Imagine a packed real-estate expo in Miami. Investors aren’t asking about square footage—they’re comparing the weekly yield on tokenized apartments. Blockchain-based real-estate tokenization already tops $300 billion, and Deloitte projects the figure will surge to nearly $4 trillion by 2035. Regulatory clarity in Europe, innovation sandboxes in Dubai and Singapore, and compliance-first blockchains are accelerating adoption. Platforms like RealT and Lofty prove the appetite—$50 slices of rental homes still sell out within hours.

This guide spotlights eight companies turning that momentum into measurable progress for 2026. Source: Deloitte forecast reported by CoinDesk, April 24, 2025.

Key Takeaways

- Real estate tokenization is growing rapidly, projected to reach nearly $4 trillion by 2035, driven by blockchain technology.

- Tokenization enables fractional ownership of properties, reduces entry costs, and increases liquidity for investors.

- The article highlights eight companies leading the way in real estate tokenization, each with unique roles from compliance to marketplace solutions.

- Key firms like RealT and Lofty allow investors to buy fractional shares in rental properties for as little as $50, enhancing accessibility.

- Compliance and technology remain essential as the industry evolves, ensuring security for investors while creating new market opportunities.

Table of contents

- Real Estate Tokenization 101

- How We Picked the Eight Stand-Outs

- Polymesh: Compliance Baked into the Chain

- Tokeny: The White-Label Engine Behind Europe’s Big Exchanges

- Realt: Fractional Rentals That Pay You Every Week

- Lofty Ai: Daily Dividends on an Algorand Backbone

- Redswan: Opening Skyscrapers to Global Wallets

- Solidblock: The Concierge Service Behind Landmark Token Deals

- Securitize: Wall Street Credentials Meet Blockchain Rails

- Brickken: DIY Real Estate Tokenization for the Mid-Market

- At-A-Glance: How the Eight Players Stack Up

- Conclusion

Real Estate Tokenization 101

Real estate tokenization turns a building—or a fund that holds several buildings—into digital shares recorded on a blockchain. Each share is a programmable token that you can trade in minutes rather than the months a traditional closing demands, according to a 2025 TokenREITs analysis. According to Polymesh’s compliance documentation, issuers can attach rules to a real-estate token so that only investors with specific KYC, accreditation, or jurisdiction claims are allowed to hold or transfer it, and the chain checks those conditions automatically on every trade. That kind of protocol-level control is what lets these tokens move quickly while still behaving like regulated securities rather than anonymous crypto assets.

How real estate tokenization turns physical properties into compliant digital tokens on a blockchain ledger.

Legally, the bricks stay inside an LLC or regulated fund. The only real change is the cap table: instead of hiding in a filing cabinet, ownership now sits on a public ledger anyone can audit in real time.

For individual investors, tokenization provides three practical benefits:

- Low entry cost. Platforms such as RealT and Lofty let you start with about $50 per token.

- Faster liquidity. Secondary markets can match buyers and sellers around the clock, so you can exit an investment in minutes, not months.

- Automated operations. Smart contracts route rent or dividend payments straight to verified wallets, trimming back-office costs and human error.

Technology alone does not erase risk. Every transfer must still follow securities laws, tenants may default, and a market needs enough participants before it feels genuinely liquid.

That is where the eight companies profiled next come in. Some build compliance rules into the chain itself, while others combine vetted assets, investors, and trading rails under one roof. Together they make property ownership more accessible—without borders, paperwork piles, or the high minimums that once fenced ordinary people out of real estate.

How We Picked the Eight Stand-Outs

A best-of list is earned, not guessed. We set one hard filter: a company had to place real property, or shares of a property fund, on chain before December 31, 2025. Proof meant rent or dividends landing in token-holder wallets, not slide-deck promises.

For the firms that cleared that bar, we measured five factors:

- Assets already tokenized: total property value or unit count on chain today.

- Regulatory footing: broker-dealer licenses, sandbox approvals, or protocol-level transfer controls.

- Technology depth: purpose-built security infrastructure versus a quick smart-contract wrapper.

- Market traction: investor counts, recurring deal flow, and public funding rounds.

- Industry influence: whether other platforms rely on, cite, or integrate the company’s work.

Each finalist plays a different role. Some build blockchains, others run marketplaces, and a few offer turnkey toolkits, so we compare them within their lane rather than stack-rank them against one another.

Disclosure: Polymesh, featured first, is a content partner. We included it because of documented real-estate deals and its compliance-first architecture, not sponsorship.

