For the last two decades, the digital economy operated on a tacit, often unacknowledged agreement: users provided behavioral data in exchange for “free” access to platforms. This model, often termed surveillance capitalism, fueled the rise of tech giants by converting human attention into a commodity. The “attention economy” treats human attention as a scarce commodity that firms compete for in order to monetize user engagement. However, the architecture of the web is shifting. We are moving from a passive extraction model to a participation economy, in which the value of commercial intent is no longer captured solely by intermediaries but is redistributed to the originator of that value: the user.

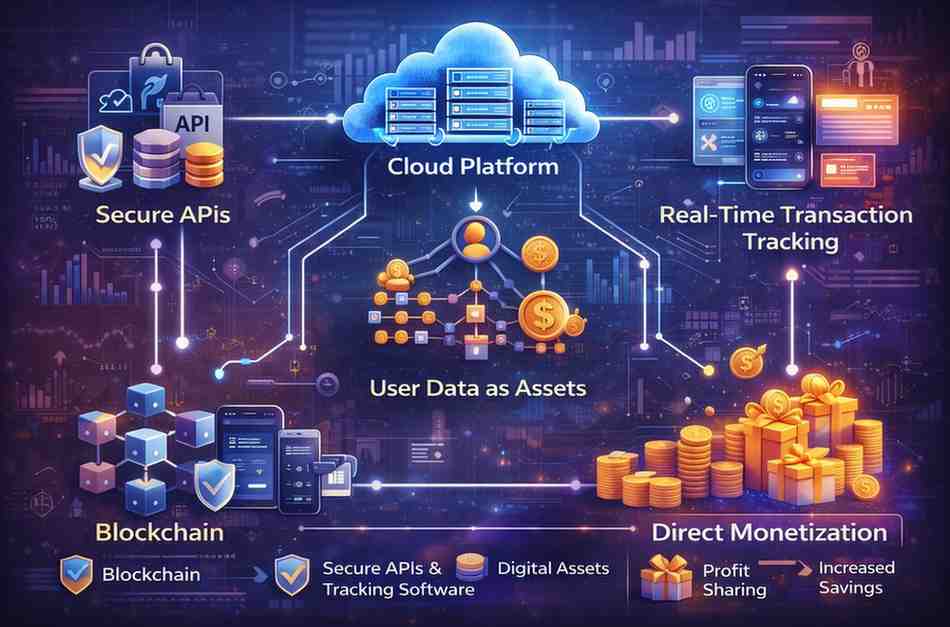

This evolution is not merely about consumer savings. It represents a fundamental restructuring of digital value exchange. Cloud-based FinTech platforms, powered by secure APIs and real-time transaction tracking software, enable users to treat their commercial intent and transactional data as digital assets.

This evolution is not merely about consumer savings. It represents a fundamental restructuring of digital value exchange. Cloud-based FinTech platforms, powered by secure APIs and real-time transaction tracking software, enable users to treat their commercial intent and transactional data as digital assets.

Table of contents

- The Architecture of the Traditional Attention Economy

- The Emergence of the Participation Economy

- Data as a Financial Asset

- FinTech Infrastructure Enabling Direct Monetization

- Bypassing the Middleman

- Behavioral Economics & Incentive Design

- The Future of Commerce: From Passive Data Extraction to Active Participation

The Architecture of the Traditional Attention Economy

To understand the magnitude of this shift, we must first dissect the prevailing model. In the traditional attention economy, the user is not the customer; they are the raw material. Platforms use AI-driven algorithms hosted on cloud infrastructure to process behavioral data, including search history, location, dwell time, and click patterns, to generate predictive models in real time.

These models are sold to advertisers via complex real-time bidding (RTB) networks. The ad-tech pipeline, involving data brokers, demand-side platforms (DSPs), and supply-side platforms (SSPs), captures the vast majority of the economic value generated by user activity.

The asymmetry here is stark. A user signals intent to purchase a laptop. That data signal travels through multiple intermediaries, each taking a cut, before an advertiser pays a premium to place an ad in front of that same user. The platform captures the revenue; the user receives only the “privilege” of seeing the ad. There is zero direct economic compensation for the user, despite their intent being the catalyst for the entire transaction.

The Emergence of the Participation Economy

The participation economy dismantles this unilateral value extraction. It posits that if user data drives revenue, the user should share in that revenue. This shift is driven by a confluence of rising data privacy awareness, regulatory pressures such as the GDPR, and, most importantly, technological innovation.

