Money moves faster every year—and in fintech, that pace can make or break your product. FedNow cleared 1.9 million U.S. payments in its July 2025 launch month, while Brazil’s PIX processed 13 billion transfers last year, proving that “instant” is now the baseline. For platforms competing in this environment, seamless payment gateway integration is no longer optional but essential to delivering the speed and reliability users expect.

If you’re building a banking app, lending platform, or cross-border wallet, you pick a gateway for uptime, fraud shields, and compliance reach—not just price. Users expect a tap, a tick, and they’re gone.

In this guide we’ll compare five integration paths—from drop-in APIs to white-glove consultancy—so you can meet those expectations without detouring your roadmap. Ready? Let’s map the terrain.

Key Takeaways

- Payment gateway integration must meet high-speed expectations as real-time payments rise, making instant transfer essential.

- Open banking and local payment methods reduce costs and enhance user experience, shifting focus from traditional cards.

- Security and compliance become more complex as fraud escalates and regulations evolve globally.

- Evaluate payment partners using a five-point scorecard focusing on developer experience, security, global coverage, cost transparency, and support.

- Among the best payment gateway integration solutions are Monstarlab, Stripe, Adyen, Finix, and Rapyd, each fulfilling specific needs.

Table of contents

Fintech Payment Integration In 2026 – Trends & Challenges

Payment tech never idles; it sprints. Below are the five forces already reshaping checkout flows, compliance checklists, and your roadmap.

1. Real-Time Payments Reset Speed Expectations

FedNow handled 1.9 million transfers in its July 2025 launch month, while Brazil’s PIX now clears about 140 million payments each day. Consumers see funds land in seconds, so any lag feels like failure. Gateways must expose always-on rails, screen risk in real time, and post confirmations instantly—no batch files, no overnight jobs.

2. Open Banking Erodes Card Dominance

Europe’s draft PSD3 puts refund liability on the provider that misses fraud, and U.S. regulators are finalising Section 1033 to force data portability. The upside: account-to-account payments cost less than card interchange and settle faster. Choose partners that already ship PSD3-ready APIs and have a migration path for U.S. mandates.

3. Fraud Escalates, Security Tightens

Bot farms, synthetic IDs, and mule rings probe every weak checkout within milliseconds. PCI DSS 4.0 raises encryption bars, and strong customer authentication expands country by country. Your gateway must tokenize data before it touches your servers, support 3-D Secure 2, and feed AI risk engines trained on global traffic patterns.

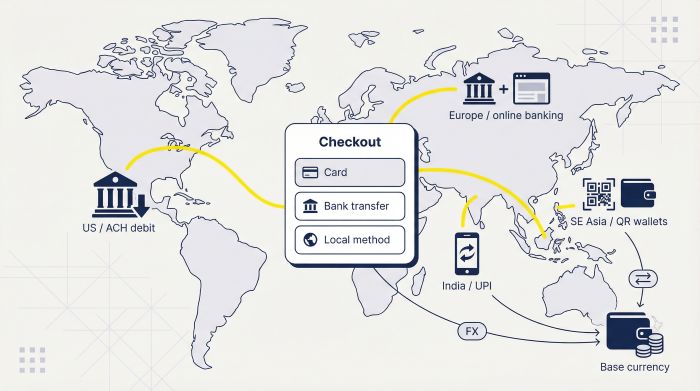

4. Global Commerce Demands Local Payment Methods

Fintech start-ups often serve users on three continents by week one. Those customers expect UPI, iDEAL, ACH debit, or a Thai QR wallet, not just cards. Modern gateways map one checkout to dozens of local rails, handle fair FX, and settle in your base currency—saving you months of regional integrations.

5. Compliance Grows More Complex, Not Less

Serve Europe and you enforce SCA, file scheme-level fraud reports, and absorb PSD3 refund rules. Expand to Singapore or Australia and new payment-service licences, capital thresholds, and reporting cadences appear. Pick providers with a public record of zero-day regulatory updates and dashboards your legal team can screenshot in minutes.

How We Evaluated Payment Gateway Integration Services

Picking a payment partner is part art, part math. We built a five-point scorecard that mirrors the real headaches fintech builders face and assigned a weight to each pillar.

Developer experience counts for 30 percent. When engineers can wire an API in a sprint, momentum stays high and costs stay low. We looked for clean REST endpoints, mobile SDKs, clear docs, and sandboxes that mirror live traffic.

Security and compliance sit at 25 percent. PCI DSS Level 1 is the entry ticket, but we also checked for built-in tokenization, 3-D Secure 2 support, and a record of shipping regulatory updates before each deadline.

Monstarlab’s U.S. team earned Stripe’s Payments Specialization credential in June 2025 after passing the platform’s capabilities assessment—a vetting process that confirms PCI Level 1 controls and a track record of successful integrations.

That third-party badge gives fintech builders external proof that Monstarlab can wire secure flows and keep audits painless.

Global Coverage and Cost Transparency

Global coverage holds 20 percent. Your first users may live in one country; your fifth growth experiment could unlock three continents. We tallied supported currencies, local payment methods, and direct acquiring licences that lift approval rates.