With the rules set, let’s meet the infrastructure players powering tomorrow’s property trades.

Polymesh: Compliance Baked into the Chain

Many blockchains add compliance later. Polymesh bakes identity checks, permissioning, and audit trails into layer 1 from day one. Every wallet belongs to a verified person or institution, so issuers can enforce KYC automatically and regulators can trace ownership without subpoenas.

The momentum is tangible: Polymesh reports that more than $30 million in property is already live through its real estate tokenization with Polymesh framework.

Polymesh’s dedicated real estate tokenization page highlights its regulated infrastructure for on-chain property ownership.

In May 2024, U.S. platform REtokens began tokenizing $30 million in multifamily and townhouse equity on Polymesh because every transfer follows the chain’s built-in rulebook, according to a Business Wire release.

For issuers, that architecture saves time: set transfer restrictions once, click Issue, and each secondary trade self-polices. Investors hold a security token regulators recognize, not an anonymous crypto asset.

If you want more detail, the team’s primer on real-estate tokenization with Polymesh walks through custody, identity flows, and dividend distribution.

Polymesh focuses on regulated assets, so the next apartment building you back can move at internet speed without losing compliance.

Tokeny: The White-Label Engine Behind Europe’s Big Exchanges

Luxembourg-based Tokeny, 23 percent owned by stock-exchange operator Euronext, lets banks, fund managers, and real-estate sponsors issue compliant security tokens without touching code.

Tokeny’s onchain finance platform provides a white-label engine for issuing and managing compliant security tokens.

Its backbone is T-REX, an ERC-3643 standard that links each token to a verified identity. Once an investor clears KYC, the wallet carries a reusable on-chain passport, so cross-border transfers still settle in seconds and stay within local rules.

Real-estate teams use the platform to cut fund launches from months to days. Upload deal documents, set buyer limits, click Issue, and T-REX handles dividends, votes, and cap-table updates. No spreadsheets needed.

Traction shows in the numbers. Tokeny reports more than 120 customers and nearly $28 billion in tokenized assets, with many issuers deploying on low-fee Polygon to trim gas costs.

For investors, the portal still feels familiar with quarterly reports. Behind the glass, though, shares stay portable, programmable, and one click from regulated secondary markets that never close.

Realt: Fractional Rentals That Pay You Every Week

Detroit-based RealT, launched in 2019, pioneered U.S. real estate tokenization by turning single-family homes and duplexes into ERC-20 tokens priced around $50 each. Every property sits inside an LLC; the tokens represent membership interests, and rental income lands in your wallet each Tuesday in USDC.

RealT’s marketplace lets investors buy fractional tokens in U.S. rental properties starting around $50 per share.

Scale has snowballed. By September 2025, RealT had tokenized more than 700 properties worth over $130 million. New offerings still sell out within hours, and a peer-to-peer market on Uniswap lets you exit whenever you want to trade.

Yields typically run in the 8–12 percent range, paid weekly, which makes the income feel tangible, yet the risks match those any landlord faces. Tenants can miss rent, roofs can leak, and token holders vote on repair budgets or eviction decisions. That transparency, plus tight compliance under Regulation D for U.S. accredited investors and Regulation S for everyone else, enforced by whitelist smart contracts, has built a community of tens of thousands of global investors.

RealT proves that real-estate tokens are more than theory: they deliver real cash flow on a cadence closer to payroll than to traditional quarterly distributions.

Lofty Ai: Daily Dividends on an Algorand Backbone

Lofty adapts RealT’s fractional-rental model but runs it on the Algorand blockchain, so each rent payment clears in seconds and costs about 0.001 ALGO in network fees.

Lofty AI’s marketplace lets investors buy fractional tokens in rental properties across multiple U.S. markets starting around $50.

The key distinction is cadence: you receive rental income every day at roughly midnight UTC and can withdraw by ACH, PayPal, or USDCa whenever you like.

Tokens stay affordable because most properties are split into 1,000 units at about $50 each. By mid-2025, the marketplace listed more than 150 homes across 40 U.S. markets, representing roughly $50 million in real estate. Daily payouts make those small stakes feel tangible, and Algorand’s near-zero fees let income compound without friction.

Governance is just as granular. Token holders vote on lease renewals, repair budgets, and potential sales, turning passive landlords into an active community that steers asset value.

Lofty files each offering under Regulation Crowdfunding, so U.S. non-accredited investors can join after a standard KYC check. If RealT proved weekly distributions work, Lofty shows a property can pay before yesterday’s rent check dries.

