In today’s technology-driven world, it is more important than ever to gain the proper certifications. With artificial intelligence revolutionizing financial advice and automation reshaping industrial processes, workers must learn new skills to keep pace. This article covers two of those areas: Financial planning (which is becoming more integrated with fintech trends) and instrumentation and control (the basis for engineering and technology-based careers). Suppose you are a new advisor navigating digital wealth management or an engineer delving into intelligent systems. In that case, certifications like the financial planner certificate or specialized instrumentation courses present the ways of the world to you! We will explore these areas, spotlight their tech-based aspects, and explore how they converge in today’s fluid job market.

Table of contents

- The Tech Evolution in Financial Planning: Why Certifications Matter

- Instrumentation and Control: The Backbone of Tech-Driven Industries

- Where Finance and Tech Converge: Synergies in Certifications and Careers

- The Long-Term Benefits: Investing in Your Future Through Certifications

- Conclusion: Charting Your Path in a Tech-Centric World

The Tech Evolution in Financial Planning: Why Certifications Matter

Financial planning has always centered on budgeting, investments, and retirement plans. With all the advances in technology, however, the industry is in the middle of a revolution. Short for financial technology, fintech has also given us tools such as robo-advisors, blockchain for secure transactions, and AI-powered predictive analytics. These advances enable planners to serve personalized, data-informed advice at scale, but they also require new competencies. Enter the kind of certifications that span traditional finance and the cutting edge of tech.

