Private capital has shifted its position in the defense sector. Once characterized by slow-moving procurement processes and incumbent-led systems, the domain has become increasingly attractive to long-term investors. Since the late 2010s, funding directed toward defense technology has grown steadily, indicating a structural reconfiguration of how strategic capabilities are identified, financed, and operationalized.

This transformation is driven less by reactive forces and more by foundational change. Procurement models have evolved, investor priorities have shifted, and the technical demands of modern conflicts have changed. A new class of dual-use companies now builds for both commercial and defense customers, integrating modular, software-centric technologies into core national security frameworks.

Key Takeaways

- Private capital is increasingly attracted to the defense sector, shifting from slow procurement to faster, mission-oriented startups.

- Investment focuses on validated systems, with emphasis on performance, adaptability, and rapid deployment.

- A growing number of startups serve both government and commercial markets, enhancing revenue resilience and speeding up development cycles.

- Structural changes like expanded defense budgets and procurement model reforms have accelerated funding in defense technology.

- Valuations reflect real-world deployment success rather than speculation, emphasizing the need for technical rigor and operational integration.

Table of contents

- The Rise of Mission-Oriented Startups

- Evolution of Capital and Valuation Benchmarks

- Structural Catalysts Behind Capital Acceleration

- Capital Concentrating Around Functional Sectors

- Valuation Uplift Rooted in Deployment, Not Speculation

- Enduring Constraints and Structural Frictions

- Sustaining Strategic Momentum

- Conclusion

The Rise of Mission-Oriented Startups

Defense startups have transitioned from peripheral players to central contributors. These firms are designed for speed, technical adaptability, and delivery in complex operational settings. Many are rooted in commercial engineering disciplines but built with defense standards in mind. Their platforms span areas such as cybersecurity, autonomous surveillance, secure communications, and space-based systems.

The market increasingly rewards those who can prove impact through deployment. Capital is favoring startups that have delivered validated systems under mission conditions, met interoperability standards, and responded to operational constraints in real time. Execution matters more than theory, and delivery has replaced ambition as the primary driver of valuation.

These companies support a shift away from legacy platform models toward reconfigurable, upgradable technologies. Their architectures reflect the new strategic requirement: the ability to respond dynamically to fluid threat environments without relying on protracted upgrade cycles.

Evolution of Capital and Valuation Benchmarks

Investment across early and growth stages continues to expand. Traditional barriers, including opaque procurement systems and limited access to government contracts, are diminishing. In their place are clearer channels that favor technical proficiency and readiness for deployment.

Valuation frameworks have also matured. Startups in the defense sector are now often evaluated using metrics aligned with those of high-performing enterprise technology peers. Growth-stage firms are evaluated based on criteria such as system maturity, speed to operational integration, and technical validation under live conditions.

A growing number of these firms operate with hybrid revenue models. Serving both government and commercial markets allows for shorter iteration cycles and more resilient cash flows. This dual-track approach enhances capital durability and creates tighter feedback loops between field testing and product development, thereby improving the overall effectiveness of the process.

Structural Catalysts Behind Capital Acceleration

The acceleration of funding in defense technology is the result of several converging structural shifts. Each contributes to a more agile and capital-efficient innovation cycle in national security.

1. Expanded Defense Budgets and Strategic Funding Programs

Many advanced economies have increased defense spending, targeting modernization and resilience. Government programs are directing resources toward modular, autonomous, and software-defined capabilities. These trends have attracted private capital that seeks alignment with institutional priorities and long-term national objectives.