Redswan: Opening Skyscrapers to Global Wallets

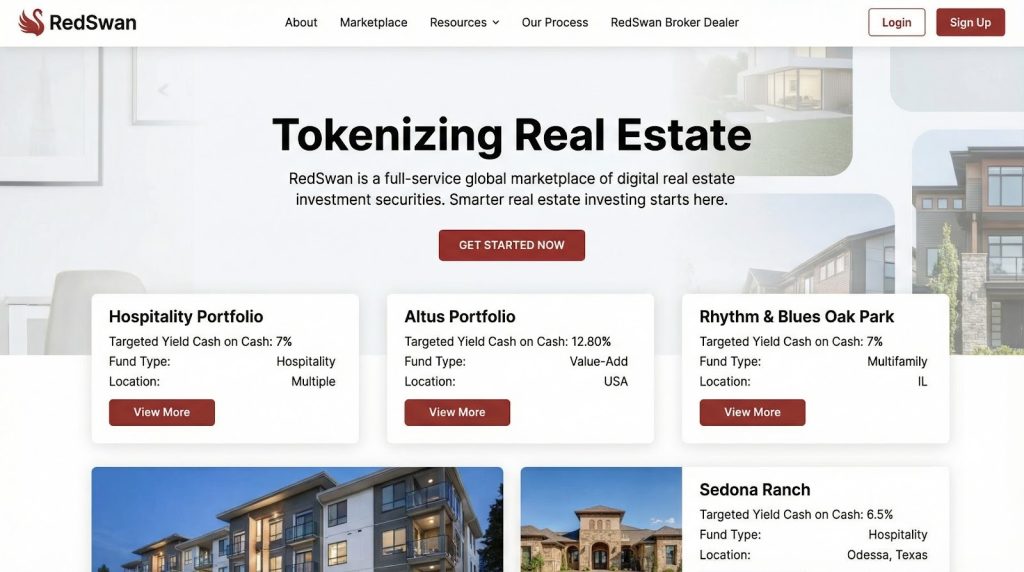

Houston-based RedSwan CRE focuses on institutional-scale commercial real estate such as luxury hotels, student-housing portfolios, and multimillion-dollar apartment towers that once required six-figure tickets. The team vets each sponsor, sets up an LLC or LP, and issues security tokens (initially ERC-1400 on Ethereum, now often on Stellar to cut fees) to accredited and overseas investors.

RedSwan’s marketplace highlights institutional-scale tokenized commercial real estate portfolios with targeted yields and diversified strategies.

Scale shows in the numbers. RedSwan reports more than $4 billion in tokenized assets and a $5.2 billion deal pipeline as of late 2025. Flagship deals include a $66 million student-housing portfolio, plus several prime California multifamily projects. Stellar integration, started in 2025, lowered settlement costs and opened doors to faster secondary trading.

Liquidity is the next frontier. Through FINRA-approved affiliates and alternative trading systems, you can sell after the standard lock-up instead of waiting seven years for a refinance or sale. That partial liquidity attracts global investors hunting steady yield.

Sponsors win, too. Token sales diversify the cap table and raise equity faster than traditional syndication, turning an exclusive capital stack into a cross-border crowdfunding funnel while staying inside compliance lines.

Solidblock: The Concierge Service Behind Landmark Token Deals

SolidBlock gained early attention in 2018 by structuring AspenCoin, an $18 million security-token offering that sold a 19 percent slice of the St. Regis Aspen Resort to accredited investors. The token now trades on INX and tZERO, proving post-issuance liquidity in practice.

Today the Tel Aviv– and New York–based team runs a turnkey tokenization service: it forms the SPV, drafts the legal wrappers, mints compliant tokens, and delivers a white-label investor portal. Company statements say clients can launch in under eight weeks. Embedded transfer rules allow those tokens to list on FINRA-registered venues such as INX, where SolidBlock has arranged more than $150 million in real-estate listings since 2020.

SolidBlock’s successor, DIBS Capital, offers a distributed investment banking platform to tokenize real estate and connect assets with global capital.

The platform stays blockchain-agnostic. Most midsize clients favor Ethereum for familiarity, while larger sponsors move to Polygon to trim gas costs. Either way, SolidBlock keeps regulators satisfied and guides investors toward secondary trading once lock-ups expire.

