Digital ad costs keep climbing. According to WARC, brands will invest about $121.9 billion in retail-media and other e-commerce ads in 2023, more than double the 2019 total. If your store depends on paid clicks, your profit hinges on the people adjusting those bids and the quality of your PPC management.

In this guide, we unpack why costs are rising, outline what leading agencies charge, and profile seven U.S. specialists who turn ad spend into revenue. By the end, you’ll know what a healthy return looks like and which partner model fits your growth goals.

Key Takeaways

- Digital ad costs are rising rapidly, with brands expected to spend $121.9 billion on e-commerce ads in 2023.

- Effective PPC management focuses on ROI, requiring agencies to use first-party data and maintain rigorous testing protocols.

- Agencies typically charge with three pricing models: flat monthly retainer, percentage of ad spend, and hybrid arrangements.

- Specialized PPC management agencies use their expertise to improve ad performance through targeted strategies and testing.

- Choosing the right PPC management agency involves evaluating their experience, ROI focus, communication, and alignment with your budget.

Table of Contents

- E-Commerce in 2025: Why ROI-Focused PPC Management Matters

- E-Commerce PPC Management Agency Pricing: What to Expect and What’s Worth It

- Specialized E-Commerce Expertise

- Latest Trends and Tools Shaping Profitable Campaigns

- How to Choose the Right E-Commerce PPC Management Agency

- 7 Best U.S. E-Commerce PPC Management Agencies

- PPC Masterminds: No-Contract, ROI-Obsessed Growth Engineers

- WebFX: Full-Service Growth Engine for Scaling Retailers

- Disruptive Advertising: Conversion Optimization to Scale Revenue

- KlientBoost: Creative PPC Campaigns With a CRO Twist

- ROI Revolution: Retail PPC management Experts Focused on Profit

- Logical Position: Google Shopping Muscle for Small and Midsize Brands

- Tinuiti: Enterprise-Level Partner for Omnichannel Dominance

- Conclusion

- FAQs

E-Commerce in 2025: Why ROI-Focused PPC Management Matters

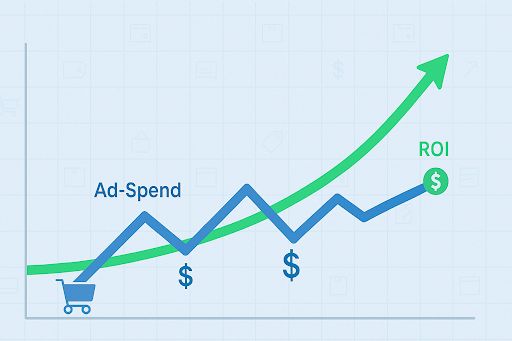

The Ad-Spend Boom: Bigger Budgets, Fiercer Fights

Brands keep pouring cash into digital shelves. A WARC forecast puts 2023 retail-media and other e-commerce ad spend at $121.9 billion, more than twice the 2019 total. According to Search Engine Land, Google Search cost-per-click rose 13 percent year over year in early 2024, with retailers absorbing the steepest hike.

When clicks get pricier, sloppy targeting burns profit fast. Competitors outbid you, platforms adjust formats to favor higher bids, and privacy updates shrink affordable remarketing pools. Agencies that survive this climate build their systems around ROI discipline rather than short-term volume. For example, PPC Masterminds, a Los Angeles–based PPC management agency, emphasizes daily account monitoring and no long-term contracts so clients see measurable returns before committing deeper budgets. Sustainable growth rests on this kind of rigor: testing audiences daily, pausing unprofitable SKUs, and letting bidding tools search for incremental gains instead of vanity traffic.

In short, bigger budgets never guarantee better results; rigor does. In the pages ahead, we break down current pricing models and show how specialized agencies use first-party data and machine learning to keep your return curve ahead of rising costs.