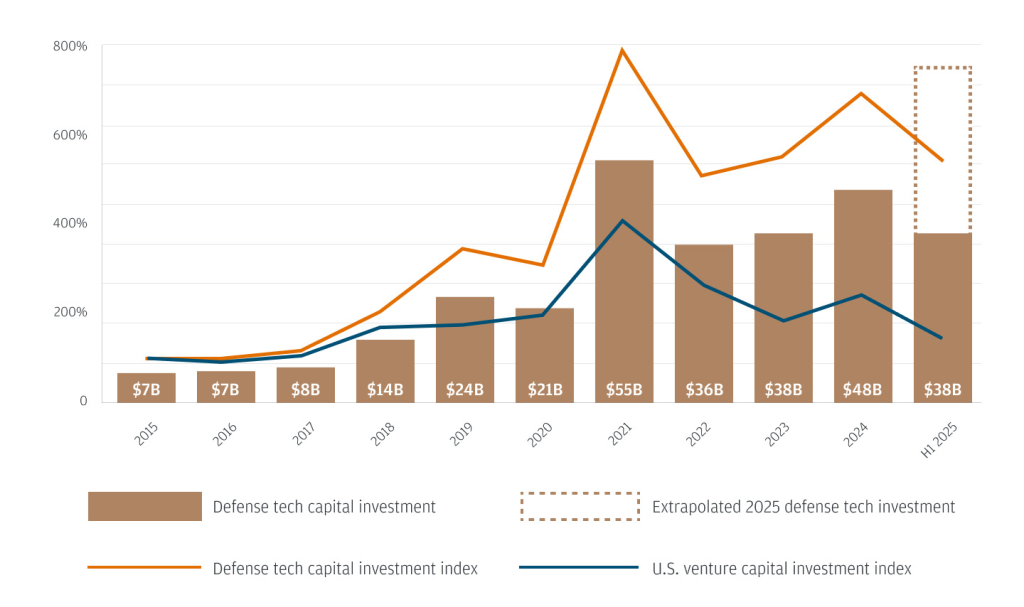

Image: US Defense Tech venture investment activity | JP Morgan

2. Procurement Model Reforms

The procurement environment has changed. Historical reliance on entrenched vendors has given way to more open, performance-based processes. Pilot programs are quicker to launch. Contracts are awarded based on technical benchmarks and delivery milestones. Criteria now prioritize system resilience and adaptability. These changes enable younger, engineering-driven firms to compete based on the strength of their products rather than on political access.

3. Geopolitical Uncertainty and Operational Urgency

Global instability has led to increased focus on platforms that offer near-term capability. Defense planning now demands systems that can be deployed quickly, updated frequently, and integrated across domains. Investment has responded by targeting companies that meet these standards without requiring extended development horizons.

4. Cyber Conflict as a Primary Battlefield

Cyber operations have become a central feature of modern conflict. Adversaries now target networks, satellites, and logistics platforms to cause systemic disruption. As a result, there is a growing demand for technologies that ensure communications continuity and restore degraded systems. Capital has flowed into firms that build cybersecurity infrastructure at an operational scale.

5. Contested Space Domains

Space is now an active theater, not just a monitoring layer. Governments are developing orbital assets for navigation, resilience, and surveillance. Companies that build modular and redundant satellite systems are receiving funding priority. These assets are increasingly seen as essential for both civil continuity and strategic deterrence.

6. Strategic Investment Mandates

A portion of capital entering the sector is mission-oriented rather than return-maximizing. Sovereign wealth funds, national vehicles, and other institutions are backing companies that align with long-range defense and industrial policy goals. These investors are more willing to fund extended development cycles and navigate complex regulatory pathways, providing startups with longer-duration capital and fewer exit constraints.

Capital Concentrating Around Functional Sectors

Funding is clustering in sectors that deliver both operational urgency and commercial applicability:

- Real-time mission systems that enhance situational awareness and tactical decision-making

- Cybersecurity platforms for threat detection, system recovery, and communications integrity

- Autonomous systems for reconnaissance, surveillance, and automated logistics

- Hardened communications networks designed to resist jamming and signal interference

- Orbital systems engineered for high-survivability missions in contested environments

- Sensor fusion platforms that integrate intelligence across air, sea, land, space, and cyber domains

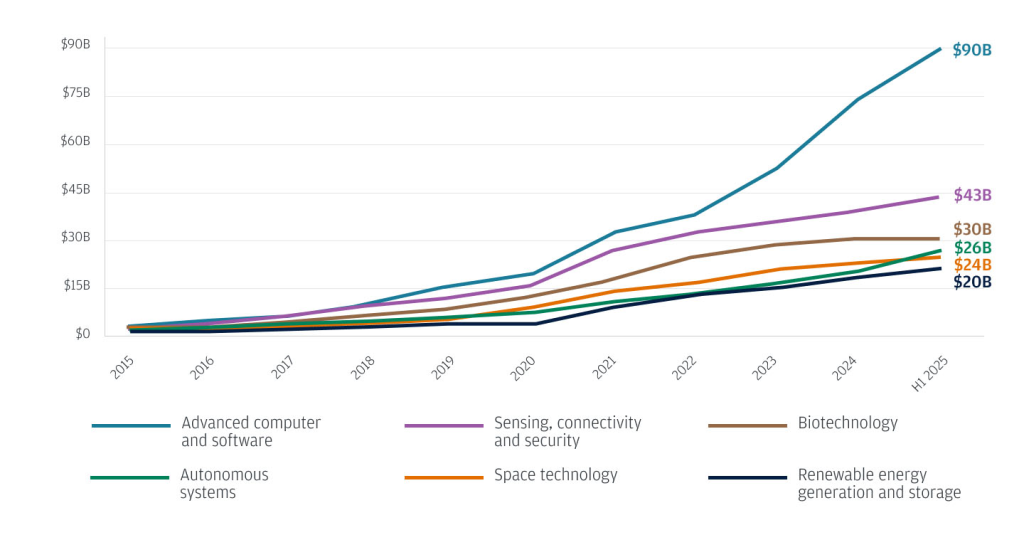

Image: Cumulative invested venture capital for select Defense Tech categories, 2015 onwards | J.P. Morgan