Pathways to Professional Excellence

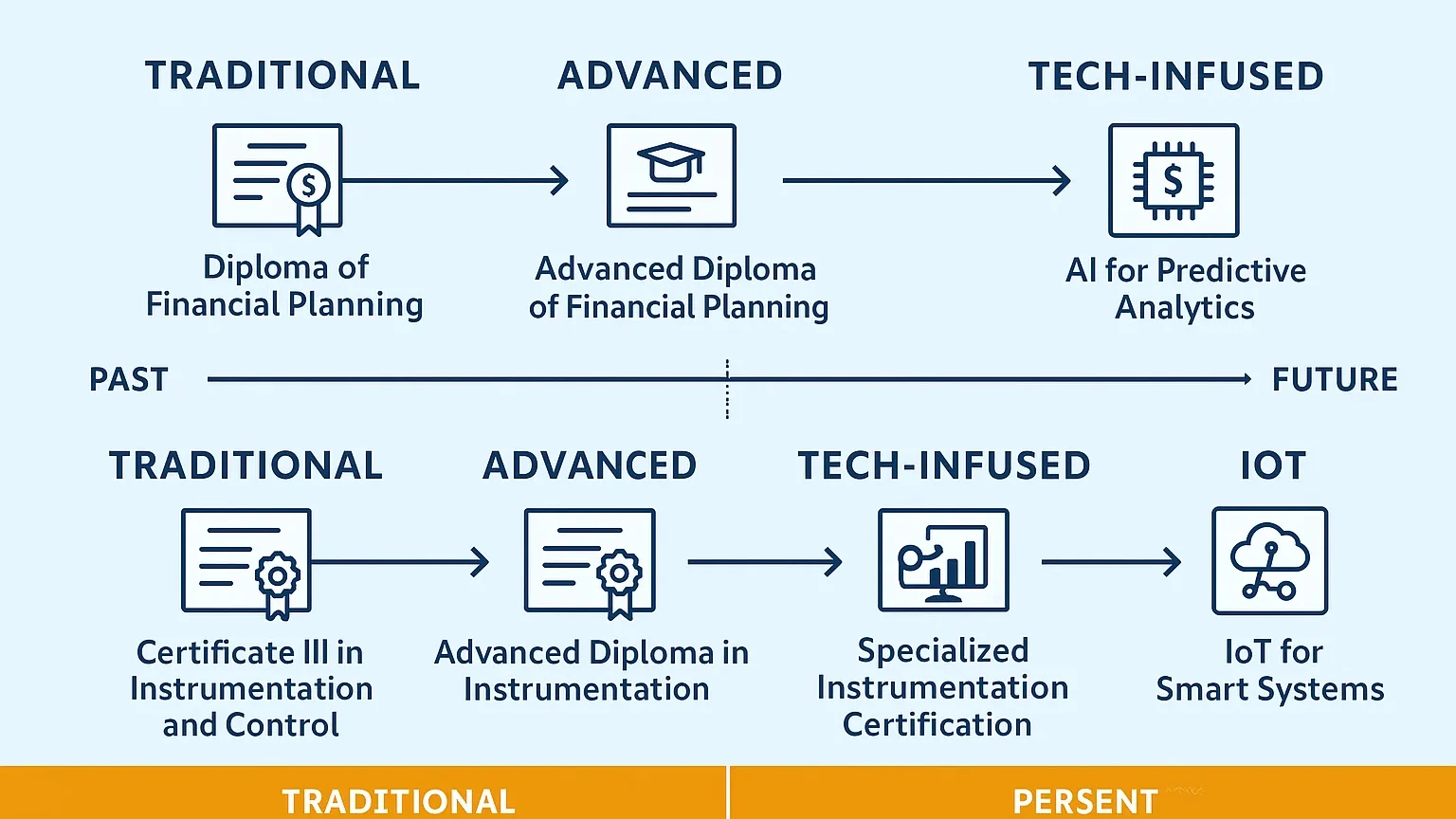

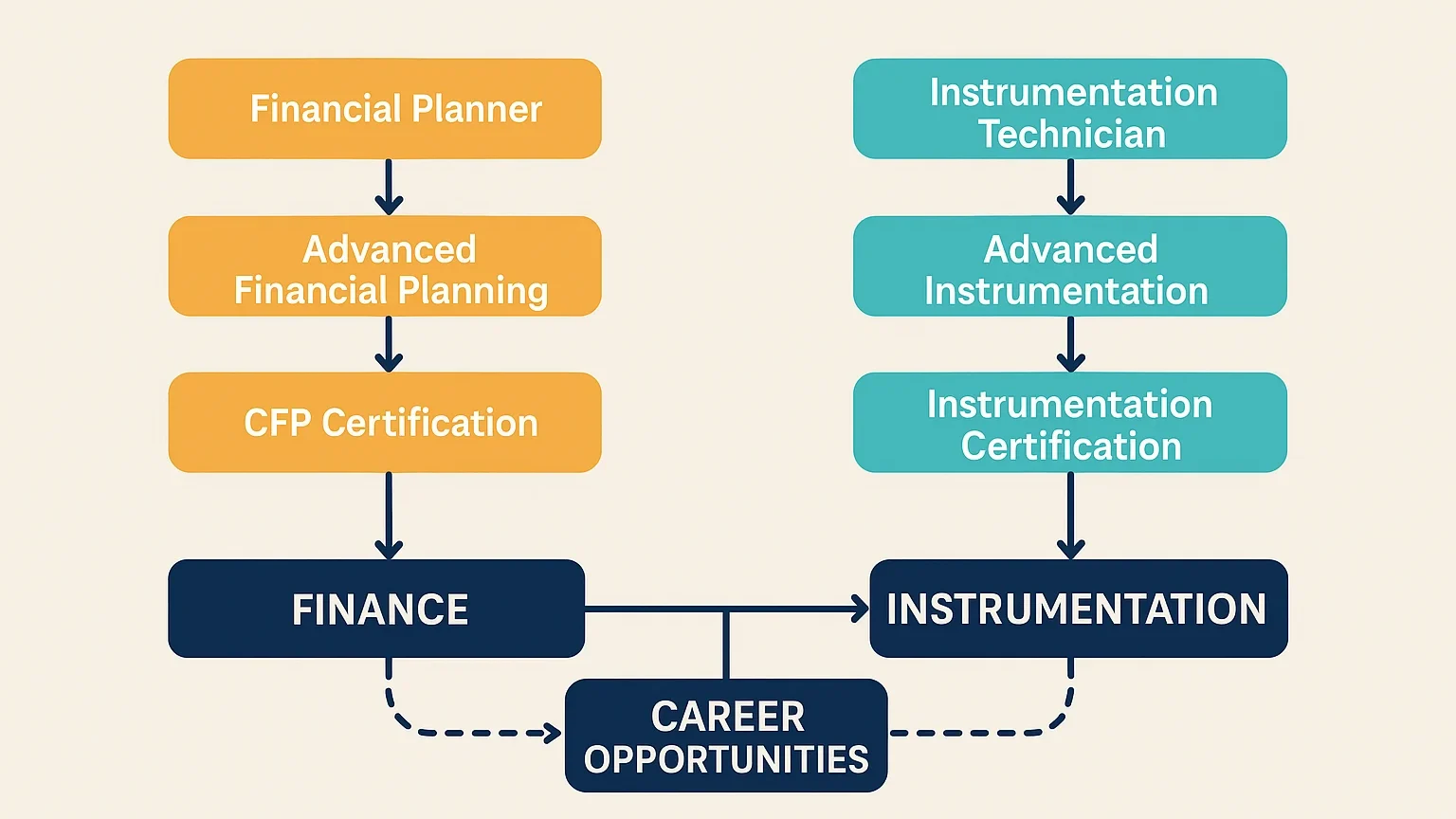

A good place to start is with the Diploma of Financial Planning, which is an entry-level qualification. The course builds core skills in compliance (ASIC RG146), financial advice, investments, risk management, and client relations. The Advanced Diploma covers complex, client-focused solutions in a digital world, while the Bachelor of Financial Planning offers a complete education and pathway to higher qualifications.

The Certified Financial Planner® (CFP®) qualification is the ultimate global standard held by more than 140,000 professionals (5,500 in Australia). It demands a degree, experience, and firm ethical guidelines that certify proficiency in sophisticated, tech-integrated financial advice. For specialised skills, SPAA offers the six-module SMSF Specialist Advisor™ (SSA™), which is tailored to self-managed superannuation and practical regulatory compliance. 90 GFM March 2014 Weighing in: Who offers the best superannuation training?

The tech touch here is unmistakable. Modern financial planners use machine learning for portfolios and big data to predict market trends. For instance, AI algorithms can simulate thousands of economic scenarios in seconds, helping advisors mitigate risks for clients. Online learning platforms have made these certifications more accessible, allowing flexible study amid busy schedules. Pursuing a financial planner certificate through structured courses ensures you’re not just compliant but also tech-savvy, ready to leverage tools like algorithmic trading software or cybersecurity protocols for client data protection.

Career-wise, these certifications open doors to roles in wealth management firms, banks, or even fintech startups. With Australia’s financial services sector booming, driven by superannuation reforms and digital banking, the demand for certified planners is high.

