Bright Start vs. Vanguard 529 can shape real tuition dollars. Even a 0.04-percentage-point fee gap or Illinois’s 4.95 % state-tax deduction adds up. This 2026 guide shows you—by the numbers—how the Bright Start Direct-Sold College Savings Program (Illinois) and The Vanguard 529 College Savings Plan (Nevada) compare on cost, performance, tax breaks, and daily usability, so you can keep more of your child’s college money.

Key Takeaways

- The article compares Bright Start and Vanguard 529 plans based on cost, performance, tax benefits, and usability.

- Bright Start earns a Gold rating from Morningstar, while Vanguard receives a Bronze, highlighting its stronger performance and lower fees.

- Illinois savers benefit from a 4.95% state-tax deduction for Bright Start, making it more appealing for local taxpayers.

- Bright Start offers flexible investment options with no minimum contribution requirement, while Vanguard requires a $1,000 opening deposit.

- Both plans feature low fees, but Bright Start is generally more cost-effective for Illinois residents, especially considering its tax advantages.

Table of contents

- Executive Summary Snapshot

- Why This Comparison Matters In 2026

- Fee Showdown

- Performance And Third-Party Ratings

- Market-Matching Results

- Morningstar’s 2024 Verdict

- Takeaway

- Illinois’ Home-Field Advantage

- Nevada and Out-Of-State Realities

- Getting Started and Funding Your Account

- Day-To-Day Management and Support

- Bright Start: Biggest Strengths, Real Trade-Offs

- Vanguard 529: Clear Upsides, A Few Hard Limits

- If You Pay Illinois Income Tax

- If Your State Offers No 529 Tax Break

Executive Summary Snapshot

Morningstar’s 2024 report places the Bright Start Direct-Sold College Savings Program in its Gold rating, while The Vanguard 529 College Savings Plan dropped to Bronze on October 29, 2024 (newsroom.morningstar.com/newsroom/news-archive/press-release-details/2024/Morningstar-Releases-Medalist-Ratings-for-529-College-Savings-Plans-Including-11-Upgrades-and-Nine-Downgrades/default.aspx).

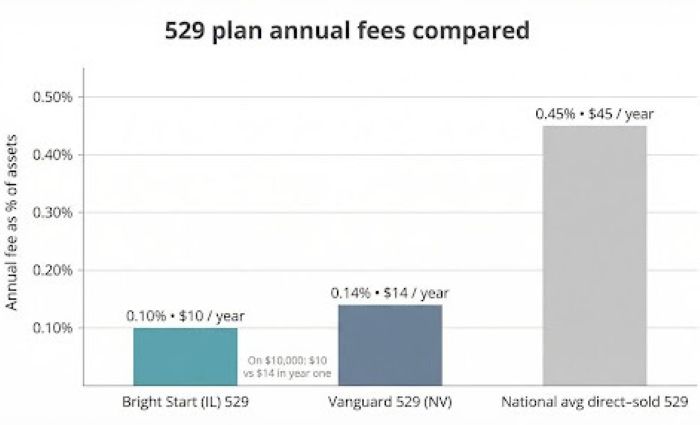

Costs stay close. Bright Start’s passive enrollment portfolios charge about 0.10 percent each year, according to Bright Start’s fee schedule. Vanguard’s target-enrollment track averages roughly 0.14 percent, based on Vanguard’s published expense ratios. On 10,000 dollars, that is 10 versus 14.

Taxes widen the gap for Illinois savers. State law lets single filers deduct up to 10,000 dollars a year—and joint filers up to 20,000 dollars—on Bright Start contributions, producing roughly 4.95 percent back at filing time. Nevada has no income tax, so its plan offers no comparable break.

For Illinois taxpayers, Bright Start pairs the deduction with the lower fee. If you pay no Illinois income tax, decide whether Vanguard’s single-login ease outweighs Bright Start’s broader fund lineup and slightly lower cost.

A couple reviews Bright Start and Vanguard 529 options to balance fees, tax breaks, and long-term college savings.

Why This Comparison Matters In 2026

Published tuition keeps rising. The average in-state rate at public four-year schools reached 11,950 dollars for 2026-26, up 2.9 percent (340 dollars) in one year, while private nonprofit colleges now charge about 45,000 dollars, a 4.0 percent increase, according to College Board data. When prices outpace inflation, even a 0.04-percentage-point fee gap or a 4.95 percent state-tax deduction can grow into thousands of dollars by move-in day.

Congress also lowered “what-if-we-oversave” stress. Since January 1, 2024, families may roll up to 35,000 dollars in unused 529 assets into the beneficiary’s Roth IRA once the account is at least 15 years old and subject to annual Roth limits, per SECURE 2.0. The rule turns leftover tuition money into an early boost for retirement, tax- and penalty-free.