Cost transparency weighs 15 percent. Predictable fees help finance teams plan and founders model margins. We favoured providers that publish rates or use simple interchange-plus mark-ups with no hidden gateway charges.

Support and documentation fill the final 10 percent. Even the best APIs spark questions at 3 am. We prize 24/7 channels, quick human responses, and community forums where peers swap fixes.

Every service you’ll see next scored well across all five pillars. The weights simply show where each one shines, so you can match strengths to your roadmap without guesswork.

5 Best Payment Gateway Integration Solutions for Fintech Companies

Logos of top payment gateway integration services for fintech

1. Monstarlab – Custom Payments Integration Services

Most gateways hand you an API key and wish you luck. Monstarlab hands you a team. The firm’s Monstarlab’s payment solutions deliver end-to-end integration with zero-downtime migration, complete architecture diagrams, checkout UI components, and the compliance evidence regulators expect. Developers like that Monstarlab engineers wire Stripe, Adyen, or a regional acquirer of your choice, then push code to your repo with playbooks for future tweaks. Product managers value the risk audits baked into each milestone. Finance teams see clear project-based pricing with no surprise gateway fees. It is not the cheapest route, yet it is often the fastest way to market-ready reliability.

2. Stripe – Developer-Friendly Gateway with Global Reach

Stripe became the default answer to “how do we take payments?” by treating developers like VIP customers. Its REST APIs read like plain English, client libraries exist for every major language, and the test dashboard shows real webhook logs so you can debug in minutes. A junior engineer can launch basic card payments before lunch, then add Apple Pay, ACH debit, or subscriptions the same afternoon. Stripe now supports more than 130 currencies and dozens of local methods, so new markets open with a toggle. Pricing stays simple: a flat percentage plus a small fixed fee, with volume discounts at scale.

3. Adyen – Enterprise-Grade Payments with Unified Commerce

Adyen powers checkouts for Uber and Spotify because it treats payments as a global network problem, not a local plug-in. One contract unlocks over 250 payment methods across 70 countries, all processed on Adyen’s own acquiring licenses. That direct access lifts approval rates and keeps data in one reconciliation file your finance team can read. RevenueProtect, the built-in fraud suite, blends machine learning with custom rules, so you tighten security without hurting conversion. Fees follow an interchange-plus model: you pay scheme costs plus a transparent markup and no setup fees.

4. Finix – Payments Infrastructure You Can White-Label

Finix flips the script by turning you into the payment facilitator. The platform supplies merchant onboarding flows, KYC checks, settlement schedules, and a dashboard that rolls every sub-merchant into tidy charts. Forbes named Finix the top gateway for sales data in 2025, a nod to those granular analytics. Integration is deeper than a drop-in button, but the docs walk you through each milestone, and the developer success team stays on the call until the webhook fires green. Finix remains United States-centric, yet published plans outline near-term international coverage.

5. Rapyd – One Api to Collect, Hold, And Pay Out Worldwide

Rapyd aims to make every payment simple. Its single API taps local rails in more than 100 countries, from UK bank transfers to Indonesian e-wallets to Mexican cash vouchers. You collect, hold, and pay out through one contract. Hosted wallets and payout APIs turn a cross-border marketplace into a sprint item rather than a moon-shot project. Documentation is exhaustive, but once the auth flow clicks, each new method feels familiar. Pricing varies by country and payment type, so model carefully before launch.

Quick Comparison Matrix: How To Read It

Tables beat paragraphs when you want a snapshot. Scan the row that matches your priority, then jump back to the profiles for depth.

| Service | Developer experience | Security & compliance | Global coverage | Cost transparency | Support & docs |

| Monstarlab | White-glove integration, code delivered | Designs PCI-ready stacks, advisory included | Any provider you choose | Project-based, no hidden gateway fees | High-touch consultants |

| Stripe | Best-in-class APIs, quick start | PCI Level 1, built-in fraud tools | 130+ currencies, many local methods | Flat public rates, volume discounts | 24/7 chat, rich docs |

| Adyen | Robust APIs, drop-in components | PCI Level 1, RevenueProtect AI | 250+ methods, 70 countries | Interchange-plus, no setup fees | Dedicated account teams |

| Finix | PayFac APIs, deep platform control | PCI Level 1, KYC workflows | Primarily United States today | SaaS fee plus pass-through interchange | Hands-on developer success |

| Rapyd | Single API, modular features | PCI Level 1, global licenses | 100+ countries, collect & payout | Method-based, needs modelling | Multi-region support, active forum |

Conclusion

A green cell across your top two criteria usually beats minor gaps elsewhere. For instance, if speed to market is everything, Stripe’s developer column outweighs its limited payout breadth. If you need local methods in emerging regions, Rapyd’s coverage wins even if pricing takes more modelling. In any payment gateway integration decision, aligning platform strengths with your immediate product goals matters more than chasing marginal feature advantages. Keep your strategic goal front and center, and the matrix will guide you to the safest, quickest partner.