When you start trading crypto, the first surprise isn’t the price volatility, it’s the fees. Most exchanges charge maker and taker fees.

Most new traders don’t realize how much those tiny percentages can eat into profits.

The key concept? Maker vs Taker fees. Understanding this difference can save you money, sometimes a lot of money, especially if you use platforms offering 0% maker fees.

Key Takeaways

- Understanding taker fees vs maker fees is crucial for saving money in crypto trading.

- Maker fees are lower because they involve adding liquidity, while taker fees apply to market orders that remove liquidity.

- New traders should utilize limit orders with 0% maker fees to minimize costs and learn effectively.

- Pay attention to the fee structures of different exchanges to avoid hidden costs and maximize profits.

- Choosing exchanges like MEXC can help you trade without incurring high taker fees, enhancing your trading experience.

Table of Contents

Let’s break it down simply.

What Are Maker vs Taker Fees?

Every exchange rewards or charges you based on whether you add liquidity or take it away.

Maker Fees = Adding Liquidity

When you place a limit order that doesn’t fill instantly, you’re making the market.

- Because you help build the order book, exchanges usually give you a discount, and some even charge a 0% maker fee, letting you trade for free while your order waits.

Taker Fees = Removing Liquidity

If you place a market order, you’re taking liquidity away; your trade executes immediately against someone else’s order.

- Since you speed up the transaction, exchanges charge a bit more (typically 0.05% – 0.10%).

So 👉 makers = cheaper trades, takers = faster but costlier trades.

Why Fees Matter for Beginners

When you’re learning, every cent counts.

Using limited orders with 0% maker fees means you can place many small trades, test entry prices, and learn without pressure.

Example:

Say you open a $100 limit order on BTC/USDT

If it doesn’t fill right away, you pay zero fees; you’re a maker.

You can cancel, adjust, or let it hit your target, all without losing money to commissions.

That freedom to experiment is what makes maker fees so powerful for beginners.

How to Avoid High Taker Fees

If you trade impulsively with market orders, you’ll always pay the higher rate.

A simple switch fixes that:

Use limited orders.

By setting your own buy/sell price, you add liquidity and avoid taker fees entirely.

Over dozens of trades, those savings compound into real money.

Pro Tip: Plan entries and exits in advance; patience is literally profitable.

Crypto Exchange Fee Comparison

To make things clearer, here’s a comparison of the maker and taker fees charged by major exchanges, including Binance, MEXC, KuCoin, and Bybit.

This chart (Updated by Oct.2025) highlights how maker fees vary; some exchanges charge nothing (0%), others don’t. For beginners, starting where limited orders cost zero is an instant advantage.

| Exchange | Maker Fee (Spot) | Taker Fee (Spot) | Maker Fee (Future) | Taker Fee (Future) | Discount/notes |

|---|---|---|---|---|---|

| Mexc | 0% | 0.05% | 0% | 0.02% | Holding ≥500 MX for 24h → up to 50% discount on spot & futures fees (eligibility-based). – MX Deduction feature → up to 20% fee discount. – Discounts cannot be combined; the system applies the better option. – Some pairs excluded, check live Schedule |

| Binance | ~0.1% | ~0.1% | ~0.02% | ~0.05% | – Rates shown are VIP0 baseline. – Using BNB for fee payment → ~25% discount (spot), ~10% discount (futures). – Actual fees vary by VIP tier & region. |

| Kucoin | 0.10% | 0.10% | 0.02% | 0.06% | Base level fees; discounts for KCS holders or high-volume traders. |

| Bybit | 0.10% | 0.10% | 0.02% | 0.055% | Standard fees; VIP users can access lower tiers. |

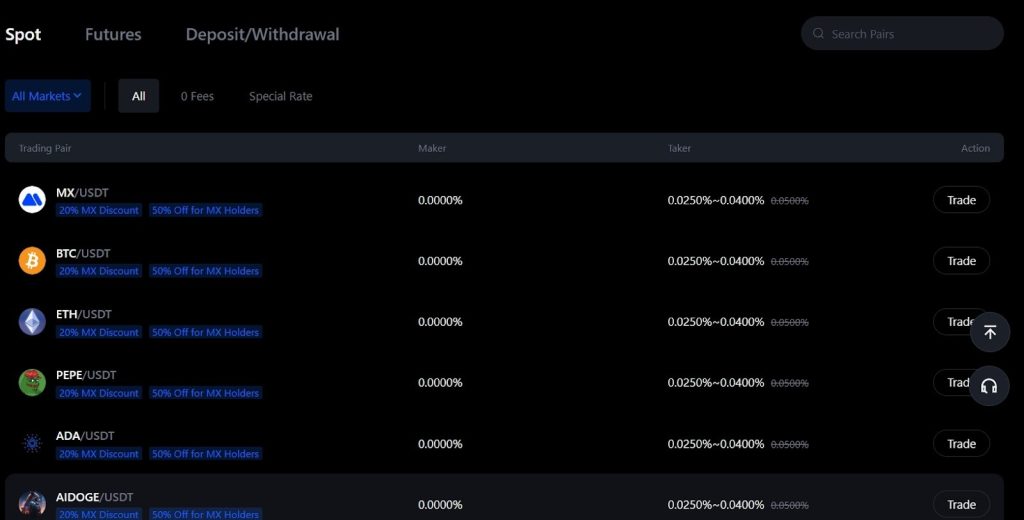

Fee Interface Example: Below is a screenshot from an exchange showing the “Spot” and “Futures” tabs and their transparent fee display (0 % maker / 0.025 % – 0.04% taker for major pairs like BTC/USDT or ETH/USDT).

How to Get the Most Out of Maker Fees

To maximize your savings, here are a few steps you can follow:

- Use Limit Orders: This is your best tool to avoid taker fees and make the most of 0% maker fees. With an example like MEXC, you can place as many limit orders as you want, and as long as the orders don’t fill immediately, you won’t pay any fees.

- Plan Your Trades: By setting realistic entry and exit points, you can ensure that your orders are placed at optimal levels. This strategy will allow you to avoid market orders and keep your fees to a minimum.

- Check Fee Structures: Not all platforms have the same fee structure, so it’s important to understand the fee schedules before you start trading. Some exchanges may have hidden costs or higher fees on certain pairs, which can eat into your profits.

Conclusion

Navigating crypto trading fees doesn’t need to be a stressful experience, especially when you understand the difference between maker and taker fees. By choosing platforms like MEXC, which offer 0% maker fees, you can start your trading journey with confidence, knowing that you can learn without worrying about high fees cutting into your profits.

As you gain more experience, remember that lower fees, especially on maker orders, mean you’ll have more freedom to experiment and test out strategies. So, whether you’re new to trading or just refining your skills, don’t overlook the power of maker vs taker fees in shaping your trading strategy.

Want to learn more about how these fees work and start trading with the best conditions? Check out the MEXC Fee Schedule and some tools for calculation, and start saving on your trades today.