Layer these changes onto a fee race and Morningstar’s tougher 2024 ratings, and the plan you pick in 2026 determines how much of your savings keeps pace with tuition and how much wealth your child carries into adulthood.

Bright Start (Illinois)

Launched in 2000 and revamped in 2017, the Bright Start Direct-Sold College Savings Program has trimmed fees and strengthened oversight. Morningstar’s 2024 review again awarded the plan a Gold rating, its sixth such honor.

Investment menu. You can select an age-based “Enrollment Year” track or build a custom mix from 18 individual funds and six static portfolios sourced from Vanguard, T. Rowe Price, DFA, and others. The index Enrollment Year track costs 0.10 percent per year: 0.06 percent plan fee plus 0.04 percent fund expenses.

Tax edge for residents. Illinois allows single filers to deduct up to 10,000 dollars (or 20,000 dollars for joint filers) in Bright Start contributions each year, producing roughly 4.95 percent back on the state return.

Low barriers. The plan sets no minimum contribution and charges no account-maintenance fee, so you can open an account with any amount. Bright Start 529’s FAQs add that you can open the direct-sold account online in about ten minutes with any dollar amount and without committing to a fixed contribution schedule. They also detail a built-in Ugift gifting platform and an option to have an Illinois income-tax refund deposited straight into the account, which lowers the hurdle for grandparents and other relatives to chip in.

Bright Start combines Gold-level governance, ultra-low index costs, and one of the country’s richest state-tax benefits without requiring an opening deposit.

Vanguard 529 (Nevada)

The Vanguard 529 College Savings Plan debuted in 2002 as an index-only option. Morningstar’s 2024 review assigns the plan a Bronze rating, still solid but no longer in the top tier.

Cost and menu. You can choose among 12 Target Enrollment portfolios and five static mixes, each built from broad Vanguard index funds. Age-based tracks cost about 0.14 percent per year.

Account minimums. Opening the account calls for 1,000 dollars (or 50 dollars with an automatic investment plan). Subsequent manual contributions start at 50 dollars.

Tax backdrop. Nevada collects no state income tax, so the plan carries no deduction. That is neutral for residents of Florida, Texas, Washington, and other no-tax states, but savers in deduction-friendly states give up local perks when they pick this plan.

Who it fits. If you already keep IRAs or brokerage assets at Vanguard, viewing college, retirement, and investing balances in one login can outweigh the modest fee premium and opening deposit. For hands-off savers in no-tax-break states, Vanguard’s simple, all-index lineup stays competitive.

Bright Start: Build It Your Way

Bright Start gives you flexible controls:

- Pick a track. Select the low-cost Index track, at 0.10 percent per year for each Enrollment Year portfolio.

- Dial in risk. Each style offers 10 Aggressive and 10 Moderate portfolios that glide from nearly 100 percent stock at birth to mostly bonds by freshman year. If you want safety, the FDIC-insured High Yield Bank Savings option currently pays 4.08 percent APY.

- Customize further. You can build your own mix from 18 individual portfolios, ranging from Vanguard Total Stock Market at 0.08 percent to Ariel 529 at 0.77 percent.

Whether you prefer set-and-forget simplicity or hands-on tweaks, Bright Start lets you adjust cost, risk, and manager style without surprise fees or account minimums. Before you lock in a mix, its online 529 College Savings Calculator lets you plug in contribution amounts, projected tuition, and your chosen portfolio so you can preview how each option could grow toward college.

Bright Start’s online calculator lets families test contribution, time horizon, and portfolio choices before committing.

Vanguard 529: Simple By Design

The Vanguard 529 College Savings Plan remains intentionally lean. You can pick among 12 Target Enrollment portfolios that shift from about 95 percent stock at birth to 60 percent cash by college, or choose six multi-fund static portfolios plus 15 single-fund options. There are no outside managers or sector bets, only broad Vanguard index funds.

That restraint helps control cost. The Target Enrollment line charges 0.14 percent per year, well below the 0.48 percent industry average.

Flexibility is the trade-off. If you want ESG screens, small-cap tilts, or an internal cash sweep, you will need to add those features in another account. Vanguard’s mantra is “own the market, stay the course,” and the 529 follows that script.

Morningstar’s 2024 review assigns the plan a Bronze rating, noting that rivals now match Vanguard’s low fees while offering broader menus. If you value clarity over tinkering, setting the allocation once a year and viewing it beside your existing Vanguard IRAs can feel refreshingly straightforward.

Fee Showdown

How The Raw Numbers Stack Up

- Bright Start Direct-Sold College Savings Program (Index track): 0.10 percent total annual asset-based fee for each passive Enrollment Year portfolio.