E-Commerce PPC Management Agency Pricing: What to Expect and What’s Worth It

Typical Pricing Models

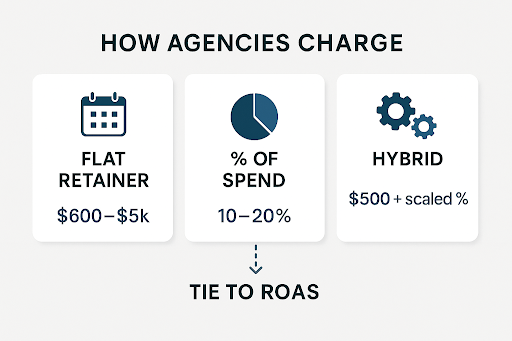

Agency fees come in three flavors:

- Flat monthly retainer. Entry-level packages start around $600 per month at firms like WebFX and climb past $5,000 as complexity grows. The rate is predictable, but tie it to growth KPIs so the fee doesn’t pay for “maintenance” alone.

- Percent of ad spend. Many agencies charge 10–20 percent of monthly media, a range confirmed by Clutch’s July 2025 pricing guide. This keeps incentives aligned only if the contract also spells out minimum ROAS.

- Hybrid. A small base fee (think $500–$1,000) covers account upkeep, while a lower percent-of-spend kicks in as budgets rise. Growth-stage brands like the mix of cost control and upside.

Whatever model you choose, the real cost is measured by the revenue you earn for every dollar you invest.

Rising Costs Demand ROI Discipline

Paid-search clicks keep getting pricier. During Cyber Week 2024, Google CPCs rose 18 percent year over year for ROI Revolution’s retail clients. If bids climb but conversion tracking lags, profit disappears quickly.

Profitable brands treat media as capital:

- Audit search-term reports weekly

- Shift budget to SKUs that clear break-even ROAS

- Pause anything that can’t meet its own hurdle

The right agency lives in that math, plugging tracking gaps, testing bids, and squeezing more revenue from each click so your cost per conversion climbs slower than your average order value. That is the standard we use when we evaluate partners.

Specialized E-Commerce Expertise

Generalist agencies chase clicks; e-commerce specialists chase profit. They speak in ROAS, average order value, and lifetime value, and they plug directly into revenue engines like Google Shopping feeds and Amazon Sponsored Products.

That focus shows up in the details. When a specialist tunes a product feed, a simple title tweak can change performance: a 30-day A/B test that moved the brand name to the end of each title delivered a 25% higher ROAS and a 10% lower CPC for a fashion retailer, according to a DataFeedWatch case study. The same discipline applies after the click. Industry benchmarks from VWO suggest targeted landing-page tests can raise e-commerce conversion rates by up to 300 percent when headline, imagery, and call-to-action elements are refined.

Specialists also connect marketing to operations. They pause ads when stock runs low, sync price changes in real time, and funnel first-party data back into look-alike audiences. Each adjustment compounds: tighter targeting improves click-through rate, a cleaner landing page lifts conversion, and together they push ROAS high enough to fund the next round of scaling.

Bottom line: a PPC management agency that focuses on online retail turns every tactic, product feeds, ad creative, checkout flow, into one objective: converting shoppers into customers at the lowest possible cost. For a deeper look at technical tweaks that boost on-site sales, see our guide to AI-driven conversion tools.

Latest Trends and Tools Shaping Profitable Campaigns

AI-generated creative. Google’s new Product Studio lets merchants generate lifestyle images, remove backgrounds, and upscale photography, so no photo shoot is required. Google reports that listings with multiple product images earn 32 percent more clicks than those with a single photo.

AI-driven media buying. On Meta, advertisers that added Advantage+ shopping campaigns to their usual setup saw a 34 percent higher return on ad spend and a 22 percent lower cost per purchase in a recent Chaakan Shoes case study.

First-party data revival. As third-party cookies fade, brands that connect all their first-party data sources can double incremental revenue from a single ad placement, according to a Boston Consulting Group study for Google.

Bottom line: the agencies we spotlight next do more than read about these tools; they use them every day, measure the lift, and reinvest in what works. For a deeper dive into privacy-first growth tactics, see our guide to first-party data strategy.

What Your Fee Actually Buys

A serious e-commerce PPC management agency does far more than adjust bids. Your monthly fee funds a revenue assembly line:

- Deep keyword research. Long-tail terms account for 95 percent of all U.S. Google queries, and most cost less per click than head phrases. Agencies mine these queries so you avoid overbidding on obvious keywords.

