual entry. Just take your time and get this right.

- Set up alerts for price changes, dividend payments, or portfolio milestones so you’re kept informed at all times.

- Finally, make it a ritual to review your dashboard at least once a week or month. The more you engage with your investments, the better decisions you will make.

It will take time to set up, but don’t stress. Once done, I bet you’ll be asking yourself, “How did I ever manage without this?”

The Summary: Grab the Power of Investment Trackers Today

There we have it: these digital tools are a rig-up for keeping investors organized and in control. The tools to track all shares, property, and even those gold and silver coins put under the roof. According to RBA / APRA, Mobile banking penetration reached 85% among Australian adults.”

So, what’s holding you back? Dive into the tool options we’ve presented, choose one you want to settle on, and relish the peace of mind that comes with knowing exactly where your investments stand.