Bitcoin mining has become one of the most energy-intensive digital industries on the planet, with annual consumption comparable to entire countries and energy often making up 70 to 90 percent of a miner’s operating costs. In 2025, many miners around the world are paying between 0.05 and 0.15 dollars per kilowatt hour for electricity, which can push the cost of producing a single Bitcoin to tens of thousands of dollars before hardware or hosting. In this environment, any serious mining strategy has to start with one question: how do you cut electricity costs without sacrificing uptime or performance?

Key Takeaways

- Electricity costs dominate Bitcoin mining, accounting for 70 to 90 percent of operating expenses.

- OneMiners focuses on low-cost industrial energy contracts and uses renewable sources to reduce costs.

- The company implements efficient facility designs and software intelligence to optimize energy consumption.

- Transparent electricity pricing allows miners to calculate profitability without hidden fees.

- Maintaining high uptime and ownership of hardware support long-term economics and profitability.

Table of contents

- Why Electricity Costs Dominate Bitcoin Mining

- How OneMiners Approaches Electricity Cost Reduction

- Leveraging Cheaper and Greener Electricity

- Facility Design That Turns kWh Into Hashrate More Efficiently

- AI Smart Mining and Revenue per Kilowatt Hour

- Transparent Electricity Pricing and Budget Control

- Uptime, Reliability, and the Hidden Cost of Downtime

- Ownership, Hardware Strategy, and Long-Term Economics

- Lower Electricity Costs, Higher Mining Profitability

Why Electricity Costs Dominate Bitcoin Mining

- Global Bitcoin mining consumes roughly 150 to 175 terawatt hours of electricity per year, similar to the usage of a mid-sized industrialized nation.

- Each mined Bitcoin can represent hundreds of thousands of kilowatt hours of electricity once difficulty and total network hash rate are factored in.

- For most professional miners, electricity alone can account for the majority of operating expenses, which means that even a one or two cent change in price per kilowatt hour can make or break profitability.

Because network difficulty steadily climbs and ASIC efficiency improvements are incremental, miners cannot rely on hardware leaps alone to protect margins. Instead, long-term success depends on sourcing cheaper, more predictable, and more efficiently used electricity while keeping machines online as close to 24/7 as possible.

How OneMiners Approaches Electricity Cost Reduction

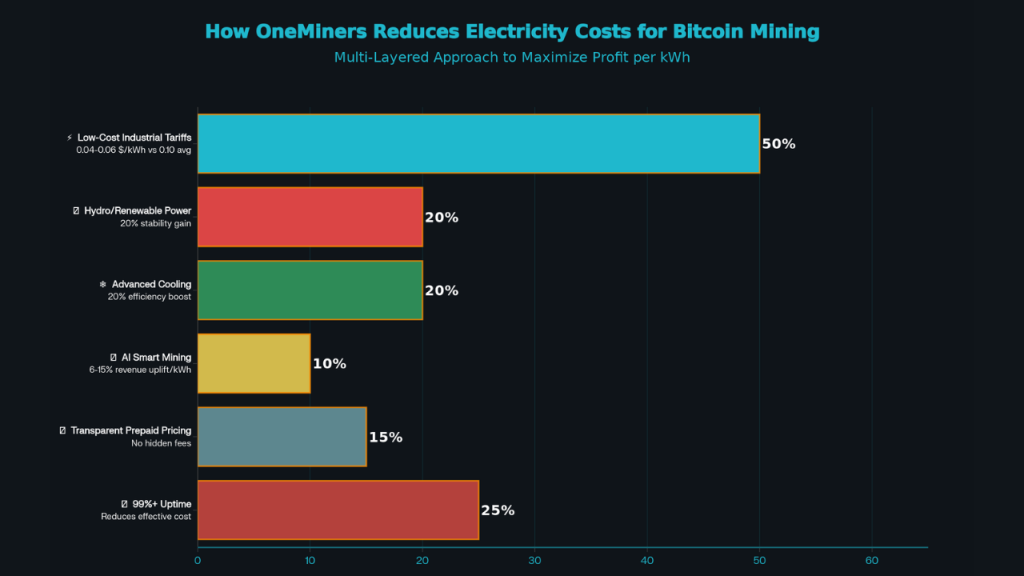

OneMiners is built around the idea that electricity is the core lever for both profitability and sustainability in Bitcoin mining, and its entire ecosystem is designed to attack that cost from several angles at once.

Key pillars of the approach include:

- Focusing on low-cost industrial energy contracts instead of residential or retail rates.

- Prioritizing regions and facilities that use renewable and especially hydroelectric power for lower and more stable long-term tariffs.

- Engineering mining environments that improve energy efficiency per terahash through better cooling, layout, and uptime.

- Adding a software intelligence layer that increases revenue per kilowatt hour without extra power draw.

- Using transparent, prepaid electricity pricing so miners can model real profitability instead of guessing around hidden fees.

This integrated strategy means miners are not just chasing a low headline rate, but actually reducing how much electricity they consume per unit of Bitcoin revenue.

Leveraging Cheaper and Greener Electricity

OneMiners deliberately locates its hosting infrastructure in regions where electricity is structurally cheaper and often heavily based on renewable sources.

Electricity cost advantages come from:

- Access to industrial or wholesale tariffs that can start around the low 0.04 to 0.06 dollars per kilowatt hour range for large deployments, significantly under typical home rates.

- Siting facilities near hydroelectric and other renewable generation, where abundant low-cost energy and favorable climate conditions reduce both direct power costs and cooling needs.

- Avoiding congested, high-priced urban grids in favor of energy-rich regions that historically export power or have surplus capacity.