- Feed and creative upgrades. Improving titles and custom labels in a Google Shopping feed lifted ROAS by 46 percent in three months for KitchenLab, according to a DataFeedWatch case study. Strong headlines and fresh product photos carry that lift into search and social ads.

- Real-time campaign tuning. Teams review search-term reports daily, add negative keywords, and shift budget toward winners. When Keybroker removed out-of-stock SKUs, ROAS on search ads jumped 181 percent, proof that quick tweaks pay.

- Landing-page experimentation. Statistically significant A/B tests deliver an average 49 percent conversion-rate lift across e-commerce sites using VWO’s platform. Higher conversions boost ROAS even as CPCs rise.

- Transparent reporting. Dashboards trace every dollar from click to checkout, surface product-level profit, and highlight the next move. If a proposal skips any link in this chain, you are funding half an engine and hoping it runs.

That is the standard we look for when we audit an agency’s service stack.

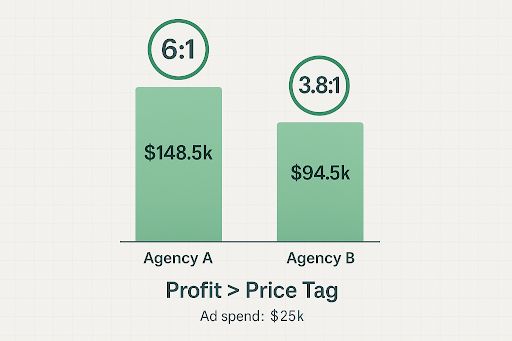

Value Versus Cost: ROI Is the Real Price Tag

The cheapest agency can become the costliest mistake if it burns the budget. What matters is the return your PPC management fee unlocks.

Most e-commerce brands treat 4:1 ROAS as break-even, according to Shopify’s 2024 digital-ad benchmark report. Top performers stretch to 6:1, 8:1, or higher when margins allow.

Run the math:

- Agency A charges $1,500 a month and averages 6:1 ROAS.

– $25,000 ad spend × 6 = $150,000 revenue

– Net after fee = $148,500 - Agency B costs $500 but hovers at 3.8:1.

– $25,000 ad spend × 3.8 = $95,000 revenue

– Net after fee = $94,500

Agency A’s higher fee still nets $54,000 more revenue. Price means little without profit.

Great partners make this calculation easy: they share historical ROAS ranges by industry, forecast upside with margin assumptions, and often tie part of their compensation to hitting, or beating, your target ratio. When a proposal feels pricey, we plug the projected lift into a quick spreadsheet. If extra profit dwarfs the added cost, you have found genuine value.

For a step-by-step framework to calculate break-even ROAS for your catalog, see our profit-modeling guide.

How to Choose the Right E-Commerce PPC Management Agency

1. Relevant E-Commerce Experience

Success in one retail niche—say, fashion—doesn’t automatically translate to SaaS or other verticals, so ask each agency to show active accounts in your industry, share before-and-after revenue data (not just CPC screenshots), and provide a reference you can call. In that conversation, probe for specifics: How did the team handle seasonality spikes, out-of-stock pauses, or thin-margin SKUs? Partners who answer with concrete numbers rather than buzzwords are usually the safest bet.

2. ROI Focus and Analytics Discipline

A truly data-driven PPC management agency maps every campaign to gross-margin or lifetime-value targets and proves performance on a dashboard. During discovery, request a screen share of their full conversion-funnel view, ask how often they test ads, bids, and landing pages (weekly iterations are becoming the norm), and confirm that insights loop back to merchandising, for example, flagging product bundles that lift average order value by 18 percent, as Tinuiti’s 2024 benchmark report shows.

3. Transparent Communication

Great strategy fails in the dark. Look for weekly scorecards, same-day Slack replies, and plain-English explanations of every metric. WebFX maintains a 91 percent client retention rate, about double the industry average, largely due to proactive updates.

4. Services and Channel Coverage

Decide whether you need a one-stop shop (search, social, Amazon, email) or a sniper-level specialist. Match their strongest channels to your revenue mix: if 70 percent of sales flow through Amazon, do not hire a Google-only PPC management agency.