Instrumentation and Control: The Backbone of Tech-Driven Industries

Instrumentation and control engineering combines hardware and software to automate and optimize processes. It focuses on designing and maintaining systems that control variables like pressure, temperature, and flow. With Industry 4.0, it now integrates IoT, AI, and cyber-physical systems, driving tech innovation.

Building Skills Through Certification

The UEE31220 Certificate III in Instrumentation and Control is a nationally recognized qualification covering 23 core units and electives. It builds skills in reading instrumentation drawings, troubleshooting measurement systems, PLC programming, PID control, HMI setup, industrial network verification, and key competencies for automated environments.

The tech-related aspects shine through in units focused on automation. For example, PLC programming allows engineers to create logic for robotic assembly lines, while HMI setup enables intuitive interfaces for monitoring factory operations via touchscreens or remote apps. With IoT integration, instruments can now send real-time data to cloud platforms for predictive maintenance, reducing downtime in sectors like mining or manufacturing. Elective units add depth, including calibrating measuring instruments, repairing electronic faults, and even first aid training for on-site safety.

Delivery is flexible, blending online theory with practical sessions at campuses in Brisbane, Cairns, or Gladstone. For international students, it’s a 103-week program with options for vocational placement to gain real-world experience. Entry requires Year 11 equivalence and, for those without an electrical license, a restricted permit. While costs aren’t fixed (with subsidies available via government funding), the investment pays off in high-demand careers.