This strategy does two things at once: it lowers a miner’s monthly electricity bill and it reduces the carbon intensity of each kilowatt hour used, aligning Bitcoin mining with growing regulatory and societal pressure to cut emissions from high-power industries.

Facility Design That Turns kWh Into Hashrate More Efficiently

Simply paying less per kilowatt hour is not enough if much of that energy is wasted through poor design or downtime. OneMiners treats every aspect of its data centers as an energy optimization problem.

Key design choices that reduce effective electricity costs include:

- Using naturally cool climates and carefully engineered airflow in certain locations to deliver around 20 percent better energy efficiency than hot, improvised warehouses, because fans and cooling equipment do less work for the same chip temperatures.

- Deploying advanced cooling methods such as immersion and high-efficiency dry cooling where needed to prevent thermal throttling, so miners deliver stable hashrate instead of consuming power while underperforming.

- Installing redundant power supplies and structured maintenance processes that target a very low mean time to repair, so machines spend minimal time powered but idle or offline.

Each of these measures helps convert a higher share of every kilowatt hour into actual hashes and block rewards instead of wasted heat or downtime, effectively lowering the electricity cost per unit of revenue.

AI Smart Mining and Revenue per Kilowatt Hour

On top of the physical infrastructure, OneMiners adds a software intelligence layer designed to increase how much revenue miners extract from each unit of electricity consumed.

This smart mining approach includes:

- Automatically routing hashrate to the most profitable pools or coins within a defined strategy, based on real-time fees, luck, and network conditions, rather than leaving machines on a static, suboptimal configuration.

- Applying machine learning-driven firmware tuning that adjusts performance profiles to find a better balance between hashrate and power draw, often yielding a measurable uplift in revenue per kilowatt hour.

- Providing dashboards with clear visibility into hashrate, efficiency, thermals, and projected profitability so miners can make data-driven decisions instead of guesswork.

Industry estimates show that even a single-digit percentage improvement in revenue per kilowatt hour can have a major impact on payback periods in a post-halving environment, and OneMiners targets improvements in the mid- to high-single-digit range through this optimization layer.

Transparent Electricity Pricing and Budget Control

Unclear contracts and separate utility bills are a common pain point in mining, because hidden fees, demand surcharges, or volatile tariffs can suddenly destroy a profitability model that looked viable on paper. OneMiners addresses this by using a simple, transparent electricity pricing structure.

Core elements of this model:

- Electricity is prepaid monthly at a clearly stated cents per kilowatt hour rate, which typically includes hosting and operational costs in one figure.

- There are no surprise demand charges or extra grid fees added after the fact; the rate miners see upfront is the rate they use in their profitability calculations.

- Energy terms are published and explained so that both beginners and experienced miners can run realistic return-on-investment and halving stress tests before committing capital.

This transparency helps miners turn electricity from an unpredictable risk factor into a planned, controllable cost line in their mining business.

Uptime, Reliability, and the Hidden Cost of Downtime

Every hour that mining hardware is offline is an hour where fixed costs continue but no revenue is generated, which effectively increases the electricity cost of every coin mined when spread over the active hours. OneMiners works to keep uptime high and unplanned downtime low.

Practices that support this include:

- Designing facilities with redundant electrical paths, robust networking, and environmental monitoring to keep operations stable during grid fluctuations or local disturbances.

- Offering round-the-clock monitoring and on-site technical support so most issues are detected and fixed quickly, minimizing idle rigs and wasted paid power.

- Providing options for insurance and extended warranty coverage, which protect hardware and revenue when unexpected events occur, supporting long-term planning and investment.

Given that climate-related and infrastructure-related power disruptions are increasing worldwide, investing in reliability is effectively another way to reduce the real cost of electricity per mined Bitcoin over the life of a deployment.

Ownership, Hardware Strategy, and Long-Term Economics

Finally, electricity costs do not exist in isolation; they are part of a larger economic picture that includes hardware choice, financing, and deployment speed. OneMiners’ model is centered on client ownership of ASICs and a long-term infrastructure partnership rather than short-lived speculative schemes.

This brings several advantages that indirectly reinforce energy efficiency:

- Miners own their hardware outright, choose their pools, and control configurations, so they can continuously adapt to market conditions instead of being locked into rigid third-party setups.

- Hardware purchased through the platform can be shipped directly into hosting with streamlined logistics, cutting delays between buying an ASIC and turning electricity into revenue.

- Scalable capacity and flexible terms allow miners to add or rebalance hashrate in response to electricity price changes, Bitcoin price moves, or regulatory shifts.

In a world where electricity is both the biggest cost and the main competitive weapon, this integrated ecosystem, combining low-cost power, renewable siting, efficient engineering, intelligent optimization, transparent pricing, and reliable uptime, gives miners a structured way to push their effective electricity costs down and keep their operations profitable through the next cycles of Bitcoin mining.

Lower Electricity Costs, Higher Mining Profitability

In an industry where electricity dictates both cost structure and competitiveness, miners need more than just inexpensive power, they need an integrated strategy that transforms every kilowatt hour into maximum output. OneMiners delivers exactly that by combining low-cost renewable energy, high-efficiency facility engineering, intelligent optimization software, transparent pricing, and reliable uptime. This holistic approach not only reduces the direct cost of electricity but also improves the effective cost of mining by increasing energy efficiency and revenue per kilowatt hour. As Bitcoin mining becomes more challenging and network difficulty continues to rise, miners who prioritize energy strategy will be the ones who maintain profitability and stay resilient across market cycles. OneMiners provides the infrastructure, intelligence, and reliability to help miners achieve precisely that.