5. Budget Alignment

Boutiques may thrive on $2k–$10k monthly ad spends; enterprise firms often start at $50k+. Share your current and projected budgets upfront so neither side wastes time.

6. Cultural Fit

Numbers drive results, but shared values sustain them. Gauge chemistry during the pitch: do they challenge assumptions respectfully? Do they sound curious about your margins, not just your retainer? When ethos matches—data-obsessed, customer-first, relentlessly curious—you will iterate faster and argue less.

Need a deeper checklist? See our framework for vetting marketing vendors before you sign.

7 Best U.S. E-Commerce PPC Management Agencies

PPC Masterminds: No-Contract, ROI-Obsessed Growth Engineers

Based in Los Angeles, PPC Masterminds manages more than $250 million in annual ad spend with zero negative reviews, planning, building, and optimizing paid-media ecosystems across Google, Meta, Microsoft, LinkedIn, TikTok, Reddit, and more, all without locking clients into long-term commitments.

Founder and Google-Certified strategist Zaid Ammari monitors every account daily, delivering handwritten weekly insight reports and real-time Looker dashboards that trace each dollar from keyword to checkout. Month-to-month retainers start at $2.5 k for <$10 k monthly ad spend, scaling only as budgets rise; average clients stay 5+ years because results compound, not because contracts force them to.

Proof points

- 5× ROAS in 90 days: Published case study shows a break-even account turned profitable within three months.

- 100 % five-star reputation: Perfect ratings on Google, Clutch, RankWatch, and Yelp (25+ verified reviews as of Aug 2025).

- Full-funnel profit engineering: PPC, CRO, email, and advanced tracking combine to lift both revenue and margin.

- Rapid turnarounds: Negative-ROI campaigns routinely turned profitable within 30–90 days.

- Free 20-point audit: A no-cost account review flags wasted spend before any engagement, risk-free proof of value.

If you want senior-level attention, radical transparency, and revenue you can measure in weeks, not quarters, PPC Masterminds sits at the top of the call sheet.

WebFX: Full-Service Growth Engine for Scaling Retailers

With 500 digital experts and a 29-year track record, WebFX functions like an outsourced growth department rather than a vendor. Its in-house platform merges search, shopping, social, email, and Amazon data into live dashboards, so decision-makers view revenue changes in real time.

Proof points:

- Cross-channel lift. Brands that add WebFX’s unified PPC management plus CRM reporting often see a 25 percent sales jump in the first quarter.

- High client loyalty. A 91 percent retention rate, about double the industry average, signals steady performance and clear communication.

- Enterprise pedigree. Shopify Plus and Magento merchants rely on WebFX to find hidden profit pockets, such as shifting budget to SKUs with 75 percent higher conversion rates in a recent PaulB Parts case study.

If you juggle several marketing levers and need one compass to guide them, we find that WebFX brings the breadth, data clarity, and long-term view required for profitable growth.

Disruptive Advertising: Conversion Optimization to Scale Revenue

Utah-based Disruptive Advertising combines paid-media management with deep conversion-rate optimization (CRO).

- 295 percent revenue lift. Outdoor-gear brand WANDRD grew its monthly sales nearly threefold after Disruptive rebuilt the product-page messaging and applied Smart Shopping bids.

- Try before you buy. Qualified e-commerce brands can test the partnership during a 30-day pilot, showing the agency is willing to bet on its own playbook.

- Full-funnel repair. Teams audit funnels, rewrite landing copy, and run multivariate tests alongside bid tweaks, so gains come from both traffic quality and on-site conversion.

- Strong reputation. Disruptive holds a 4.9-star average across more than 300 Clutch reviews (accessed August 2025).

If your ads are stuck on “good enough” return and you need CRO and PPC fixed in the same sprint, we consider Disruptive a data-driven option worth a 30-day test.