Startups in these sectors often use a hybrid revenue approach, serving government and commercial customers simultaneously. This model enables faster iteration, diversifies income streams, and strengthens their investment profile.

Valuation Uplift Rooted in Deployment, Not Speculation

Valuations in the defense sector are increasing based on real progress, not perceived future potential. Companies that secure contracts, deliver integrated systems, and pass technical validation under operational conditions justify higher capital multiples. Their performance reduces risk, accelerates procurement, and validates both the technology and the operating model.

Conventional financial metrics such as recurring revenue, margin, and capital efficiency still apply. However, the differentiator is now grounded in real-world deployment. Investors are placing a premium on firms that prove their systems can withstand adversarial conditions and integrate into mission-critical workflows.

Enduring Constraints and Structural Frictions

Despite significant advances, the defense innovation ecosystem still faces headwinds:

- Pilot-to-scale conversion gaps that hinder long-term cash flow and delay full-scale adoption

- Compatibility challenges with legacy systems that increase development cost and reduce speed

- High onboarding requirements, such as facility clearance and secure data handling protocols

- Investor mismatch when capital arrives with expectations borrowed from the consumer or SaaS sectors

Addressing these issues will require alignment between startups, capital providers, and procurement authorities. Standardized integration protocols, clearer onboarding pathways, and better investor education can help resolve these frictions and increase sector efficiency.

Sustaining Strategic Momentum

Maintaining forward progress requires continued alignment across key stakeholders:

- Procurement frameworks must emphasize performance, adaptability, and rapid deployment over historical incumbency

- Startups must remain focused on field delivery, mission readiness, and system resilience

- Investors must operate with calibrated expectations around regulatory timelines, compliance requirements, and deployment cycles.

When these conditions are met, defense technology can remain a productive, strategic, and technically rigorous destination for innovation capital. The sector’s growth reflects not only geopolitical necessity but also institutional commitment to long-term capability development.

Conclusion

Defense technology has shifted from a peripheral investment category to a core pillar of national capability and industrial strategy. The companies shaping this sector are not operating on the margins. They are redefining how critical infrastructure, intelligence, and security systems are conceived, built, and deployed.

This reorientation reflects more than a response to external threats. It signals a structural shift in how capital, innovation, and procurement intersect. The emphasis is now on systems that are technically rigorous, operationally deployable, and built for scalability. That direction is clear and unlikely to reverse.

The firms that will lead are those that deliver with precision, integrate with purpose, and operate with a clear understanding of mission-critical requirements. Their role is no longer optional. It is foundational.

References:

- Ballester, F. (July 2025). Defense tech startups attract growing VC interest. VDS Tech. https://vds.tech/news/defense-tech-startups-venture-capital-interest/

- Bogoslaw, D. (September 2025). How VCs are fueling innovation in defense tech. Venture Capital Journal. https://www.venturecapitaljournal.com/how-vcs-are-fueling-innovation-in-defense-tech/

- Hodgson, L. (October 2025). The iron bubble: Why defense tech might not be overhyped. PitchBook. https://pitchbook.com/news/articles/the-iron-bubble-why-defense-tech-might-not-be-overhyped

- JPMorgan. (September 2025). Defense tech innovation and the role of startups. https://www.jpmorgan.com/insights/business-planning/defense-tech-innovation-and-the-role-of-startups

- Klempner, J., Rodriguez, C., & Swartz, D. (February 2024). A rising wave of tech disruptors: The future of defense innovation. McKinsey & Company. https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/a-rising-wave-of-tech-disruptors-the-future-of-defense-innovation

- Salvius, S. (August 2025). Defense tech VC: Frontier to core allocation. SG Analytics. https://www.sganalytics.com/blog/defense-tech-vc-frontier-to-core-allocation/

- Sion, M., Wenzel, J., & Quirk, E. (n.d.). Defense investment is at a turning point. Bain & Company. https://www.bain.com/insights/defense-investment-at-a-turning-point/