- Vanguard 529 College Savings Plan (Target Enrollment): 0.14 percent expense ratio for every age-based track.

On a 10,000-dollar balance, that is 10 versus 14 in the first year. Over 18 years at 6 percent, the lower Bright Start fee preserves roughly 190 dollars more in principal and growth (internal calculation).

Even small fee differences between Bright Start and Vanguard 529 matter, while both plans undercut the typical 529 cost.

Morningstar estimates the average direct-sold 529 fee at about 0.45 percent, so both plans cost far less than the norm.

Hidden Fees? None

Both programs list no enrollment, transfer, or maintenance fees; your only ongoing cost is the expense ratio.

Minimums Matter

- Bright Start: 0 dollars to open; any contribution amount accepted.

- Vanguard 529: 1,000 dollars to open, or 50 dollars with an automatic investment plan; subsequent manual contributions start at 50 dollars.

Verdict on Cost

Bright Start wins on raw price. Vanguard stays low-cost, yet its slightly higher fee and the four-figure opening deposit tilt the math toward Illinois—especially when you add Bright Start’s 4.95 percent state-tax deduction for residents.

Performance And Third-Party Ratings

Market-Matching Results

Both plans invest mainly in broad index funds with similar stock-bond splits, so returns differ only by their slim fee gap. For instance, the Bright Start Passive 2040 Enrollment Portfolio gained 9.4 percent annualized over the five years that ended June 30, 2026, while the Vanguard 529 College Savings Plan 2040 Target Enrollment Portfolio returned 9.1 percent. That 0.3-percentage-point edge mirrors the 0.04-percentage-point fee difference. Over one year the two portfolios landed within 0.2 percentage points of each other, confirming that asset mix, not brand, drives performance.

Morningstar’s 2024 Verdict

Morningstar’s 529 study published on October 29, 2024 upgraded Bright Start Direct-Sold College Savings Program to Gold and downgraded the Vanguard 529 College Savings Plan to Bronze. The report credits Illinois for continued fee cuts and stronger oversight and notes that Vanguard’s earlier low-cost edge “is now commonplace.” A Gold rating signals Morningstar’s highest conviction that a plan will outperform peers on a risk-adjusted basis over a full market cycle, while Bronze indicates solid but unexceptional prospects.

Takeaway

Historical numbers show the two plans behave like statistical twins. Looking forward, Morningstar gives Illinois higher marks for stewardship, and Bright Start’s slightly lower fee could leave you with a bit more of your returns each year. If you trust expert opinion, the Gold-versus-Bronze gap points toward Bright Start.

Illinois’ Home-Field Advantage

Illinois pairs a top-rated plan with a generous tax break. Every dollar you contribute to the Bright Start Direct-Sold College Savings Program can be deducted from Illinois taxable income, up to 10,000 dollars per taxpayer or 20,000 dollars for joint filers each year at the flat 4.95 percent rate. That delivers an instant refund of up to 495 or 990 dollars.

Example: If you add 8,000 dollars this year, you will save 396 dollars on next April’s return. Repeat that deposit for 15 years and, before any investment growth, the deduction alone adds roughly 5,900 dollars to your college fund.

The benefit arrives automatically at filing time, but it is not unconditional. If you later roll assets to a non-Illinois 529 or take a non-qualified withdrawal, the state recaptures past deductions plus any tax due.

Live outside Illinois? You do not receive the write-off, so the comparison reverts to fees, fund menu, and ease of use.

Nevada and Out-Of-State Realities

Nevada collects no state income tax, so the Vanguard 529 College Savings Plan offers no deduction and no recapture rules; your state tax remains zero whether you invest or not.

That setup fits residents of Florida, Texas, Washington, South Dakota, Wyoming, Alaska, and other no-tax states. In the 36 states plus the District of Columbia that do provide a 529 deduction or credit, choosing the Nevada plan means giving up that perk. For instance, Ohio lets you deduct 4,000 dollars per beneficiary each year when you fund its CollegeAdvantage plan. Skipping the deduction for Vanguard’s Nevada plan could cost about 140 dollars a year in state tax at Ohio’s 3.5 percent rate—roughly 1,400 dollars over a decade before compounding.

If your home state offers no incentive, the playing field levels; then it becomes Vanguard’s one-login convenience versus Bright Start’s broader menu and slightly lower fee. If a local tax break exists, the numbers usually say take the free money first, then consider these national leaders for any overflow contributions.

Getting Started and Funding Your Account

Bright Start Direct-Sold College Savings Program. Online enrollment takes about five minutes. Enter your information, link a bank account, and you are finished. The plan sets no minimum to open and no minimum for later contributions, so you can launch an account with the next twenty-dollar birthday check.