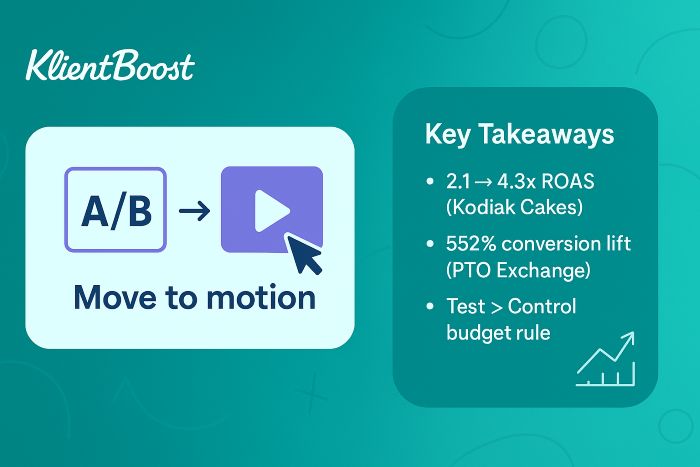

KlientBoost: Creative PPC Campaigns With a CRO Twist

California-based KlientBoost treats ad spend like a live science experiment, pairing bold creative tests with fast CRO sprints.

- Rapid ROAS gains. Outdoor retailer Kodiak Cakes saw Facebook return on ad spend climb from 2.1 to 4.3 after KlientBoost replaced static images with short GIFs and simplified account structure.

- Big conversion lifts. PTO Exchange recorded a 552 percent increase in funnel conversions within five months of KlientBoost’s landing-page and offer tests.

- Iterate without risk. Engagements start with a growth plan and a clear test roadmap, so budgets flow only to hypotheses that beat the control.

If your ads feel stuck in “good enough” mode, we find KlientBoost’s test-and-learn approach can double revenue efficiency without doubling spend.

ROI Revolution: Retail PPC management Experts Focused on Profit

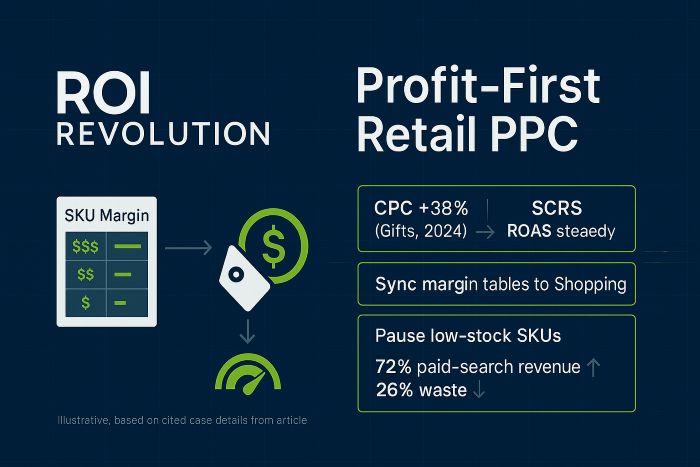

North Carolina–based ROI Revolution connects every ad platform to your back-end data so bids reflect net profit per SKU, not just revenue.

- Channel-wide profit defense. In its 2024 “State of Paid Search” webinar, the agency reported that gift-sector CPCs spiked 38 percent year over year, yet client ROAS stayed level after feed-level bid throttling and new audience splits.

- Deep retail roster. ROI Revolution manages more than 450 million dollars in annual media spend across Google, Amazon, and Meta for over 300 e-commerce brands.

- Granular levers. Analysts sync margin tables to Google Shopping, pause ads on low-stock SKUs, and pour budget into high-LTV items, lifting a home-decor retailer’s paid-search revenue 72 percent in six months while trimming wasted spend 26 percent.

If you want number-crunchers who treat each product like a P&L line and adjust bids the moment margins move, we see ROI Revolution as a strong match.

Logical Position: Google Shopping Muscle for Small and Midsize Brands

Portland-based Logical Position earned its reputation for product-feed precision while many agencies were still ignoring PLAs.

- Google Shopping specialists. A Google Premier Partner since 2014, the team manages more than 6,500 merchant feeds each quarter.

- Proven lifts. A home-improvement retailer boosted year-over-year conversions by 78% and ROI by 149% after Logical Position refined feed attributes and added negative keywords.