Graduates emerge as instrumentation technicians, ready for industries on the National Skills Shortage list, such as oil and gas, pharmaceuticals, automotive, and water management. In a tech context, these roles involve working with smart sensors that feed data into AI systems for process optimization. Imagine calibrating flow meters in a brewery where AI adjusts recipes based on real-time analytics, or troubleshooting control loops in a mining operation using drone-integrated monitoring. Enrolling in instrumentation courses like this one equips you with the skills to thrive in these environments, where automation is not just a tool but the core of efficiency.

The field is evolving rapidly with advancements like edge computing, where data processing happens at the device level to minimize latency, or blockchain for secure data logging in critical infrastructure. Professionals here often collaborate with software developers to integrate instrumentation with enterprise systems, highlighting the interdisciplinary nature of modern tech careers.

Where Finance and Tech Converge: Synergies in Certifications and Careers

At first blush, financial planning and instrumentation are poles apart: one involves the stewardship of money, the other the manipulation of physical systems. But in today’s integrated economy, they are inextricably linked, primarily through tech. Think of fintech in industrial applications: financial planners offering advice to tech firms on funding and automating production. Meanwhile, the instrumentation pros in engineering sectors, including mining, must speak the language of money and economics to make the case for investments in more intelligent automation.

For example, one financial planner with a tech focus could specialize in helping engineering firms allocate capital to IoT upgrades. They provide credibility for certain ‘high stakes’ decisions, eg, financing of renewable power plants using state-of-the-art control devices. Specialised Instrumentation technicians, on the other hand, deal more often with financial-related topics, such as calculating the cost of sensor networks or determining how long it will take to recoup the investment. Cross-training in both certifications can create hybrid practitioners; for example, a consultant who manages the optimization of industrial finances using financial modeling and control systems.

Tech bridges this gap further. AI in finance actually employs the same algorithms as those of PID controls used in instrumentation, since they also depend on feedback loops to ensure accuracy. Blockchain, a fintech darling, takes on data integrity in industrial IoT setups, where nobody likes to mess with critical measurements. In Australia, where mining and resources have driven the economy, professionals with cross-disciplinary perspectives are worth their weight in gold. A financial planner certificate can accompany instrumentation classes to teach cost-benefit analysis of tech deployments, as well as careers in project finance for engineering projects.

The rise of sustainable tech also serves to elevate these links. Financial advisers direct investments in green instrumentation, such as sensors to monitor carbon, while engineers promise the profitability of such systems. This is easier with Recognition of Prior Learning (RPL) in courses like instrumentation, where finance pros can upskill by transferring skills across domains for jobs in fintech consultancies or industrial finance teams.

The Long-Term Benefits: Investing in Your Future Through Certifications

You get what you invest in these certs. For financial planning, they provide oversight and ethical guidance, while sharpening tech skills for digital tools. Benefits include a higher earning potential. CFP® holders frequently experience higher salaries and the ability to work abroad, as the credential has global significance.

In instrumentation, real-world, tech-focused training addresses skill gaps and creates steady work in growth industries. With automation set to add trillions to global GDP, demand is rising for skilled professionals to implement secure, cyber-resilient systems.

Both fields demand lifelong learning, keeping professionals updated on advances like quantum finance and 5G-enabled instrumentation. The flexibility in online and blended learning delivery suits today’s lifestyle, and you can learn while you earn.

Consider barriers, such as rigorous entry requirements or the need for physical, hands-on practice, but the benefits outweigh them. A bonus: grads claim better job satisfaction thanks to tech integration, which makes jobs dynamic and impactful.

Conclusion: Charting Your Path in a Tech-Centric World

As technology reshapes industries, certifications in financial planning and instrumentation stand out as gateways to fulfilling careers. Whether you’re drawn to the analytical world of finance, enhanced by AI and fintech, or the innovative realm of control systems and automation, starting with a financial planner certificate or instrumentation courses is a strategic move. These paths not only build expertise but also open doors to interdisciplinary opportunities where finance and tech converge.

In 2025, with AI advancements and industrial digitization accelerating, now is the time to upskill. Research providers, assess your goals, and embark on this journey; your future self will thank you. By blending traditional knowledge with tech prowess, you’ll not just adapt to change but drive it.