Vanguard 529 College Savings Plan. The digital form is equally smooth, but you must deposit 1,000 dollars to activate the account, or 50 dollars if you set up automatic transfers. Each manual contribution after that also starts at 50 dollars. The upfront hurdle can delay savers who prefer to start with smaller amounts.

Day-To-Day Management and Support

Interfaces. The Bright Start Direct-Sold College Savings Program uses a standalone portal that shows contribution history, goal progress, and one-click rebalancing. Aggregators like Mint can still read the balance, but you will manage college savings on a separate tab. The Vanguard 529 College Savings Plan appears inside Vanguard’s main dashboard, so IRAs, brokerage, and college accounts share one screen, a plus if you already keep other assets there.

Customer service. Both programs staff United States call centers that answer 529 questions Monday through Friday, 8 am–5 pm Central Time for Bright Start and 8 am–5 pm Eastern Time for Vanguard. Illinois adds periodic webinars and in-state workshops led by the Treasurer’s office, while Vanguard support covers IRAs, exchange-traded funds, and 529s in the same queue.

Maintenance. Neither plan charges exit or transfer fees, and both allow the IRS-permitted two reallocations per calendar year. You can handle beneficiary changes, plan-to-plan rollovers, and the new 529-to-Roth conversions online with pre-filled forms.

If you want a single financial view, Vanguard’s integration wins. If you prefer state-run education sessions or like watching a progress bar march toward tuition, Bright Start’s dedicated portal feels motivating. In either case, routine upkeep works much like online banking.

Bright Start: Biggest Strengths, Real Trade-Offs

Strengths

- Ultra-low Index track fee, 0.10 percent per year for every age-based portfolio

- Up to 10,000 dollars single / 20,000 dollars joint Illinois tax deduction worth 4.95 percent each year

- Morningstar has awarded the Bright Start Direct-Sold College Savings Program Gold six times, most recently in October 2024

- Broad selection: 18 individual funds, six static mixes, and 20 enrollment portfolios, all with no minimum to open

Trade-offs

The wide menu can prompt analysis paralysis, and the Active Blend options cost up to 0.40 percent. If you live outside Illinois, you miss the state-tax boost, so Bright Start’s edge narrows to fee and flexibility alone.

Vanguard 529: Clear Upsides, A Few Hard Limits

Upsides

- 12 Target Enrollment portfolios and six static mixes, all index-only, keep choices quick

- Average age-based expense ratio 0.14 percent, with no enrollment or maintenance fee

- One Vanguard login displays 529, IRA, and brokerage balances together, a convenience many households value

Hard limits

- 1,000 dollars to open (or 50 dollars with automatic transfers) and 50-dollar minimum for later manual deposits

- No state tax deduction unless your home state allows benefits on any plan, which fewer than ten states do

- Menu stops at broad indexes, so there are no ESG, small-cap value, or sector funds if you want extra tilts

Bottom line: Vanguard excels at hands-off, single-dashboard simplicity, while Bright Start wins on flexibility and, for Illinois residents, tax savings. Match the plan to what matters more to you—ease or optionality.

If You Pay Illinois Income Tax

Illinois makes the choice simple. Bright Start Direct-Sold College Savings Program contributions are deductible up to 10,000 dollars per taxpayer (20,000 dollars joint) at the 4.95 percent flat rate. That delivers an instant refund of 495 or 990 dollars each year.

Example: Contribute 6,000 dollars every January and you cut your Illinois tax by 297 dollars for that year. Over 18 years, even before investment growth, the recurring break adds about 5,350 dollars to the account. Add market returns and the tax savings compound alongside your investments.

Unless you value Vanguard’s single-login convenience more than a near-five-percent rebate on every contribution, Bright Start is the logical pick. Choose the passive Index track, keep fees at 0.10 percent, and review the allocation once a year.

If Your State Offers No 529 Tax Break

With no home-state incentive, fees and user experience decide the match-up.

Choose the Vanguard 529 College Savings Plan if you:

- Already hold other Vanguard accounts and want everything on one dashboard.

- Prefer an index-only lineup—12 Target Enrollment and six static portfolios—and plan to set the allocation and leave it.

- Are comfortable with the 1,000-dollar opening deposit (or 50 dollars with automatic transfers) and 50-dollar later minimums.

Choose Bright Start if you:

- Want the option to switch between a 0.10 percent Index track and an Active Blend track (up to 0.40 percent) without moving money.

- Like starting with no minimum contribution, ideal for twenty-five-dollar birthday gifts or uneven cash flow.

- Prefer a plan that holds a Morningstar Gold rating for stewardship.

Either way, both programs undercut the 0.45 percent national average for direct-sold plans and post near-identical market returns. Pick the interface and flexibility mix that makes you most likely to keep funding the account.