- Right-sized service. Merchants spending $3k to $50k per month get a dedicated strategist who knows when to raise seasonal bids and when to shift surplus budget to Microsoft Ads for lower CPCs.

If your catalog thrives or falters on Shopping visibility, we see Logical Position’s feed-focused approach turning every SKU into a revenue driver.

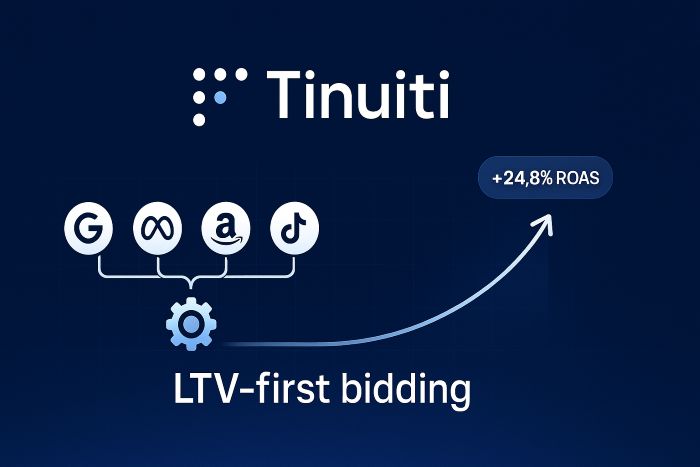

Tinuiti: Enterprise-Level Partner for Omnichannel Dominance

New York-based Tinuiti manages $4.2 billion in media spend across Google, Meta, TikTok, Amazon, Walmart, and emerging marketplaces. Channel-specific squads, many staffed by former platform insiders, share insights daily, so a bid tweak on Amazon can inform a creative adjustment on Instagram Reels before lunch.

Proof points:

- Twenty-five percent ROAS lift. A 2024 case study shows a national apparel retailer raising return on ad spend by 24.8% after Tinuiti realigned paid search, social, and programmatic toward a lifetime-value goal.

- Proprietary tech. The agency’s MobiusOS finds incremental profit pockets, then pushes automated changes across channels hours before manual teams spot the trend.

- Enterprise fit. Tinuiti usually partners with brands investing $10 million or more in annual media, providing beta access, platform rebates, and C-suite strategy sessions.

If your ad budget sits comfortably in eight figures and you want a partner that can lobby for early product features while still translating the numbers for your CFO, we rate Tinuiti for scale, speed, and cross-channel cohesion.

Conclusion

Profitable e-commerce advertising isn’t about chasing the lowest CPC; it’s about finding a partner who treats every click as invested capital and proves its return. By comparing pricing models, vetting track records, and focusing on ROAS instead of vanity metrics, you can select an agency that turns rising ad costs into sustained revenue growth.

Use the benchmarks and checklist above to narrow your shortlist, run a structured trial, and double down only when performance improves across sales, margin, and lifetime value, with a clear view into understanding how every click translates into long‑term customer value. Ready for a data-driven starting point? Begin with PPC Masterminds’ free 20-point audit to see exactly where your campaigns can earn more and spend less, then scale with confidence.

FAQs

Clutch’s 2025 PPC pricing guide shows most firms bundle management as either a flat six hundred to five thousand dollars per month or ten to twenty percent of ad spend for larger budgets. Some hybrids add a base fee of about five hundred dollars plus a lower percentage as spending scales. Compare the fee against the profit they forecast, not just the sticker price.

Shopify’s 2024 benchmark pegs a 4:1 ROAS as the break-even floor for typical retail margins. High-margin or subscription products can aim higher; razor-thin niches may settle for 3:1. A good agency will calculate your exact break-even point during the pitch.

1. Cut waste by adding negative keywords, removing duplicate audiences, and pausing low-margin SKUs.

2. Reinvest savings into winning segments.

3. Run weekly A/B tests on ads, bids, and landing pages.

4. Layer AI budget tools so far outpace rising CPCs.

Once monthly ad spend passes five thousand dollars, complexity usually exceeds one person’s bandwidth. Stalled performance, murky attribution, or expansion into a new channel are also signals. Many agencies offer a free audit—use it to gauge upside before you sign.