We are witnessing the rise of decentralized monetization models where the friction of the middleman is removed. Users are beginning to understand that their digital footprint, specifically their commercial intent, has measurable market value. The technology now exists to facilitate a user-controlled value exchange, allowing individuals to bypass the traditional ad-tech tax and interact directly with the economic beneficiaries of their data.

Data as a Financial Asset

In the context of digital commerce, not all data is created equal. While social sentiment data is valuable, transactional metadata and commercial intent signals are the gold standard. When a user executes a transaction, they generate a bundle of high-value data points: brand preference, price sensitivity, basket size, and frequency.

Historically, this data was harvested. It is now being positioned as a monetizable digital asset class. By structuring purchasing behavior as an asset, users can leverage their spending power. The act of buying is no longer merely an expenditure; it is a data-generating event that commands a market price. FinTech platforms are emerging as custodians of this asset class, providing tools that enable users to capture economic rent previously lost to advertising intermediaries.

FinTech Infrastructure Enabling Direct Monetization

The transition to this new model requires robust fintech infrastructure. We are seeing the proliferation of sophisticated aggregator platforms that utilize API integrations to connect thousands of merchants into a unified digital interface. These platforms do not merely list products; they also track commercial intent and attribution in real time.

Central to this architecture are cloud-based microservices and API-driven attribution systems that map user interactions to verified transactions, enabling automated revenue sharing. This establishes a verifiable “proof of purchase” that triggers a value transfer.

This is the technical framework behind cashback for online shopping. While often marketed to the layperson as a simple perk, from an architectural standpoint, it functions as a FinTech protocol for revenue sharing. It is a programmatic incentive mechanism in which the merchant pays a commission for a verified sale, and the platform splits that revenue with the user.

By utilizing cashback for online shopping as a data monetization mechanism, these platforms effectively democratize the affiliate revenue model. Instead of a third-party publisher keeping the entire commission for referring a sale, the user acts as their own referrer. The aggregator provides centralized access to global commerce networks, but the user captures the value of their own conversion.

Bypassing the Middleman

The economic efficiency of this model is compelling for both market participants. For merchants, the traditional ad-tech model entails paying for impressions or clicks without a guarantee of conversion. This results in a high and variable Customer Acquisition Cost (CAC).

The participation model shifts this to a Cost Per Sale (CPS) framework. Merchants only pay when value is realized. Because the risk is lower, they are willing to share a significant portion of that margin.

By engaging in this ecosystem, users bypass the advertising middleman. The budget that a brand would have spent on a display ad to retarget a user is instead routed directly to that user’s digital wallet. This direct merchant-to-consumer incentive loop reduces system-wide friction and redistributes economic power from passive platforms to active participants.

Behavioral Economics & Incentive Design

The shift toward digital monetization of personal data fundamentally alters user psychology. Behavioral economics suggests that users are far more engaged when they perceive themselves as stakeholders rather than passive consumers.

When users realize they are earning a return on their data and spending, purchasing becomes more intentional. This is not merely about discounts; it is about the gamification of data contribution. The feedback loop purchase, verify, reward creates a potent dopamine response that reinforces platform loyalty.

Furthermore, this model aligns incentives. In the extraction model, platforms maximize time-on-site to serve more ads, often at the detriment of user well-being. In the participation model, the platform’s goal is to facilitate a high-value transaction that benefits the user. The success of the platform is inextricably linked to the financial benefit of the user.

The Future of Commerce: From Passive Data Extraction to Active Participation

As we look toward the horizon, the participation economy will likely merge with emerging Web3 technologies. We can anticipate decentralized commerce protocols in which cashback for online shopping evolves into tokenized value streams, governed by smart contracts rather than centralized intermediaries.

In this future state, consumer data ownership will be the default. Users might hold their intent data in a personal vault, selectively granting access to merchants in exchange for instant micropayments or governance tokens within a brand’s ecosystem.

The trajectory is clear. The era of passive surveillance capitalism is facing a structural challenge. We are moving toward a future of participatory value redistribution, where the boundary between consumer and earner blurs. The tools we see today are just the early signals of a digital economy designed to reward participation, accuracy, and intent. Users of the future will not merely spend money; they will engineer their own economic returns through the strategic deployment of their data assets.