Beyond Aspen, the firm has tokenized hotels in London, condos in Phuket, and mixed-use projects in Mexico City, with deal sizes from $3 million to $25 million. That mid-market band is too small for investment banks and too large for Kickstarter-style crowdfunding, giving SolidBlock a clear lane: fast, compliant capital formation for global developers, plus friction-light access for investors who want a curated slice of prime property.

Securitize: Wall Street Credentials Meet Blockchain Rails

San Francisco–based Securitize is the only U.S. tokenization firm that holds all three key licenses: a FINRA-registered broker-dealer, a registered transfer agent, and an SEC-regulated alternative trading system (ATS), according to an SEC filing. That stack lets the company guide a deal from private placement to secondary trading without leaving its own ecosystem.

Institutions have noticed. KKR, Hamilton Lane, and other asset-management giants now distribute tokenized slices of their multibillion-dollar real-estate and private-credit funds through Securitize, cutting minimum tickets from millions of dollars to about $10,000. Those tokens settle on Avalanche or Polygon and, once lock-ups expire, trade around the clock on Securitize Markets.

If you are an issuer, the dashboard automates compliance checks, cap-table updates, and dividend distributions while mirroring every change in official transfer-agent records, creating an auditable dual ledger that keeps regulators and auditors comfortable. If you are an investor, you can buy into a trophy office portfolio at 2 a.m. and, if the need arises, exit a month later on a regulated venue.

Securitize combines institutional compliance with tokenized funds, offering a regulated gateway into on-chain real-world assets.

With more than $4 billion in tokenized assets under administration as of October 2025, Securitize shows that real-world-asset tokenization has moved from crypto curiosity to an institutional tool, and that round-the-clock liquidity for private real estate is now within reach.

Brickken: DIY Real Estate Tokenization for the Mid-Market

Barcelona-based Brickken helps developers and family offices that lack a legal army or a seven-figure budget. The self-service platform lets you upload deeds and appraisals, choose a jurisdictional template, and launch a compliant ERC-3643 offering in a few clicks. The dashboard then handles KYC, cap-table management, and dividend distribution while Chainlink oracles feed live valuations.

Brickken’s self-service enterprise tokenization platform lets mid-market issuers tokenize and manage real-world assets with built-in compliance and investor onboarding.

Momentum arrived quickly. Since the Token Suite went live in March 2023, clients have tokenized more than $250 million in real-world assets across 14 countries. In January 2025 Brickken closed a $2.5 million seed round that valued the firm at $22.5 million and secured a spot in the EU’s flagship blockchain sandbox, giving its compliance playbook an official stamp of approval.

Why it matters: Low-cost tooling pulls mid-sized projects—Spanish coworking spaces, Thai resorts, Mexican condos—into the on-chain era and shows that democratization is genuine, not just a slogan.

At-A-Glance: How the Eight Players Stack Up

| Company | Core role | First real-estate deal | Assets tokenized (as of Oct 2025)* | Main chain(s) | Lowest buy-in |

| Polymesh | Regulated L1 infrastructure | REtokens (U.S.), 2024 | USD 30 million | Polymesh | N/A (infra) |

| Tokeny | White-label SaaS | Monaco apartments, 2020 | 120+ issuers / ≈ USD 28 billion** | Ethereum / Polygon | N/A (B2B) |

| RealT | Single-family rentals | Detroit duplex, 2019 | 700+ homes / ≈ USD 130 million | Ethereum / Gnosis | USD 50 |

| Lofty AI | Daily-payout rentals | Ohio home, 2021 | 150+ homes / ≈ USD 50 million | Algorand | USD 50 |

| RedSwan | Commercial portfolios | Student housing, 2020 | USD 4 billion listed | Ethereum / Stellar | USD 1,000 |

| SolidBlock | Tokenization concierge | St. Regis Aspen, 2018 | USD 150 million listed | Ethereum / Polygon | USD 10,000 |

| Securitize | Institutional funds & ATS | KKR REIT tranche, 2022 | USD 4 billion AUA | Avalanche / Polygon | USD 5,000 |

| Brickken | Self-serve mid-market | Spanish coworking, 2023 | USD 250 million / 14 countries | Ethereum / Polygon | Varies |

*Rounded figures combine equity and debt where publicly disclosed; they indicate scale, not audited totals.

**Tokeny reports issuer count; the total AUM figure includes all asset classes.

Conclusion

Use the grid as your compass. Infrastructure sits at the top, retail plays in the middle, and institutional or DIY tools at the bottom. Match your priority—whether compliance, liquidity, or minimum ticket size—to choose your best starting point.